Crypto insights platform Santiment believes that one of 2021’s top altcoins could be reigniting its boom cycle.

In a new tweet, Santiment tells its 70,700 followers that layer 2 Ethereum-scaling solution Polygon (MATIC) is starting to flash bullish signals after the meltdown in May that saw its price collapse over 70% from the all-time high of $2.62.

“MATIC is showing signs of a potential reversal, according to our data. The popular ETH-based altcoin is hanging on above support for now, and supply on exchanges is encouragingly dropping.”

Despite the recent crash, Santiment unveils that Polygon’s on-chain activity continues to grow on a monthly basis.

“MATIC’s daily active addresses is showing really healthy signs of growth over the past few months and is still remaining consistent this month. It’ll be hard to ignore the bullish case for MATIC if the growth continues.”

The daily active addresses is an on-chain metric that shows the daily number of unique addresses that were active on the network as a sender or receiver.

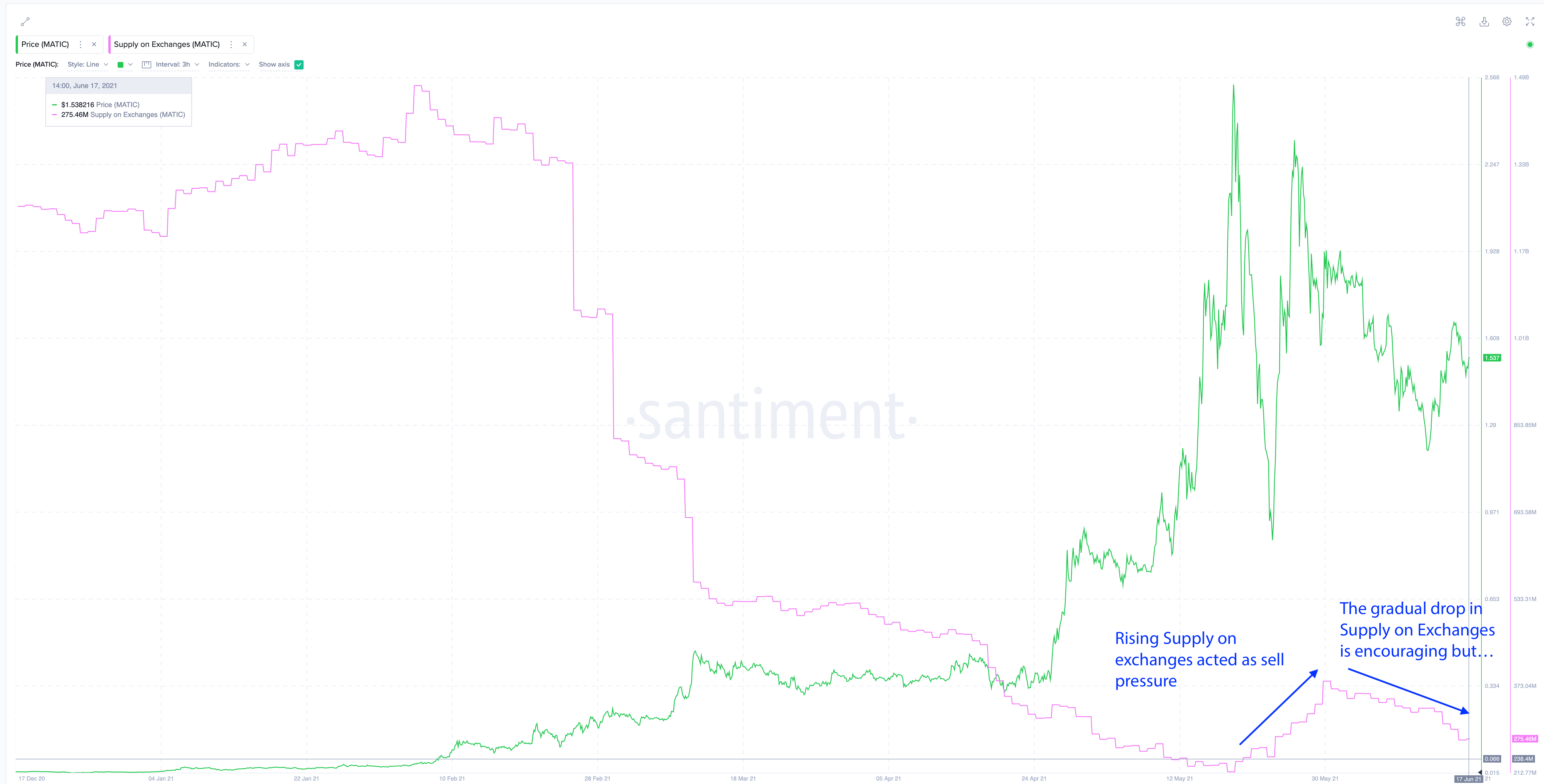

Santiment adds that Polygon’s supply on exchanges has significantly fallen after last month’s brutal sell-off.

