In addition to being untethered to governments and banks, Bitcoin was seen by many as a censorship-resistant, anonymous currency that could be sent to anyone from anywhere.

Privacy, despite being touted as a mainstay in the Bitcoin ethos, has been adopted by altcoins such as Monero [XMR] and Zcash [ZEC].

However, even with the presence of these privacy-centric coins, Bitcoin has an air of privacy, through the concept of CoinJoins. This form of transacting Bitcoins enables multiple BTC payments from several users into one transaction, thereby creating difficulty for third parties to deduce the two ends of the transaction.

Longhash, the crypto-analytics firm reported that these CoinJoin transactions are on the rise since the beginning of the year. The Longhash report obtained CoinJoins data from zkSNACKs CTO, Adam Fiscor, the company behind the Wasabi Wallet.

Source: Longhash

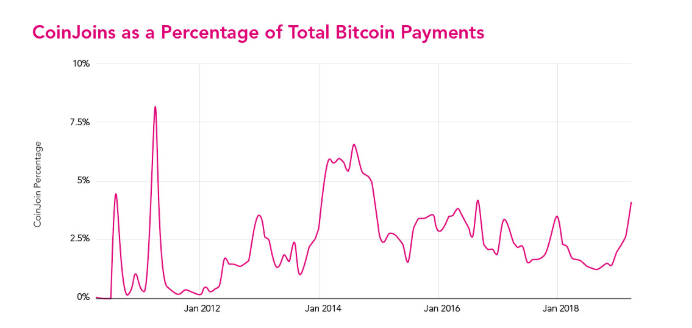

Since the beginning of January 2018, when the BTC price was in full swing, CoinJoin transactions started to dip. Through the infamous crypto winter when BTC’s price fell to under $3,200, privacy was less looked upon by the larger coin market, with more emphasis placed on salvaging the price.

In the past few months however, CoinJoin transactions are seeing a resurgence owing to the market recovering and Bitcoin inching closer to its glory days. Additionally, the report added that Wasabi Wallet’s release in August 2018 was also an important factor in the rise in the number of CoinJoin transactions, with the percentage of monthly Bitcoin payments growing from 1.31 percent to 4.09 percent.

The report pointed out key points through Bitcoin’s history where CoinJoin transactions have surged. Longhash stated that the rise in CoinJoin transactions before 2013 was due to developers testing out transactions with minimal payments on the network, peaking at over 7.5 percent of all BTC transactions. The release of the Blockchain Shared Coin Integration in November 2013 caused CoinJoin transactions to surge in 2013-2014, reaching over 6.25 percent.

Following the removal of Blockchain’s CoinJoin feature, transactions saw a massive dip in early 2014. Join Market, the CoinJoin implementation that was pegged to enhance the privacy and fungibility of BTC transactions, was released in 2015, which led to a massive increase in the CoinJoin transactions. This took their share to almost 4 percent, which the current upswing has overtaken.

CoinJoins create a layer of anonymity for Bitcoin transactions, but the report states that “the existence of these types of transactions are relatively easy to identify.” Two key points are required to uncover such transactions; first, the transaction will have two outputs of the same value and second, the output value will not be more than the input value.

ambcrypto.com

ambcrypto.com