Institutional investors have been wary of the cryptocurrency field, and one of the main arguments for that falls on the volatility of their price. It’s not unusual for a random altcoin to pop and surge 100% in a day without any evident reasons or based on a seemingly unimportant announcement.

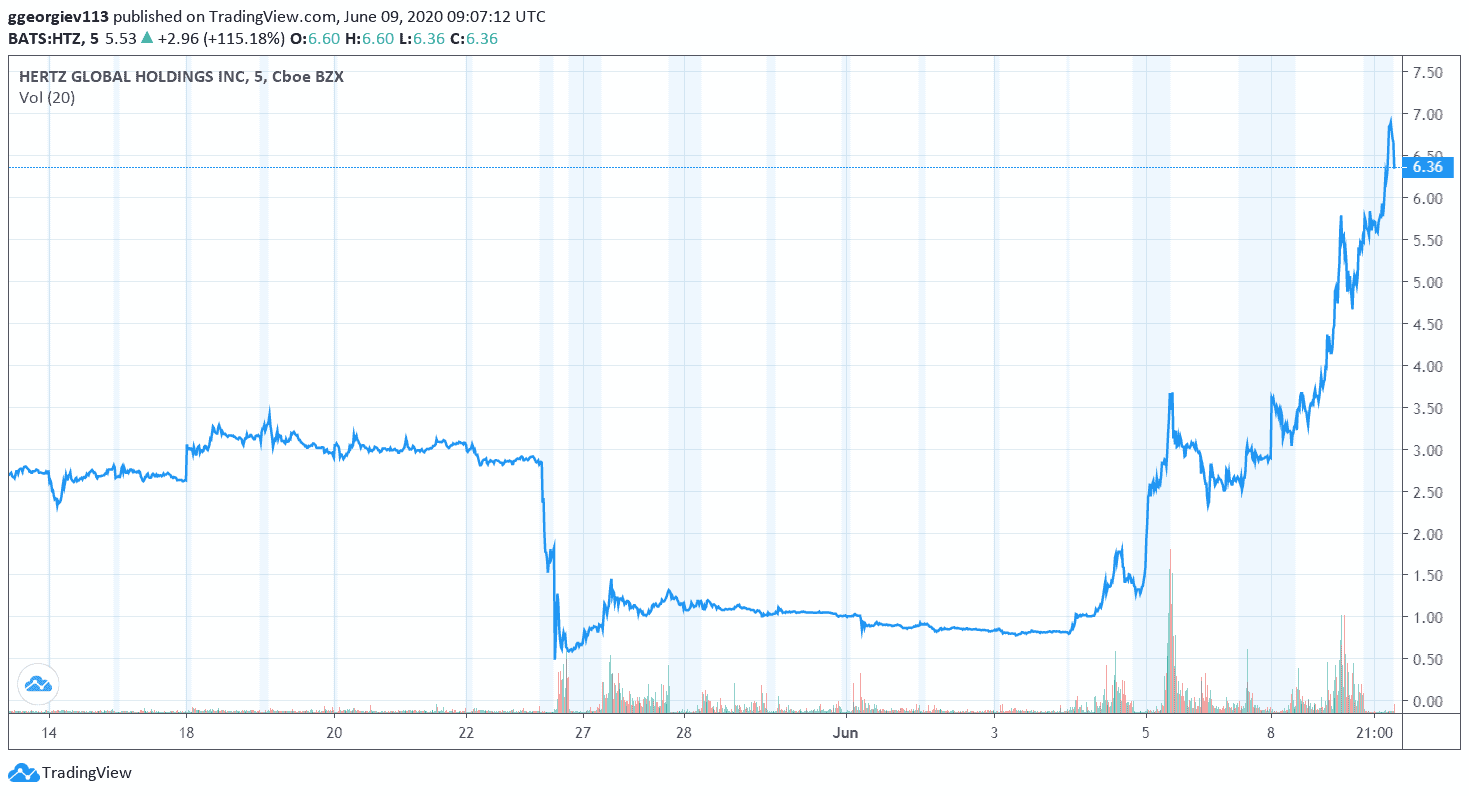

However, legacy markets don’t seem that much different at present times. The stock price of Hertz Global – a US-based car rental company, has surged by almost 900% in two weeks. Talk about stock season!

Stocks Are Popping Like Altcoins

The last few months have been a wild ride in every aspect of the word. In March, legacy markets collapsed as the S&P 500 and other major indices recorded multi-year lows. However, the US Federal Reserve took action and injected trillions of dollars in the economy, propping up a massive run-up.

However, some companies popped in a way that’s much attributed to the “volatile” cryptocurrency market. A fresh example comes from Hertz Global Holdings – it’s a corporation operating a few rental car brands based in the US, and it’s listed on the New York Stock Exchange under the HTZ ticker.

At the time of this writing, HTZ trades at around $5,53, marking a staggering increase of about 1000% since May 22nd. What is more, the stock is poised for more gains as the pre-market price is already at $6.36.

The case with Hertz is particularly interesting because towards the end of May, the company filed for bankruptcy.

But it’s not just them. Transocean Limited, touted as the world’s largest offshore drilling contractor and carrying the RIG ticker in NYSE, is up more than 110% since the beginning of June and is poised for more gains as the market opens.

The S&P 500 has almost reached its ATH levels from February as it’s currently at about 3,232.39 points, just about 140 points less than its value from before the crash. The Nasdaq 100 is already trading at new all-time highs. In other words, the losses from the March crash are almost entirely recovered.

So Much For The “Volatile Crypto Market” Narrative

While it’s true that there are specific less-known cryptocurrencies that pop up from time to time, marking tremendous gains in a day or two, this becomes a lot less common in the cryptocurrency market.

Another thing to consider is the fact that it’s a widely unregulated market, unlike Wall Street, where everything happens under the careful watch of numerous authorities and governmental agencies.

Yet, most cryptocurrencies are also coping well with the current conditions. Bitcoin recovered from its March downturn, while other large-cap altcoins are also well on their way to do so.

It’s worth noting, though, that the cryptocurrency market managed to recover without having to receive trillion-dollar injections and significant governmental support.

cryptopotato.com

cryptopotato.com