Trading for the first bitcoin futures exchange-traded fund (ETF) approved by the Securities and Exchange Commission (SEC) began this week for U.S. investors, and the cryptocurrency market appears to be rallying around its launch. The ProShares Bitcoin Strategy ETF (BITO) was the first to list on the New York Stock Exchange, with trading starting on Tuesday.

However, it’s vital to note what the approved ETF actually looks like and how much potential demand there might be for these products. One way to gauge interest is to see how other ETFs around the world have performed and what investors are actually looking for in a bitcoin investment vehicle.

This article is part of Crypto 2022: Policy Week, a look at how regulators and legislators are shaping cryptocurrency and how the industry is fighting back.

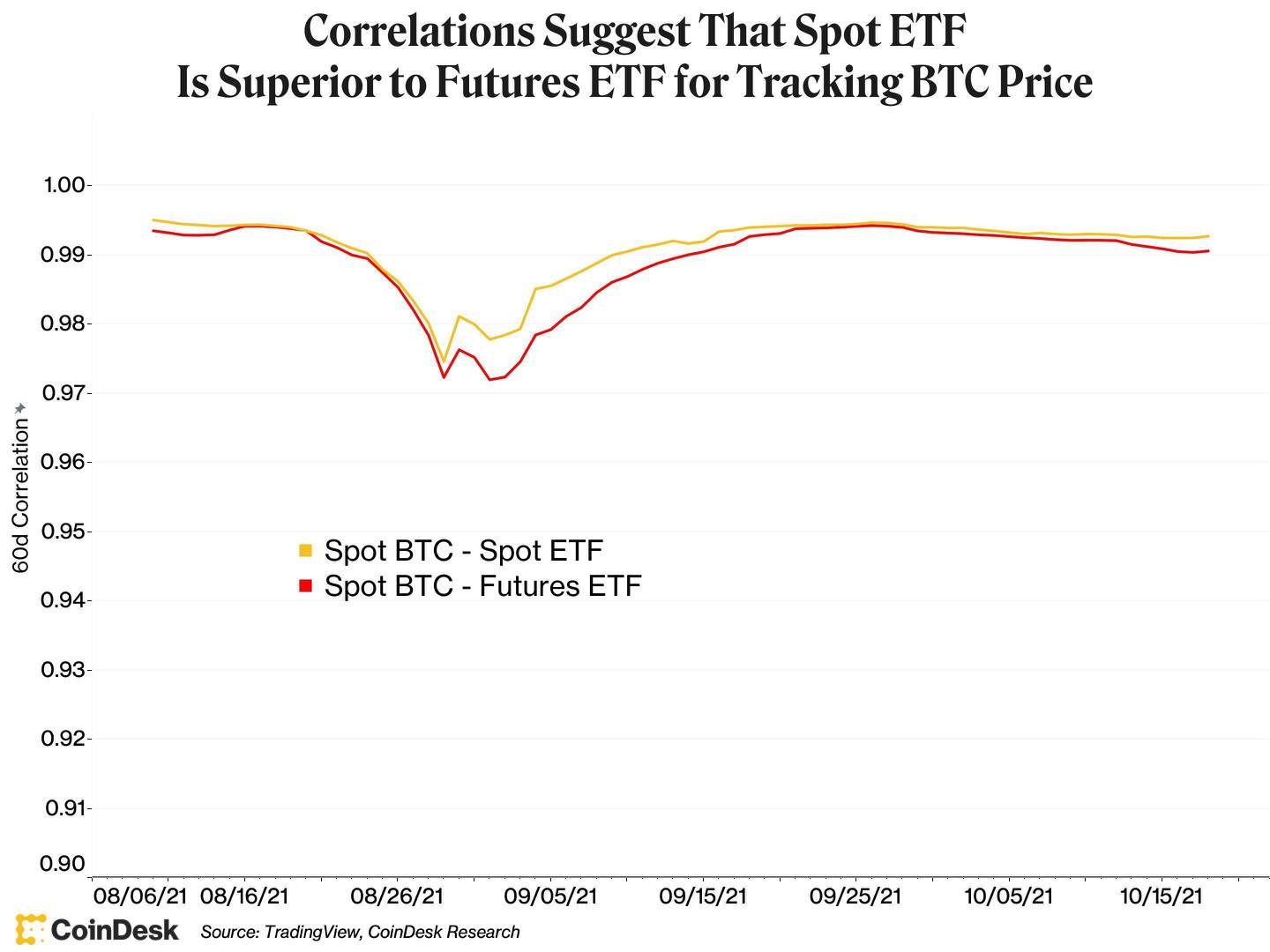

The SEC-approved bitcoin ETF is a futures-based trading products and does not hold any of the underlying crypto assets. A futures-based ETF tracks a derivative of bitcoin, rather than the actual asset. According to CoinDesk Learn, “Bitcoin futures may diverge from the spot price of bitcoin due to the prevailing market sentiment, so bitcoin futures ETFs might also occasionally track the price of bitcoin inaccurately.”

In contrast, spot-based ETFs hold the underlying asset and give investors direct exposure to the price movements of bitcoin. However, these investment products have been repeatedly rejected by the SEC.

Read more: What Is a Bitcoin Futures ETF?

Looking north: ETFs in Canada

