Key highlights:

- BTC is up by a small 1% over the week as it meets the support at the 20-day MA around $46,300

- The cryptocurrency lost ground near $50,000 earlier in the week after closing above $49,400

- A daily closing candle beyond $50,000 will be required for the bullish surge to continue

| Bitcoin price | $47,350 |

|---|---|

| Key BTC resistance levels | $47,820, $49,325, $50,000, $50,660, $52,000 |

| Key BTC support levels | $46,000, $45,516, $44,000, $42,456, $42,000 |

*Price at the time of publication

After weeks of price growth for Bitcoin, it seems that the buyers might be starting to show signs of slowing down as they pull back from the $50,000 resistance seen earlier in the week. BTC had surged from as low as $37,500 at the start of August and surged as high as $50,500 on Monday this week.

Unfortunately, the cryptocurrency was unable to produce a daily closing candle above the $49,400 (1.272 Fib Extension) and has since rolled over from the $50K resistance. The coin is now trading inside an ascending wedge pattern as the buying pressure starts to slowly fade.

Nevertheless, BTC did find support at the 20-day MA around $46,300 today, and this is further bolstered by the 200-day MA at $46,000. This will be a crucial support to defend to prevent BTC from slipping further lower over the following days.

There are some strong fundamental factors that might have led to the drop-off from the $50K resistance.

