A recent poll by the popular gold proponent Peter Schiff indicated that most of his followers believe that the price of the bullion will never surpass Bitcoin’s.

One BTC > Ounce Of Gold

Peter Schiff is a prominent US economist and a famous gold-bug. However, he is also a well-known Bitcoin basher and rarely misses an opportunity to lash out against the primary cryptocurrency.

He recently published a rather compelling poll on his personal Twitter account, asking, “how long do you think it will take before the price of an ounce of gold is higher than the price of one Bitcoin?

How long do you think it will take before the price of an ounce of #gold is higher than the price of one #Bitcoin?

— Peter Schiff (@PeterSchiff) June 30, 2020

While he has previously asserted that “only fools are choosing Bitcoin” over gold, the poll results probably disappointed him. Only 10.2% of the 22,309 voters have answered that an ounce of gold will cost more than one bitcoin in less than a year. 9.5% believe it will take less than two years, and 12.3% – less than five.

The remaining 68%, on the other hand, showed serious negativism that such a dramatic change could ever occur, by choosing the “never gonna happen” answer.

Gold Vs. Bitcoin Pricewise

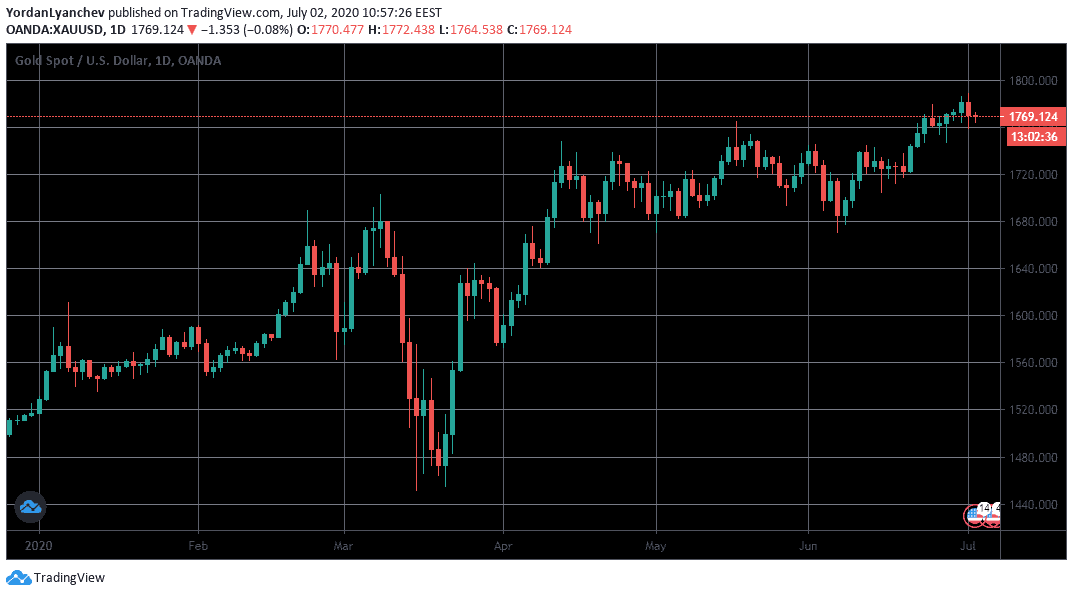

Gold’s performance in 2020 has been quite notable, especially during and after the most intense days of the COVID-19 pandemic. The bullion entered the new century at $1,522 per ounce, surged to $1,700 before the crisis, bottomed at $1,450 after the Black Thursday, and since then has been increasing its value. Merely days ago, it registered its new 8-year high of nearly $1,800.

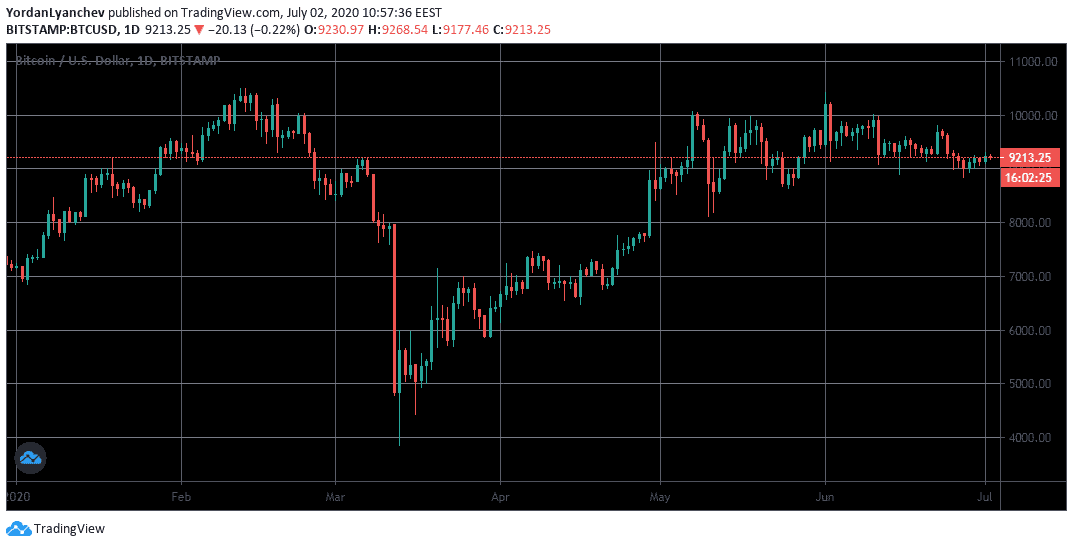

Gold’s increase marks a year-to-date surge of approximately 16%. As impressive as it sounds, it’s still significantly lower than Bitcoin’s YTD results. Despite plunging in mid-March to below $4,000, the primary cryptocurrency’s 2020 run has been considerably bullish.

Its surge from $7,200 at the start of the year to $9,200 at the time of this writing means that BTC is up by nearly 30%. Or, as CryptoPotato reported yesterday, Bitcoin has so far outperformed not only gold, but the S&P 500 index, WTI, and the dollar.

As such, looking at the price differences between the precious metal and the primary cryptocurrency, the skepticism exhibited by the majority of the poll participators seems somewhat justified.

cryptopotato.com

cryptopotato.com