If you’re looking for reasons behind bitcoin’s recent price surge, this video tells the whole story.

Because it’s so completely dull.

Has bitcoin gone too far, too fast? Here's how two traders are thinking about bitcoin futures. via @CNBCFuturesNow https://t.co/StSHvYGYD9 pic.twitter.com/aHKgt62GNe

— CNBC (@CNBC) May 22, 2019

The two established analysts with decades of trading experience talk about bitcoin with maturity and logic. They make a strong case for allocating portfolio funds to crypto, and no-one mentioned bubbles or scams.

The way people talk about bitcoin is changing, especially on mainstream finance outlets. It’s evolving. Bitcoin is a social movement as much a technical one, so the way it’s talked about among traditional investors is incredibly important to its future.

This interview isn’t provocative or controversial. It’s downright boring. And that’s bullish as hell.

Bitcoin’s narrative has changed. It’s a legitimate asset class now

The Futures Now interview was a mature and sensible debate between GRZ Energy’s Anthony Grisanti and Equity Armor Investment’s Brian Sutland. Both have decades of experience on the futures and options markets.

Gold will ben the topic of discussion when the @CNBCFuturesNow crew joins the @HalftimeReport at 12:40pm –Having a difficult time rallying even with the uncertainty over trade –Whats the next move

— Anthony Grisanti (@AnthonyGriz) May 21, 2019

They each recommended a small allocation to bitcoin as a portfolio hedge. They talked about bitcoin like any other asset class. It was discussed in the same breath as gold and currencies without any scorn.

Both shrugged off bitcoin’s volatility and no-one mentioned bubbles or scams or crime. They spoke of bitcoin as a legitimate part of the trading ecosystem.

Bitcoin should be 5-10% of your portfolio

Grisanti advocated that traders allocate 5-10 percent of their portfolio to bitcoin.

“Usually in a portfolio, gold is about 5-10% of the portfolio so there’s nothing wrong with saying bitcoin couldn’t be 5-10% of a portfolio right now.”

It echoes Grayscale’s campaign for investor’s to #DropGold and replace it with bitcoin in your portfolio.

Excited to share that the #DropGold TV spot begins airing nationally TODAY during commercial breaks on:

– AMC

– Comedy Central

– Fox Business

– Fox News

– FX

– IFC

– Nat Geo

– NFL

– Paramount

– SundanceCan't wait? #WatchNow via https://t.co/mo009CyYFL

— Grayscale (@GrayscaleInvest) May 16, 2019

Sutland agreed, claiming that a small allocation could provide a strong hedge against geopolitical threats and fiat currency weakness.

“If you size it appropriately in your portfolio, a couple percent holdings, that can be a hedge against political turmoil or just fiat currencies deteriorating.”

Although he admitted that 80 percent swings are still a threat and no-one should go all-in on cryptocurrencies.

“I would not move all my money into bitcoin as a safe haven, so you’re right about that. But a fraction of somebody’s portfolio when they’re worried about what’s going on in the world; as long as you size it appropriately.”

What next for the bitcoin price?

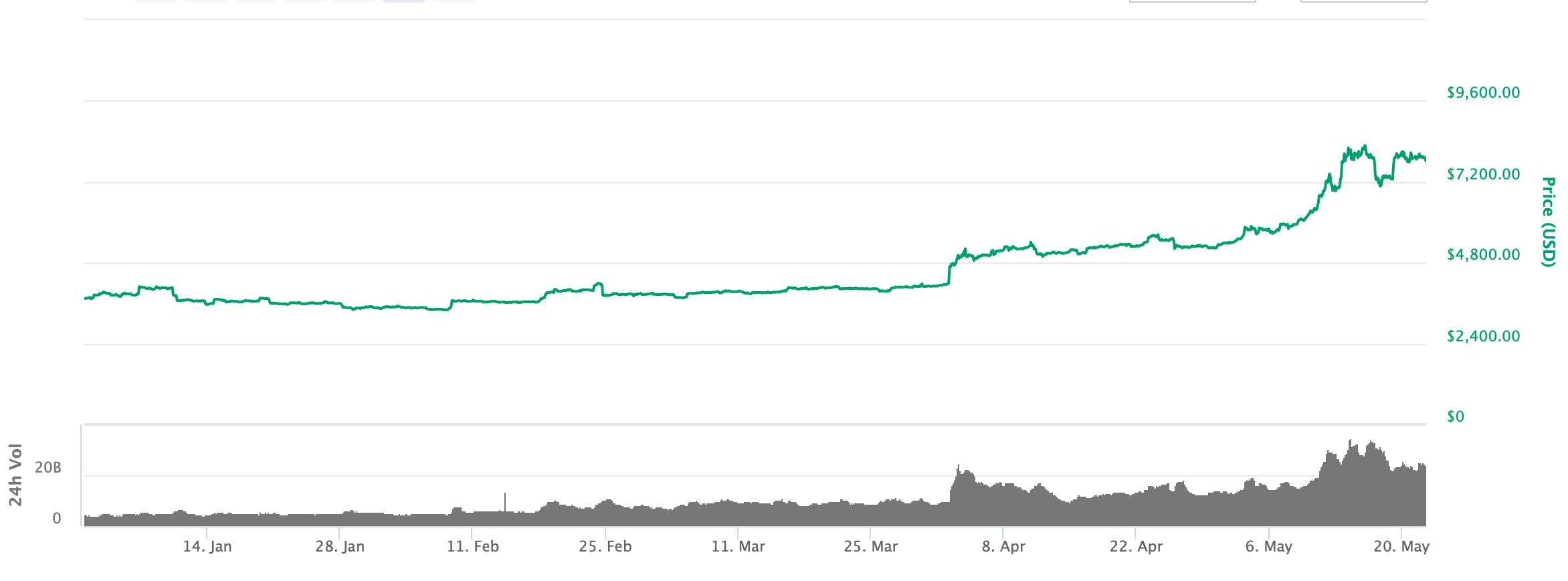

Grisanti was a little more bearish on the short-term prospects of bitcoin. He expects a pullback to the $7,000 range after the strong move upwards.

“The market’s had a nice run but I think it consolidates a little bit. I’m looking to sell at $8,000… and I’m looking for a move back down to $7,000 and I think consolidation for this market is actually very healthy, very good for it. I’ve noticed over the last few sessions that the volumes have come back down a little bit. And to me that means that the market does want to consolidate. That you’re not getting the buyers coming into the market with the strength that they did a couple of weeks ago.”

It’s an intelligent and reasoned analysis of bitcoin’s potential movements, which is refreshing to see on mainstream financial news outlets.

Sutland struck a more bullish tone, especially as a long-term prospect:

“I do think bitcoin is still in play. I think it’s becoming the alternative play to gold if you’re looking for a safe haven right now. The transactions you see are ticking up. It’s much easier to move money around using that rather than a bar of gold or even gold futures. I think bitcoin futures are becoming more and more in play. And so for that reason I think there’s still legs to the upside in the long-term.”

“From scam to sexy”

As CCN reported, research discovered that the language around bitcoin has changed for the positive. Not only are more academics talking about cryptocurrency, they’re understanding it better:

“[The research] further noted that scholars are enhancing the quality of their discourse when they review the cryptocurrency in research papers, public conversations, and debates.”

This is the real bull case for bitcoin. Bitcoin is a social movement and it’s slowly converting the most influential financial minds on the planet. If that’s not bullish, I don’t know what is.

Click here for a real-time bitcoin price chart.