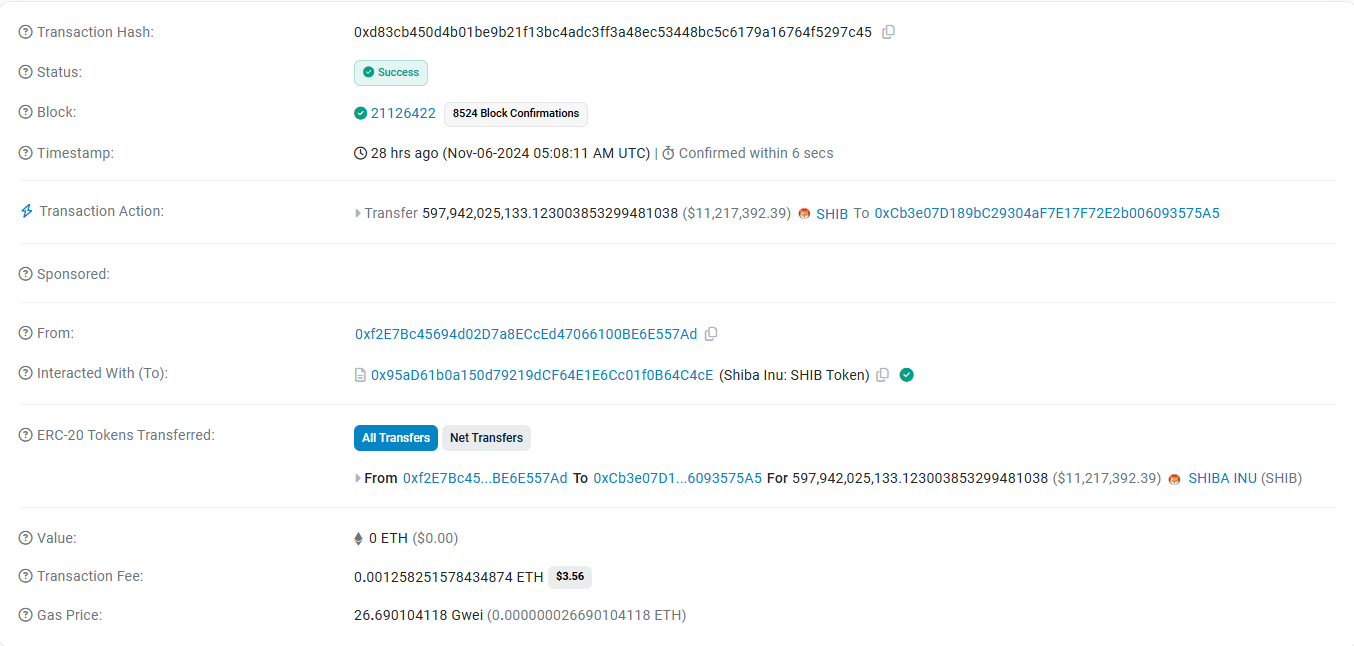

A recent on-chain transaction showed that 597 billion SHIB tokens worth more than $11 million have been moved from an unidentified whale address.

The Shiba Inu community has taken notice of 2024, which has led to conjecture regarding its motivations and possible effects on the price of SHIB. In general, such significant fluctuations can lead to volatility, particularly on an asset that is as susceptible to significant transactions as SHIB. Significant volume transfers by whales frequently raise concerns about possible sell-offs, which could drive the price lower.

Uncertainty surrounds whether this transfer is a sign of an impending sale or just a calculated wallet shuffle. With 6.39 trillion SHIB moved in the last day, SHIB has seen a noticeable increase in large transaction volumes, reaching its highest level in a week according to an analysis of the current on-chain data. This spike in activity might indicate increased interest from major players and a change in the mood of the market. These kinds of whale movements could be a reaction to or a prediction of broader market trends as SHIB tries to breach important resistance levels.

At $0.000019, the top of an ascending triangle pattern, SHIB is presently facing strong resistance on the price chart. This level has repeatedly stopped the upward trend, posing a significant obstacle to future gains. SHIB may pave the way for a protracted rally if it is able to break and stay above this level, with $0.000022 as the next target to keep an eye on. The trend may turn bearish on the downside if it falls below the $0.000017 level, particularly if major holders start to sell off their holdings.

In that case, $0.000015 would be the next support that is a crucial level to stop additional losses. As SHIB gets closer to the triangle pattern's apex, and whale activity increases, traders should prepare for potential price fluctuations. The next few days may be crucial for SHIB's short-term course regardless of whether this whale movement portends a significant sell-off or strategic repositioning.

u.today

u.today