During yesterday’s trading session, gold’s futures contracts and shortly after the spot price broke above the coveted $2,000 level for the first time.

In the cryptocurrency market, Bitcoin remains relatively calm, while some altcoins are fluctuating with another all-time high charted by Chainlink.

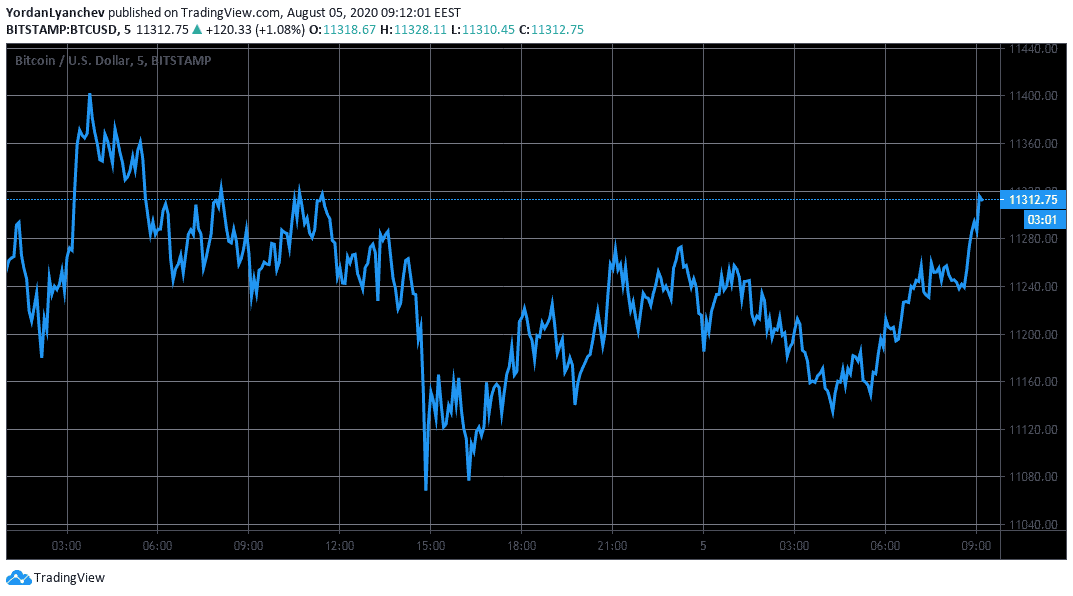

Cryptocurrency Price Movements

After yesterday’s unsuccessful attempt to overcome the $11,500 resistance, Bitcoin headed downwards. The primary cryptocurrency tested the support and psychological level at $11,000, but the bulls didn’t allow further decline and reversed BTC’s movements. At the time of this writing, Bitcoin has regained strength and is currently situated at $11,300.

As CryptoPotato reported yesterday, there’s a bullish pattern forming, which could spike the price towards $12,000 again. Should it occur, $12,000 will be a major hurdle for Bitcoin before it has the chance to face the daily resistance at $12,350. Alternatively, if the pattern is rejected and BTC heads south, it could rely on $11,000, $10,780, and $10,280 as support.

In the altcoin market, Chainlink is making headlines again. After painting a fresh all-time high yesterday, it did the same just hours ago. LINK’s new ATH is just beneath $10 – at $9.95 on Binance.

Ethereum’s Medalla testnet launch hasn’t yet affected the price significantly, and ETH is trading again at about $390. Ripple, however, has retraced after the recent gains by 4% and is below $0,30. Cardano and Binance Coin are up by 4.6% to $0.143 and $23, respectively.

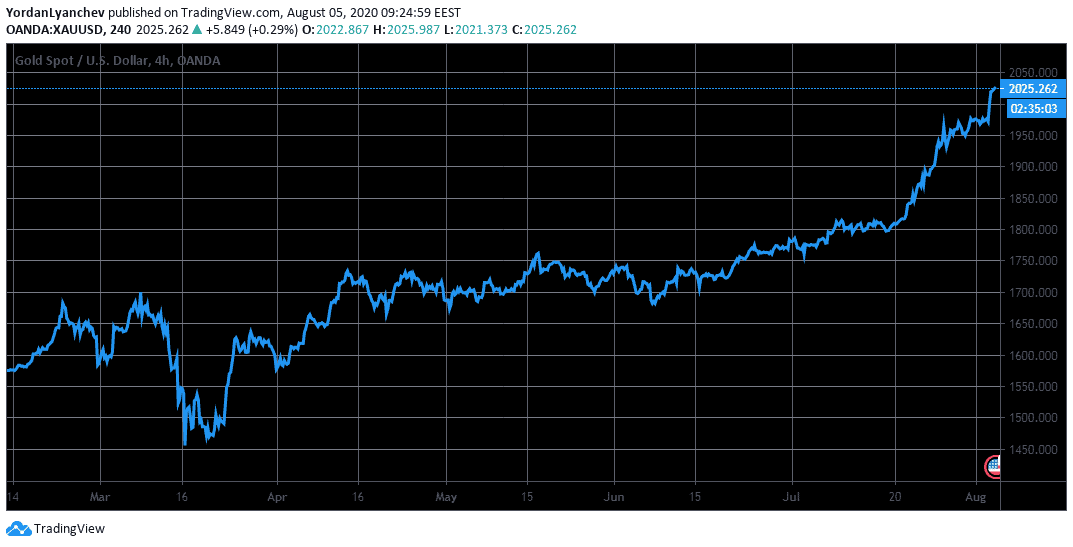

Gold’s Rise To $2,000

The optimistic predictions from the likes of Goldman Sachs and permanent gold-bug Peter Schiff regarding the precious metal’s price have materialized quicker than expected. During yesterday’s trading session, the bullion went into uncharted territory at above $2,000 an ounce for the first time.

Gold’s rally has been quite impressive this year, especially after the COVID-19 pandemic broke out. The metal dumped to $1,460 during the March sell-offs but since then has increased its value against the dollar by nearly 40%. Thus, it firstly managed to break the previous ATH from 2011 at $1,910 days ago and is now trading at $2,025.

According to George Cheveley, a fund manager at Ninety One, the cause of this rally is “uncertainty about whether the world plunges into recession next year or recovers, spurred on stimulus money. When you think of both of those outcomes, gold has a place.”

As typically regarded as a safe-haven tool, the precious metal indeed performs at its best during a financial crisis. As such, Peter Schiff commented that this price surge, while rewarding for gold investors, could portend “extreme economic hardship” for most people.

While personally vindicating and financially rewarding, gold’s rise above $2K is not a cause for celebration. As #gold continues to set and break new records, rewarding all with the foresight to own it, remember that the move portends extreme economic hardship for most Americans.

— Peter Schiff (@PeterSchiff) August 4, 2020

cryptopotato.com

cryptopotato.com