- Chainlink price prediction appears to be bullish.

- The strongest resistance is present at $24.96.

- The strongest support is present at $20.02.

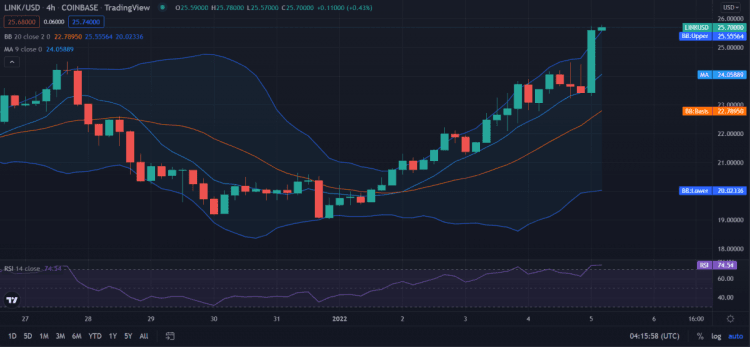

The Chainlink price prediction of January 5, 2022, reveals the market following a strong bullish. The price of Chainlink has been skyrocketing over the past few days. On December 3, 2021, the price went from $21.7 to $23.7 on the same day, an outrageously strong bullish momentum. The next day Chainlink continued with the same velocity and reached $24. On January 5, 2022, the price declined for a short while, only to skyrocket again to rise to $25.7, which is the current price of Chainlink.

LINK/USD 4-hour price prediction: Market undergoing a breakout

The Chainlink price prediction reveals the market’s volatility to be following an immense increasing movement. This means that the price of Chainlink is becoming significantly more prone to undergo variable change. The upper limit of the Bollinger’s band is present at $25.55, which serves as a point for the strongest support rather than the resistance. The lower limit of the Bollinger’s band is present at $20.02, which serves as another point for the strongest support.

The LINK/USD price appears to be moving over the price of the Moving Average, signifying a bullish movement. The market’s trend seems to be dominated by bulls. The LINK/USD price appears to be crossing over the upper limit of the Bollinger’s band, signifying a breakout happening in the market. The market might soon undergo a reverse trend, but the price will increase significantly for now.

The Relative Strength Index (RSI) is 74, which shows a severely overbought stock for the cryptocurrency, meaning that the cryptocurrency falls on the overbought extreme. The RSI can be seen moving in a straightforward, stable which may indicate that this RSI value will be maintained. This may result in a reverse trend very soon, and if the odds are in the bears’ favor, then the cryptocurrency can experience severe devaluation.

Chainlink Price Prediction for 1-day: LINK/USD strongly bullish at $25.7

The Chainlink price prediction reveals the market’s volatility following a slight increasing movement, which means that the price of Chainlink is becoming more prone to experience variable change. The upper limit of the Bollinger’s band is present at $24.96, which serves as a point for the strongest support rather than the resistance. The lower limit of the Bollinger’s band is present at $17.02, which serves as another point for the strongest support.

The LINK/USD price appears to be moving over the price of the Moving Average, signifying a bullish movement. The market’s trend seems to have skyrocketed over the curve of the Moving Average just recently. The LINK/USD price appears to be crossing over the upper limit of the Bollinger’s band, signifying a breakout happening in the market. The breakout may result in a reversal in the market, giving bears the opportunity to seize the market.

The Chainlink price prediction shows the Relative Strength Index (RSI) to be 63, signifying a little overbought value for the cryptocurrency. This means that the cryptocurrency falls slightly towards the overbought extreme. The RSI path can be seen to have shifted to an inclining movement, which may indicate future increments in the price and fall completely into the overbought section.

Chainlink Price Prediction Conclusion: Odds are in the bulls’ favor

The conclusion of the Chainlink price prediction shows that the recognition made in the current behavior of LINK/USD indicates that it is following a massive upwards trend that may shift to a downwards direction soon. LINK/USD has risen smoothly to the $26 mark; the has price reached $25.7 on January 5, 2022 and might keep growing until the $26 mark due to the strong bullish momentum.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

cryptopolitan.com

cryptopolitan.com