As Americans attempt to understand the effects of the futures ETF, there is no better place to look than Canada for contrast. The upstairs neighbor has several crypto-focused ETFs trading on the Toronto Stock Exchange with billions of dollars in assets under management. 3iQ Coinshares, Purpose Bitcoin and CI Galaxy Bitcoin are three of the largest funds; Purpose is the largest with $1.2 billion (CAD $1.64 billion) in assets under management (AUM) as of Oct. 13.

More importantly, the top three ETFs by AUM are all directly invested in spot bitcoin with the futures-based alternative drawing in only $7.6 million (CAD $10.48 million) AUM or about 0.3% of Canadian ETFs, providing insight to the preference of investors.

Why is the SEC adamant on approving a less favorable alternative?

The chairman of the SEC has been outspoken about investor protection and the oversight that comes alongside futures markets and other derivatives. Gensler deemed the spot bitcoin market susceptible to manipulation and an illegitimate source for an exchange-traded product. However, Bitwise argues the regulated CME bitcoin market is now the leader in price discovery, making it a viable option for spot-based ETFs.

The addition of any bitcoin ETF was a long time coming in the United States, but hopeful ETF providers have had even less luck in other countries, with France and Australia just beginning to offer “crypto-focused” equity funds. Holding stock in mining companies or in crypto-invested strategic companies like MicroStrategy has been a loophole for investors to gain exposure to the growth of the crypto industry. The United States’ recent decision may pave the way for regulation worldwide, considering its sheer dominance throughout other ETF markets.

