On Tuesday (July 27), Mike Alfred, Co-Founder and CEO of NYDIG subsidiary Digital Assets Data, gave his long-term price prediction for Bitcoin.

On Jan 11, NYDIG announced that it had acquired Digital Assets Data, which was co-founded in 2018 by brothers Mike and Ryan Alfred and which “provides a powerful data and research platform to deliver institutional-grade information and insights on digital assets to a broad customer base of professional asset managers, hedge funds, family offices, and institutional investors.”

Earlier today, the Digital Assets Data CEO tweeted that he believes the Bitcoin price will reach $1 million within the next 10 years:

1 #Bitcoin will be worth $1,000,000 in under 10 years.

— Mike Alfred (@mikealfred) July 27, 2021

Although some might consider Alfred’s price prediction a bit unrealistic, it is worth remembering that back in December 2020, Scott Minerd, Global Chief Investment Officer of Guggenheim Partners and the Chairman of Guggenheim Investments, said that “Bitcoin should be worth about $400,000.”

Guggenheim Investments is “the global asset management and investment advisory division of Guggenheim Partners and has more than $233 billion in total assets across fixed income, equity and alternative strategies.” It focuses on “the return and risk needs of insurance companies, corporate and public pension funds, sovereign wealth funds, endowments and foundations, wealth managers and high net worth investors.”

On 16 December 2020, after the Bitcoin price had finally broken through the $20,000 level on all crypto exchanges to set a new all-time high, Minerd, talked about Bitcoin during an interview on Bloomberg TV.

The interview started by the Guggenheim CIO being asked by Scartlet Fu, Bloomberg TV’s Senior Editor of the Markets Desk, about the Guggenheim Macro Opportunities Fund and the decision by its managers to invest “up to 10% of its net asset value in Grayscale Bitcoin Trust.” In particular, he was asked if Guggenheim had started buying Bitcoin yet and how much this decision was “tied to the Fed’s extraordinary policy.”

Minerd replied:

“To answer the second question, Scarlett, clearly Bitcoin and our interest in Bitcoin is tied to Fed policy and the rampant money printing that’s going on. In terms of our mutual fund, you know, we are not yet effective with the SEC. So, you know, we’re still waiting.

“Of course, we made the decision to start allocating toward Bitcoin when Bitcoin was at $10,000. It’s a little more challenging with the current price closer to $20,000. Amazing, you know, over a very short period of time, how big run-up we’ve had, but having said that, our fundamental work shows that Bitcoin should be worth about $400,000. So even if we had the ability to do so today, we’re going to monitor the market and see how trading goes, what evaluation that ultimately we have to buy it.“

He then explained how his firm came up with the $400K valuation for Bitcoin:

“It’s based on the scarcity and relative valuation, such as things like gold as a percentage of GDP. So, you know, Bitcoin actually has a lot of the attributes of gold and at the same time has an unusual value in terms of transactions.“

Then, on February 2, when Bitcoin was trading around $40K, Minerd said during an interview with CNN’s Julia Chatterley that Guggenheim’s research suggested that the Bitcoin price could eventually get as high as $600K.

"Cryptocurrency has come into the realm of respectability & will continue to become more and more important in the global economy." @ScottMinerd talks $GME / $SLV / $BTC and the logic of bubbles versus buying frenzy. pic.twitter.com/ZWoZqZNU2M

— Julia Chatterley (@jchatterleyCNN) February 2, 2021

With inflation increasing around the world, naturally many retail investors are drawn toward Bitcoin due to its appeal as an inflation hedge. One of those countries where the popularity of Bitcoin has been rapidly going up is Turkey, where “annual inflation hit a two-year high of 17.53% in June,” according to a report by Reuters published on July 5. The report went on to say inflation “has been held up by the Turkish lira’s depreciation, depleted monetary credibility and a burst of demand as the economy emerges from the coronavirus pandemic.”

Earlier today, British rapper Zuby posted a couple of tweets to provide an idea of Bitcoin’s popularity in Turkey.

Another one. pic.twitter.com/2oDWsMAC1U

— ZUBY: (@ZubyMusic) July 27, 2021

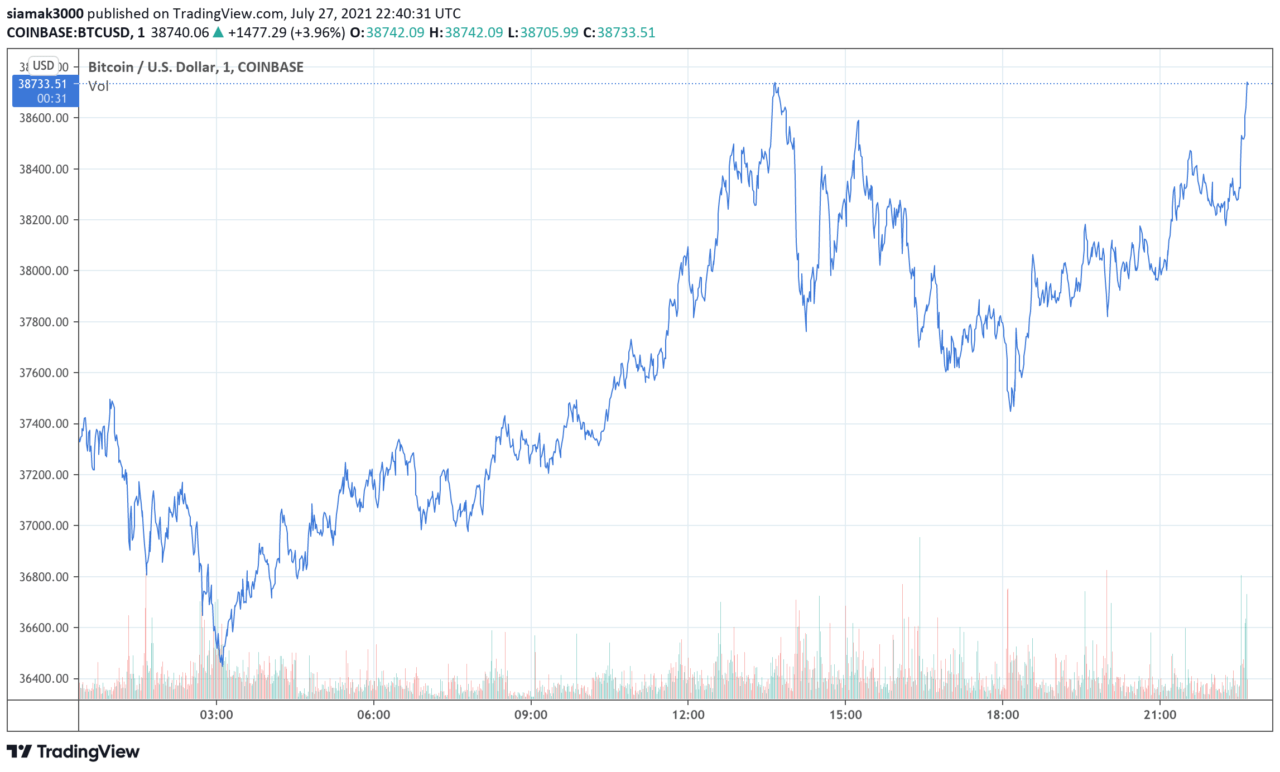

According to data by TradingView, on crypto exchange Coinbase, Bitcoin is currently (as of 22:35 UTC on July 27) trading around $38,518, up 3.82% in the past 24-hour period.

cryptoglobe.com

cryptoglobe.com