- Polkadot price analysis is bearish today.

- DOT/USD found resistance at $28.5.

- Consolidation has been seen since midnight.

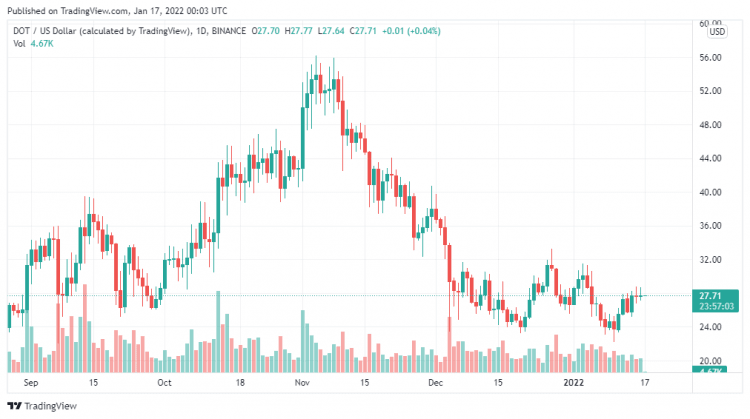

The Polkadot price analysis is bearish today, as we anticipate a return from the $28.5 resistance after consolidation following yesterday’s break. DOT/USD will most likely retrace and establish a higher low to complete its move down.

Polkadot is currently trading at $26.83 on Binance. Technical indicators are showing that the market has become bearish. The most likely scenario is consolidation after yesterday’s break of $32, with a possible retracement back to $28.5.

A bearish descending triangle pattern has formed over the last few days. Polkadot price analysis shows that the breakout took place on January 22, once DOT reached close to the $32 resistance level before breaking it down. We now anticipate a retrace back to the lower high at around $28.5, which will act as support for now, unless it starts consolidating again and fails to move any higher than its current position at around $26.

Polkadot price movement in the last 24 hours: Sellers exchange hands with bulls

The most likely future is that of consolidation, with the price either staying at the same level or moving higher in an attempt to establish a higher low on the market. This has happened several times during its downward movement, with small attempts of recovery followed by further lows. An example of this was seen yesterday morning – DOT had reached around $32 resistance before consolidating and finding support at $28.5.

We anticipate another move close to $32 resistance for another attempted break out in USD value, which should trigger a buy signal as per our previous Polkadot analysis. However, we can expect a lower high towards $28.5 before initiating any buys if that doesn’t happen. Sell signals will only be activated if the price breaks below $25.

In addition, we have been seeing a bearish divergence on the RSI, with further consolidation being expected the next day before another attempt at breaking resistance occurs. A clear break above resistance followed by a move equal to that of the initial breakout will result in a further drop towards $20 and perhaps even lower later this year.

DOT/USD 4-hour chart: DOT looks to retrace?

On the 4-hour chart, we can see that the Polkadot price is readying to reverse as further upside was thwarted.

The trading volume is also dropping while the RSI has moved into oversold territory, with further consolidation expected. The 4-hour chart shows that Polkadot price analysis shows that DOT/USD may move sideways until another attempt at breakout or retrace occurs.

With the market currently consolidating after yesterday’s breach of $32 resistance, it would appear that there is an increased likelihood of a retrace towards $28.5 instead of an attempt to break $32 resistance again. There is also a strong likelihood that the market will consolidate below $30 for some time before another breakout occurs, which can be promising if you are looking to buy in at current levels or lower.

Polkadot price analysis shows that yesterday saw heavy selling pressure towards the end of Polkadot’s downward movement, with a clear breach of the initial resistance level taking place and triggering a sell signal on its 4-hour chart once DOT/USD moved past $32. We anticipate further consolidation around this level before another move tries to establish a higher high, which may trigger more buying pressure if it manages to break above this resistance.

Polkadot Price Analysis: Conclusion

The price of Polkadot is bearish today, as the market has struggled against a strong resistance at $28.5 and has remained below it since yesterday. As a result, we anticipate a retracement before further gains can be made in the week.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

cryptopolitan.com

cryptopolitan.com