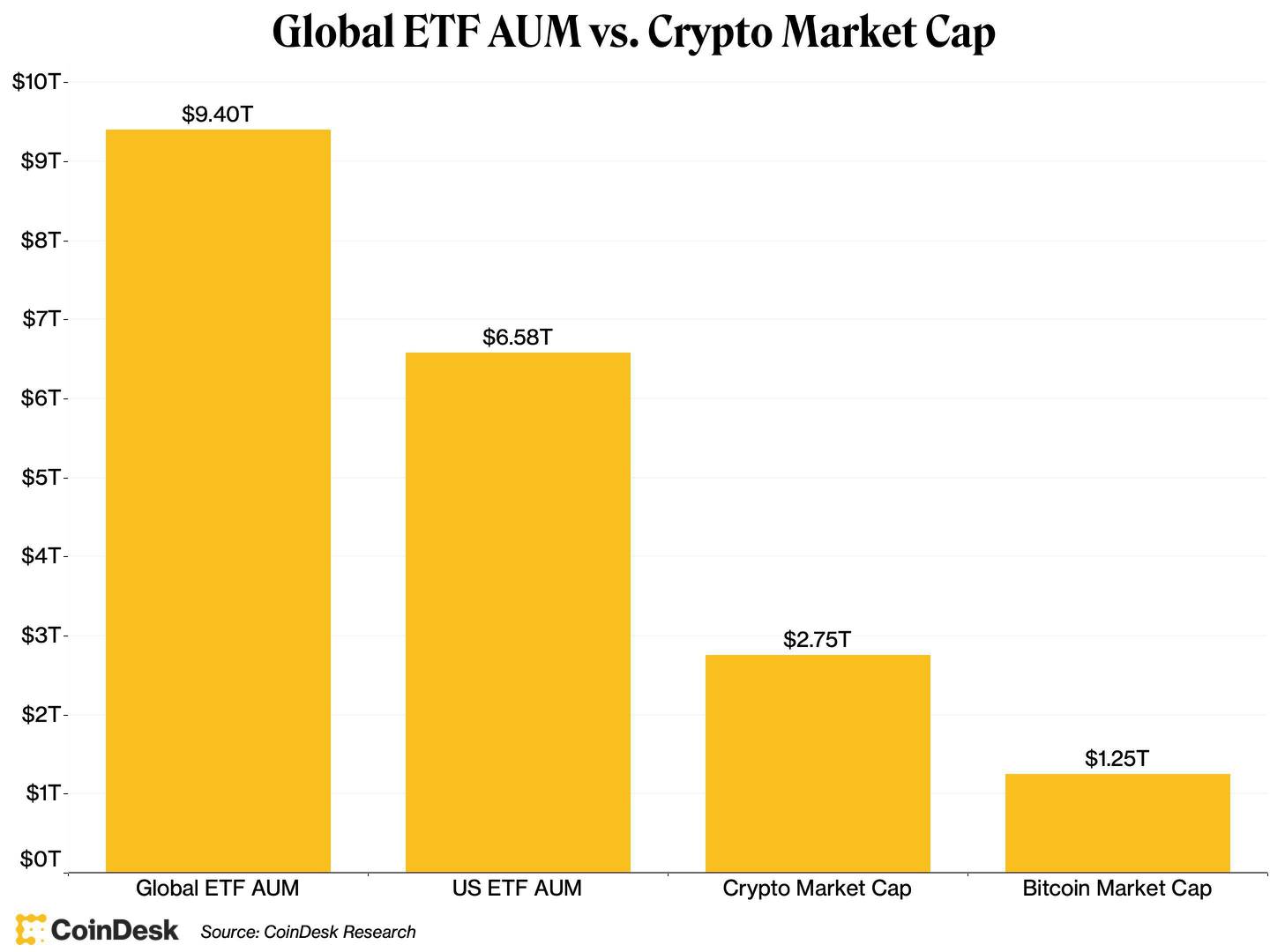

While futures-based ETFs are not investors’ first choice, the combination of crypto and ETFs could make a big splash, introducing a new class of investor to both sectors. Consider that the global ETF industry currently has $9.4 trillion in assets under management, growing at an annual rate of 26%, while crypto’s market capitalization sits at $2.75 trillion – and most of its value is being held on retail exchanges, in trusts like Grayscale (a CoinDesk sister company) or on-chain where it can be used as intended. The U.S. represents $5.47 trillion in ETF AUM, or 70% of the overall market, signaling its adoption of crypto ETFs could be unprecedented.

Sufficient demand for the futures product could also lead to an influx of capital to ETF markets and increase buying pressure on BTC. If the first day of trading was any indication, the U.S. market has clearly been waiting for easier access to bitcoin. ProShares’ BITO ETF did over $1 billion in volume, the second highest of any ETF at launch.

Furthermore, the launch of futures-based ETFs may be a stepping stone to the maturity of bitcoin trading markets and the eventual listing of a spot-based product. If the SEC agrees with Bitwise, that the regulated CME market is responsible for price discovery, a wave of true spot ETFs might not be far off.

coindesk.com

coindesk.com