“During the recent crypto meltdown, MATIC’s supply on exchanges saw a consistent rise that acted as sell pressure. Since then, it has gradually declined to almost where it bounced off.

This is encouraging but it’s still too early to tell whether there’ll be more to come as MATIC’s price finds its direction.”

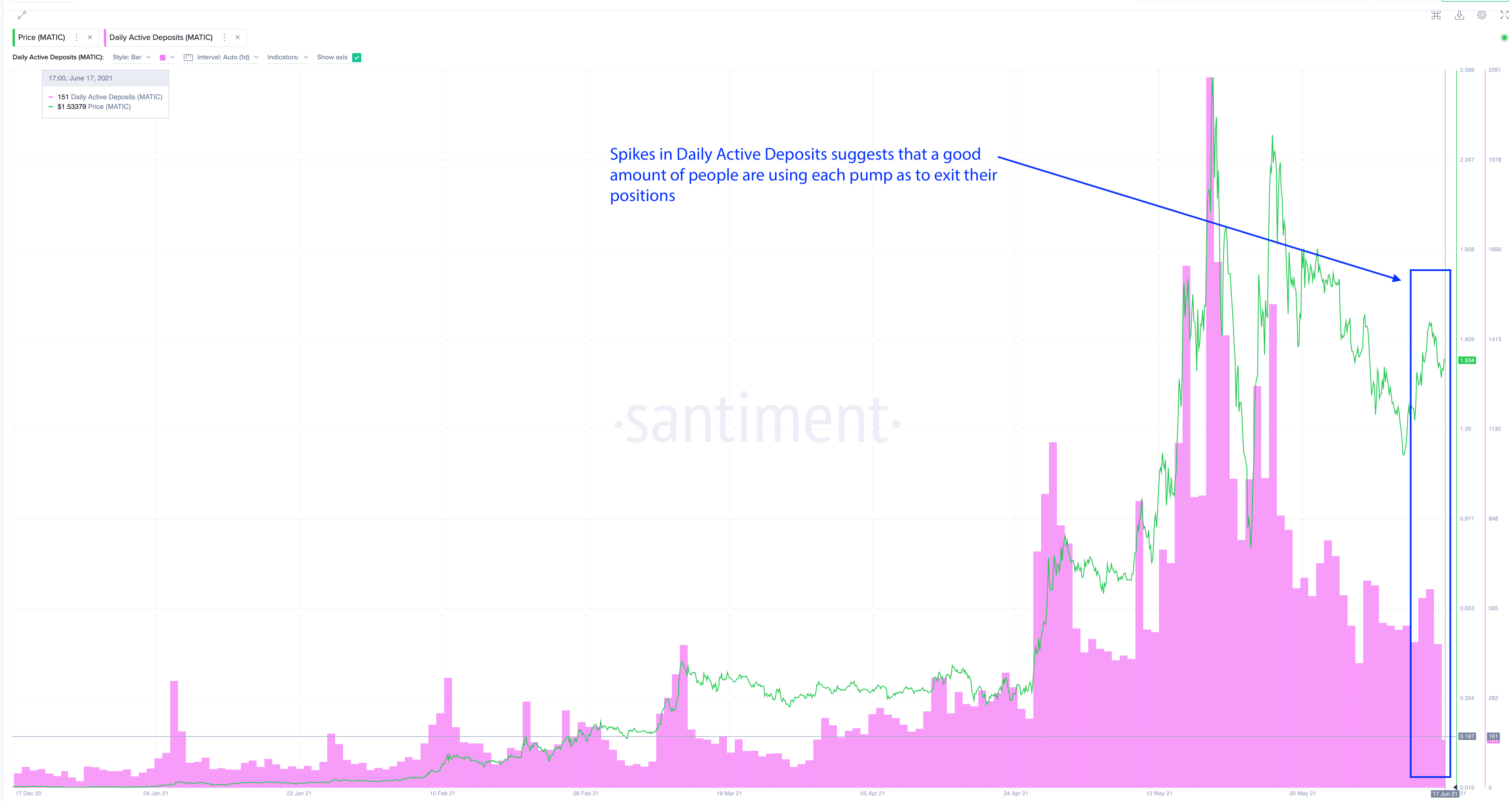

However, not all on-chain data support a bullish bias, according to Santiment. The crypto analytics firm notes that the daily active deposits metric, which shows the total number of all incoming and outcoming transactions involving deposit addresses (like an exchange wallet) on a particular day, is still on the up and up.

“On-chain data is still showing a good amount of sell pressure as each rally saw spikes in daily active deposits as well. This suggests that a good amount of people are using any pump to exit their positions.”

dailyhodl.com

dailyhodl.com