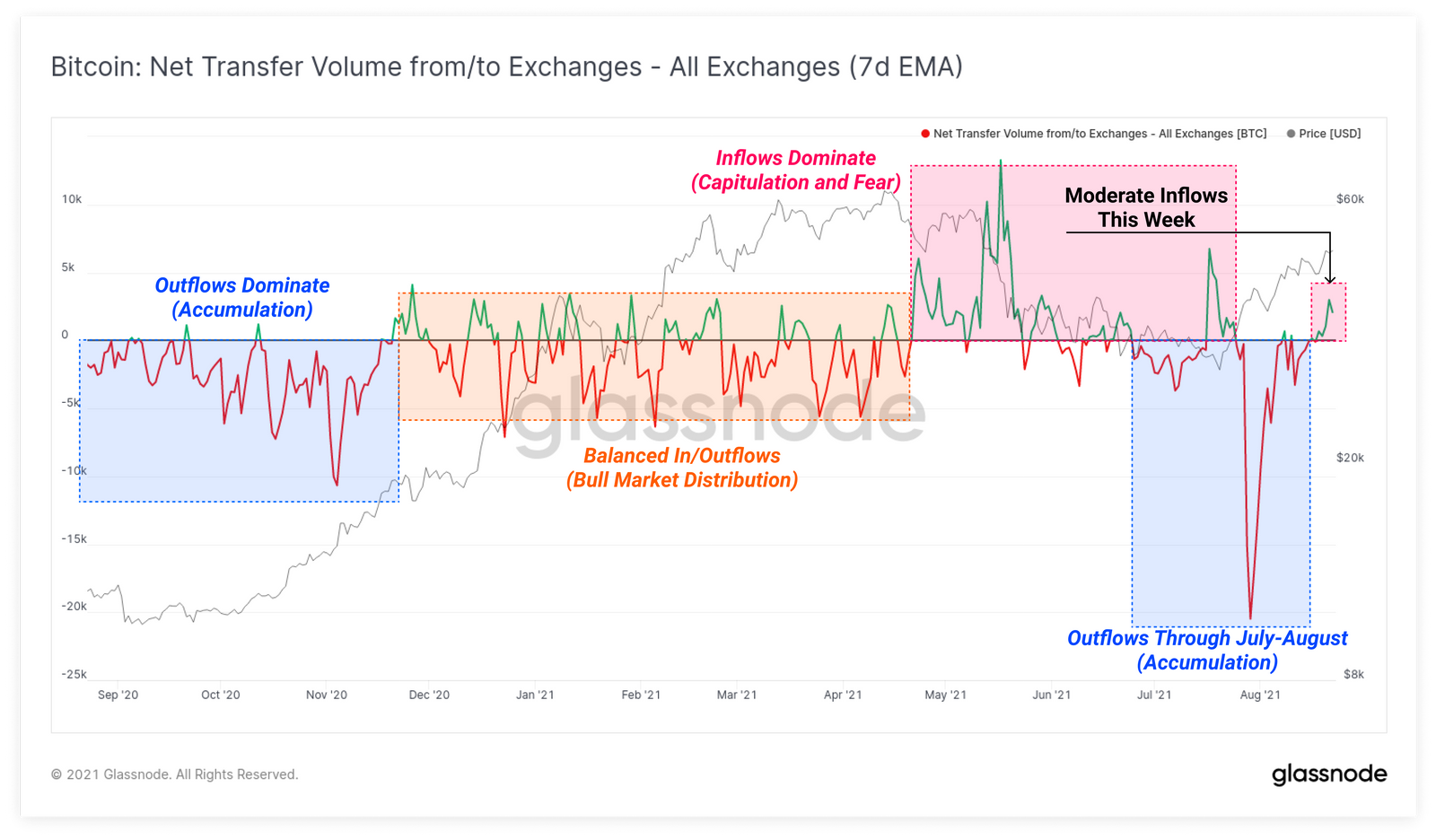

Firstly, it seems that traders are starting to take advantage of the market strength as inflows into exchanges start to dominate. Over the past two months, more BTC has left exchanges than entering exchanges - indicating that investors are holding their assets rather than selling them off. However, over the past week or so, it seems that more BTC is starting to enter exchange wallets. This typically suggests that traders are sending coins to exchanges to be sold.

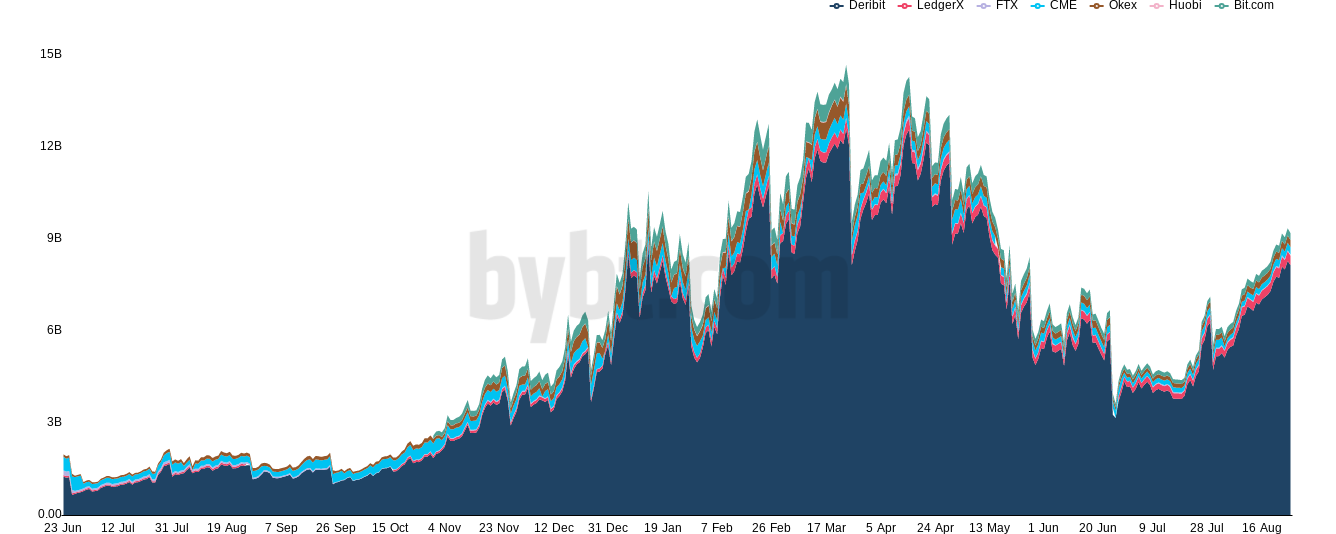

Additionally, $2 billion worth of options is set to expire today. This is a three-month high in total open interest for Bitcoin across all derivatives exchanges, and the options expiry catalyst tends to generate more fear. More often than not, the market simply shrugs off the options expiry after the event, but there is always a sense of fear in the run-up to the expiration - which is exactly what we are currently seeing.

