- Solana price analysis is bearish today.

- Strong resistance present at $182

- Solana trading price is $143

The Solana price analysis is bearish today as we expect the fatigued bulls to continue fighting for the market. On the other hand, the bears will enjoy their time of power and control. The SOL/USD price suddenly dropped today, on January 17, 2022, from $148 to $143. Solana has been down 2.71% in the last 24 hours, with a trading volume of $1,357,238,573.

As the volatility closes in, the value of Solana becomes less vulnerable to volatile change and starts to maintain the present movement, with the bears in control. The bulls’ pressure pushed the price to a high of $149 but was unable to break the resistance; the bears took advantage of this and reclaimed the market,

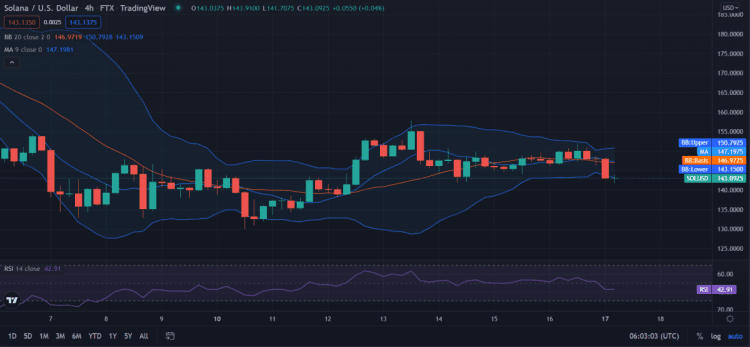

SOL/USD 4-hour price analysis: Recent developments

The most recent developments in the Solana price analysis have led us to believe that the current state of the market appears to have entered a bearish movement, with the volatility expanding gradually. As a result, the upper limit of the Bollinger’s band rests at $150, serving as a strong resistance for SOL. Conversely, the lower limit of the Bollinger’s band is present at $143, serving as another resistance point rather than the support for SOL.

The SOL/USD price travels under the Moving Average curve; this signifies the market following a bearish movement. We can see the market has closed its volatility in the past few days as the market rejected a bearish trend. However, the market seems to have changed plans as it expands the volatility and welcomes the bears.

The Relative Strength Index (RSI) score is 42 making the cryptocurrency show no sign of inflation or devaluation; instead, it shows a stable value. The cryptocurrency falls in the lower neutral region. The buying activity equals the selling activity causes the RSI score to remain dormant.

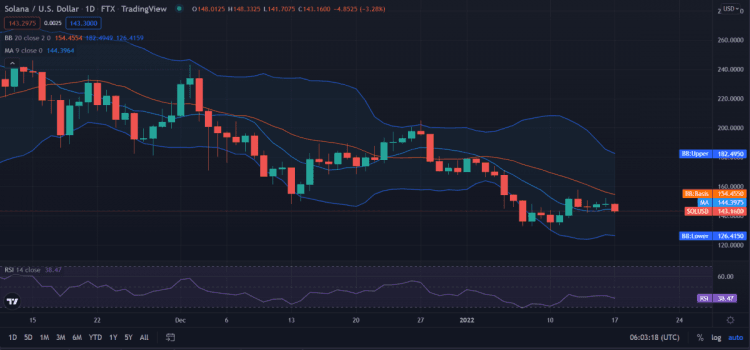

Solana Price Analysis for 24-hours: SOL/USD on the brink of devaluation

The Solana price analysis has remained bullish for the last few days; as the market enters the bearish domain, it stops its volatility to maintain its consistency. With the market volatility still massive, the bulls have an excellent chance to return and capture the market and make moves for a long-term regime, but we can assume the same for the bears. The upper limit of the Bollinger’s band rests at $182, serving as the most substantial resistance for SOL. Contrariwise, the lower limit of the Bollinger’s band rests at $126, serving as the most vital support for SOL.

The SOL/USD price appears to be crossing under the Moving Average curve, pointing towards a bearish momentum, which the bears will likely preserve for the next few days, the bulls had their chance, and they lost it. The bears took full advantage of the closing volatility. The bears have taken over the market to cause more downside pressure.

The Relative Strength Index (RSI) score appears to be 38, showing the cryptocurrency slightly falls on the undervalued side. The RSI score follows a slight downwards path entering the undervalued region. The depreciation in the RSI score indicates firm selling activity.

Solana Price Analysis Conclusion

Solana price analysis remains bearish as the volatility remains dormant, resulting in a newly bearish movement in the next few days. However, the direction is not likely to change under normal circumstances. The bears have taken the market elegantly, and as the resistance declines, the bears will have every opportunity to get the price lower.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

cryptopolitan.com

cryptopolitan.com