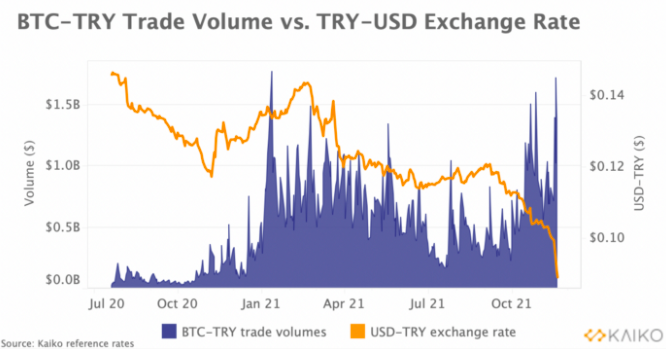

The US dollar has hit a new all-time high today at 96.6, last seen in mid-July 2020. In mid-March last year, USD went as high as 103, and after bottoming out in late May and early June, it has been mostly trending up ever since. The latest uptrend in USD came as Federal Reserve Chair Jerome Powell was reappointed for a second term, encouraging bets on higher US interest rates. With the Fed already announcing the paring of its bond purchases, the growing expectation for tighter monetary policy and an acceleration in economic data has the dollar well-positioned against other major currencies. https://twitter.com/krugermacro/status/1462844939793055748 As we have been noting, the slowdown or removal of liquidity from the market is not good for the prices of risky assets, which could negatively impact crypto prices. “A stronger greenback would have you believe the same tailwinds that propelled global asset prices—including BTC and crypto—over the last 18 months are starting to reverse course,” commented Delphi Digital. Already, this week, crypto-asset prices tumbled, with Bitcoin going to $55,600 and Ether to $4,020.  As a result, funding rates are resetting and even briefly turning negative since last week as after hitting ATH at $69,000 two weeks back, the market has been struggling to be bullish. On most exchanges, funding rates are hovering in neutral territory, the highest on OKEx at 0.0257%, indicating bullish demand is muted. At $23.36 bln, Bitcoin’s open interest meanwhile remains significantly higher than September lows of $13.11 bln but down from $28.85 bln ATH on Nov. 10. This USD is also rallying to a 16-month high amidst renewed lockdown fears in Europe after last week investors sought a safe haven on inflation worries. Surging US inflation and the prospect of a sooner than expected rate hike by the Fed has helped DXY run higher, putting pressure on riskier assets and emerging market currencies. Emerging markets are already struggling with rising inflation and especially as the dollar strengthened. The Turkish lira (TRY) actually hit record lows against the USD. This devaluation of lira since September (-35%) has been mirrored by strong growth in BTC-TRY trade volumes, noted digital asset data provider, Kaiko. The increase comes despite Turkey banning the use of crypto for payments back in April.

As a result, funding rates are resetting and even briefly turning negative since last week as after hitting ATH at $69,000 two weeks back, the market has been struggling to be bullish. On most exchanges, funding rates are hovering in neutral territory, the highest on OKEx at 0.0257%, indicating bullish demand is muted. At $23.36 bln, Bitcoin’s open interest meanwhile remains significantly higher than September lows of $13.11 bln but down from $28.85 bln ATH on Nov. 10. This USD is also rallying to a 16-month high amidst renewed lockdown fears in Europe after last week investors sought a safe haven on inflation worries. Surging US inflation and the prospect of a sooner than expected rate hike by the Fed has helped DXY run higher, putting pressure on riskier assets and emerging market currencies. Emerging markets are already struggling with rising inflation and especially as the dollar strengthened. The Turkish lira (TRY) actually hit record lows against the USD. This devaluation of lira since September (-35%) has been mirrored by strong growth in BTC-TRY trade volumes, noted digital asset data provider, Kaiko. The increase comes despite Turkey banning the use of crypto for payments back in April.  According to Chainalysis, currency devaluation has been among the main drivers of crypto adoption in the country, accounting for a large percentage of crypto use in the Middle East. Meanwhile, the Turkish central bank has cut its policy rate by 100bsp, further contributing to the lira’s historic meltdown. “This could favor crypto assets which are seen as a more stable investment alternative,” said Kaiko.

According to Chainalysis, currency devaluation has been among the main drivers of crypto adoption in the country, accounting for a large percentage of crypto use in the Middle East. Meanwhile, the Turkish central bank has cut its policy rate by 100bsp, further contributing to the lira’s historic meltdown. “This could favor crypto assets which are seen as a more stable investment alternative,” said Kaiko.

Dollar Sends Warning Signs for Risky Assets including Bitcoin and Crypto

bitcoinexchangeguide.com

23 November 2021 14:14, UTC

bitcoinexchangeguide.com

23 November 2021 14:14, UTC