The Stock-to-Flow (S2F) model determines the ratio of the amount of an asset in reserves to the value of its issue. S2F allows people to determine the abundance or deficit of assets. Traditionally, gold is considered the asset with the highest value of this ratio. Soon, cryptocurrency will take the place of the precious metal.

Bitcoin limited emission is one of the main characteristics of the digital asset. Moreover, crypto industry experts and analysts believe that this is one of its strongest advantages. This factor flush BTC with traditional assets such as gold and silver.

The deficit is the limited number of goods that are in demand on the market. Perhaps the most popular scarce commodity is gold. Although we do not know exactly the remaining amounts, it is obvious that natural resources are not unlimited.

The emission of the most popular digital asset is also limited, with a total of 21 million coins. However, unlike gold or silver, Bitcoin allows people to transfer coins via the Internet, which is the main differentiating factor.

By the way, recently the price of gold has been showing very good growth: the rate of movement of the value of the precious metal has reached a five-year high.

For example, palladium has a low S2F ratio, since in its case the available offer is small relative to the new release. Thus, he cannot fulfill the function of money, since an existing proposal can easily get renewed by a new one.

However, even taking into account the serious drop in Bitcoin price (the coin has fallen by almost 30 percent since June), cryptocurrency still greatly outperforms its rival in terms of profitability.

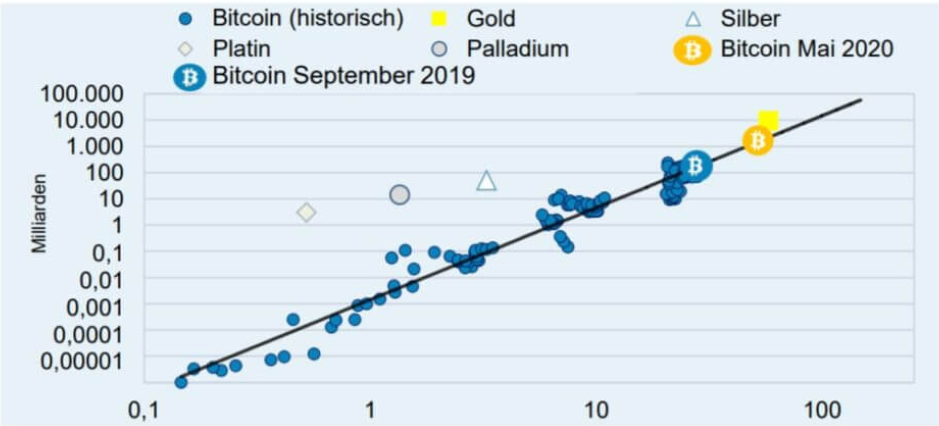

The chart below demonstrates the historical movement of the S2F index for Bitcoin and the most popular precious metals.

Source: Bayernlb.de

According to experts, the value of BTC will also grow steadily and will pleasantly surprise investors next year.

Why the Stock-to-Flow Model Does Not Apply To XRP And Ethereum

The idea is that the deficit measured by Stock-to-Flow is an input-output factor. As the ratio grows, value also tends to increase.

But this model does not apply to all digital currencies, exists over the crypto space. For example, such digital currencies as Ripple (XRP) and Ethereum (ETH) do not correlate with this indicator.

This is primarily because of both digital currencies ETH and XRP do not have a fixed emission. Therefore, when a well-known analyst on Twitter under nickname PlanB was asked to make a model for these digital assets, he replied that he could not do this.

“CEO of XRP and ETH can change flow (print new coins) as they like, so S2F is not applicable. These coins have other value based on utility rather than scarcity based monetary premium,” he notes.

the CEO of XRP and ETH can change flow (print new coins) as they like, so S2F is not applicable. These coins have other value based on utility rather than scarcity based monetary premium. Also, there is no correlation (let alone cointegration) between S2F and ETH/XRP price.

— PlanB (@100trillionUSD) November 12, 2019

Therefore, the place of these digital currencies on the market depends on the management of companies in a sense. Therefore, the Ripple Labs, which stays behind XRP, owns significantly part of all issued tokens, while Bitcoin does not have such an organization.