There might already be optimistic signs appearing as whales have already started to accumulate ahead of the options expiry. Over the past two days, one of the largest whales in the market continued to accumulate more than 500 BTC. Interestingly, this whale sold most of its holdings near the $60K all-time high in April and used the sell-off to start re-buying his holdings.

The fact that the whale has started to accumulate around $22 million worth of BTC shows he is pretty bullish for the next price move upward.

Now that's more like it. ?

— venturefoundΞr (@venturefounder) August 27, 2021

The 3rd largest #BTC whale wallet just added another 466 #Bitcoin at $47.4k today (worth $22M USD), after buying 38 BTC yesterday. This is the second buy after a selling spree of 7,500 BTC in the past 28 days, most of which he bought at low $30k pic.twitter.com/7HwOFtci9q

In other news, it appears that more institutions are involved in the cryptocurrency space than we are aware. A Twitter analyst, @MacroScope17, revealed that Morgan Stanley reported that they own a large amount of GBTC across multiple portfolios. Through an SEC filing, the analyst revealed that over 30 Morgan Stanley funds hold large amounts of the GBTC shares - gaining exposure to the number one ranked cryptocurrency.

In SEC filings, Morgan Stanley has just reported owning a large amount of Grayscale Bitcoin across multiple portfolios.

— MacroScope (@MacroScope17) August 25, 2021

The largest of these appears to be 928,051 shares held by Morgan's Insight Fund.

These are major disclosures.

Link to all filings:https://t.co/Vi4iiBa5J5 pic.twitter.com/FZfU8qS0TX

Lastly, Bitcoin hit a new milestone yesterday as the total volume of BTC moving across the network increased quite significantly. The 7-day moving average of BTC volume reached as high as $188 billion - setting a new record. In fact, this means that around 20% of the entire BTC market cap was moved in the week.

$188 Billion #Bitcoin was transferred on the network yesterday. A new record! ? pic.twitter.com/uYgZY5tkjn

— Bitcoin Archive ??? (@BTC_Archive) August 25, 2021

BTC now holds a total market cap value of around $890 billion.

Let us take a quick look at the markets and see where we might be heading.

What has been going on?

Looking at the daily chart above, we can clearly see the ascending wedge pattern starting to form this week. BTC had reached the resistance at $49,325 (1.272 Fib ExtensioN) over the weekend and struggled to break above it.

The cryptocurrency did manage to spike beyond $50K on Monday to reach as high as $50,500. However, it quickly pulled back and closed well beneath $50K. From there, BTC started to show some weakness as it dipped to $48,000 on Tuesday.

After a brief bounce back into the $49,325 resistance on Wednesday, BTC rolled over yesterday and produced a bearish engulfing candle as it dropped beneath $48,000 to close the candle at $46,850. Today, BTC dipped lower to find the support at the 20-day MA around $46,300 and the support at the lower angle of the ascending price channel. It has since pushed higher to the current $47,850 level.

The weakness at $50K is quite important to understand. It shows that the buyers were able to push from as low as $30K at the end of July to produce an enormous bull run to hit the $50K mark with a little-to-no pullback in between. As a result, it is no surprise that the buyers might be exhausted, and a retracement is needed before being able to push higher again.

Bitcoin price short-term prediction: Bullish

The recent price hike over the past three weeks has now turned BTC bullish in the short term. BTC would now have to drop beneath the August support at $37,500 to turn neutral in the short term and would need to continue further beneath $31,500 to be in danger of turning bearish.

If the sellers push lower, the first strong support lies at $46,000 (200-day MA & lower angle of the wedge). Beneath this, added support lies at $45,515 (.382 Fib), $44,000 (.5 Fib), $42,465 (.618 Fib), and $44,000.

Added support lies at $40,300 (.786 Fib & 50-day MA), and $40,000.

Where is the resistance toward the upside?

On the other side, the first resistance now lies at $47,820 (bearish .618 Fib). This is followed by $49,325 (1.272 Fib Extension), $50,000, $50,660 (1.618 Fib Extension), $52,000, and $53,000 (bearish .786 Fib).

Keep up-to-date with the latest Bitcoin Price Predictions here.

coincodex.com

coincodex.com