- Chainlink price analysis is bearish today.

- LINK/USD is currently trading at $25.39.

- Selling pressure has returned overnight.

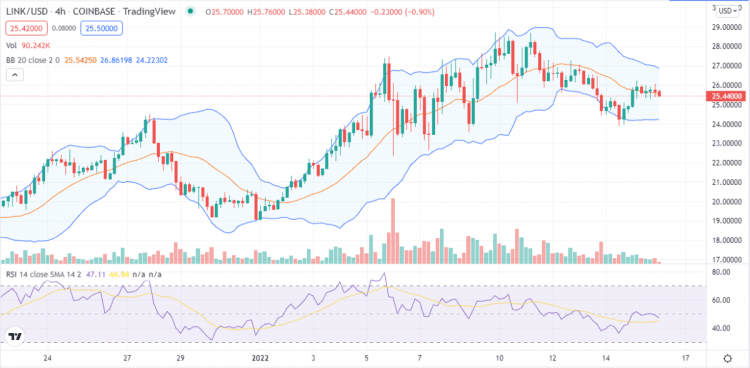

Today’s Chainlink price analysis began in a downtrend, with sellers outnumbering buyers. The LINK/USD pair fell after the sellers had amassed more shares than purchasers, indicating a downtrend. After the bearish trend lacked momentum, buyers flooded in to support at the intraday low of $25.6, turning the downturn around.

As the day progresses, selling pressure is building again as the price bounces between $25.6 and $26.8 over and over again without finding any stabilization or resistance levels. The price is now at $25.6, not far from today’s intraday low of $25.8, which was reached earlier today.

In today’s LINK/USD price analysis, we can conclude that shorting LINK/USD would be unwise. If buying pressure returns, then profiting off the uptrend would yield satisfactory results in the long run; however, if selling pressure persists, then attempting to into it will only result in losses. Today’s trading signal is neutral since the price has not reached its resistance or support levels yet. However, the long-term holding would be unwise even if buying pressure returns.

The future trend of LINK/USD is to break above resistance at $27 to test a new high and end the downward trend that began yesterday morning. A rejection here will result in LINK/USD dropping back down towards support at $24, where buyers will defend this level as demonstrated by past buying patterns.

The overall cryptocurrency heatmap is trading in mixed reactions. The largest digital asset BTC is downtrend after recording a 0.55 percent decrease in the last 24 hours. The second-largest digital asset is also trading in a negative trend today. LINK/USD is currently trading at $26.2, a 2 percent drop. Other altcoins are also trading negatively.

Chainlink price movement in the last 24 hours: Chainlink sets higher low

Today’s likely scenario for LINK/USD is that it must break above resistance at $29.63 to be able to test a new high once again and end the downtrend started yesterday morning. A rejection will see LINK/USD go down again towards support at $26, where buyers are expected to defend this level, as shown by recent buying patterns.

Currently, LINK is trading below both its 50-day and 100-day moving averages. This indicates a bearish trend in the near term, with an overall downtrend for this week. LINK/USD pair has been trading within a descending wedge for around a month but still has not broken out of it yet despite all its attempts to do so. The price will have to break out from this descending resistance before any uptrend can be expected.

LINK/USD 4-hour chart: LINK set to move lower

Today’s trading signal is neutral since the price has not reached its resistance or support levels yet. However, the long-term holding would be unwise even if buying pressure returns.

The price of Chainlink has increased significantly in recent weeks. LINK/USD has risen by 50% from its previous swing low of $19 to the present high of $26.65.

The MACD for LINK/USD is now in the bearish zone, and the moving averages (MA) do not favor further gains. However, we can see that LINK/USD has found buying support at $25.6, and buyers are currently making a comeback.

Chainlink Price Analysis: Conclusion

Chainlink price analysis today is bearish. LINK/USD is currently trading at $25, and its likely that the downtrend will continue. However, the current price presents a good opportunity to buy low in anticipation for a breakout above resistance at $27, which would send the price upwards again towards highs of around $30.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

cryptopolitan.com

cryptopolitan.com