Binance Coin (BNB) has potentially completed a fourth wave pullback by bouncing at the $385 horizontal and Fib support area.

PancakeSwap (CAKE) broke out from an ascending parallel channel and validated it as support afterwards.

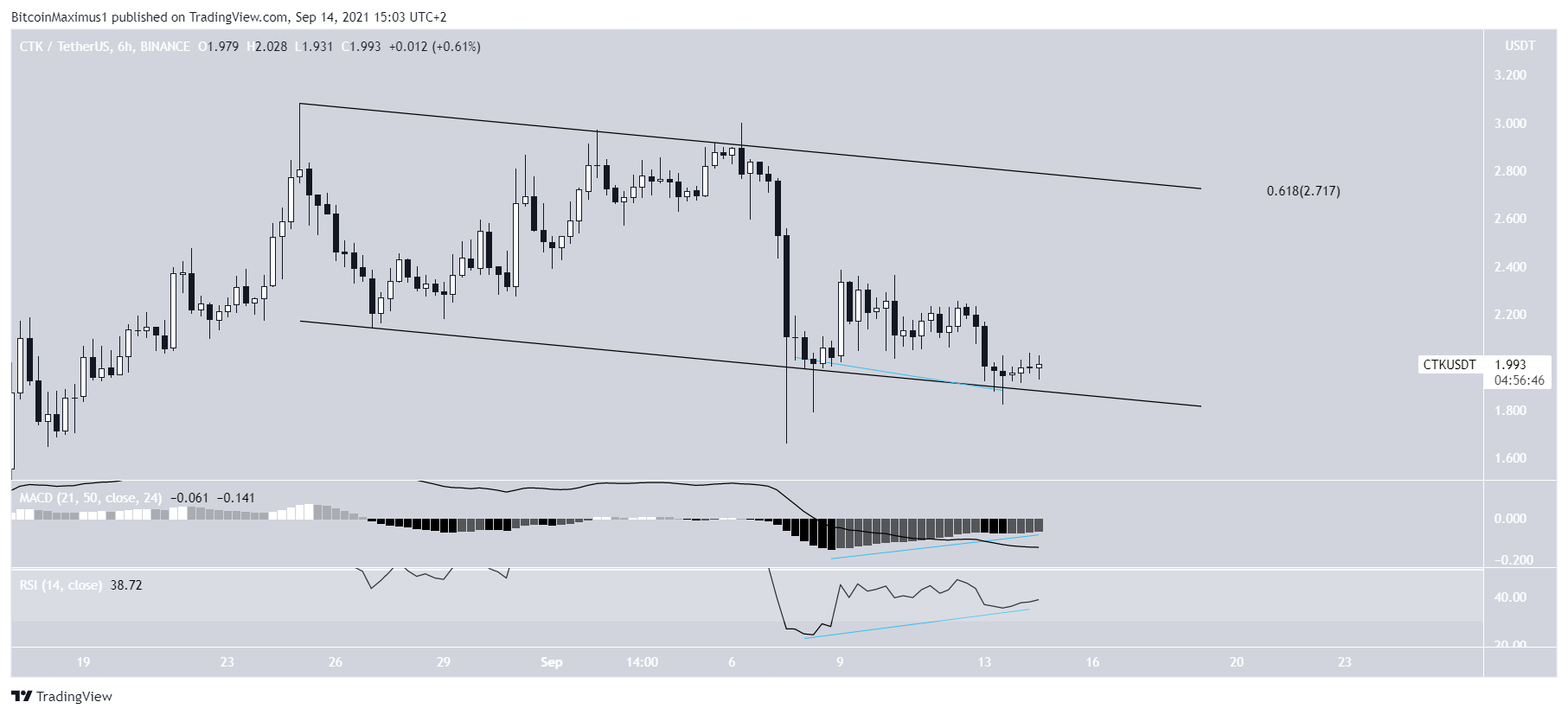

CertiK (CTK) broke out from a descending resistance line, but failed to reclaim the $3 area afterwards.

BNB

BNB had been increasing inside an ascending parallel channel since June 22. On Aug 11, it managed to break out from the channel and reached a high of $518.9 on Aug 26. The high was made right at the 0.618 Fib retracement resistance level (white).

However, it failed to break out, created a lower high and dropped sharply on Sept 7.

Despite the drop, BNB managed to bounce at the 0.5 Fib retracement support level at $385. This potentially completed a fourth wave pullback.

Furthermore, the RSI and MACD have both generated bullish divergences.

Therefore, if BNB manages to hold on above the resistance line of the channel, it will likely break out from the $510 resistance area.

Highlights

- BNB has potentially completed a fourth wave pullback.

- There is support and resistance at $385 and $510, respectively.

CAKE

Similarly to BNB, CAKE had been increasing inside an ascending parallel channel since June 22. It broke out from the channel on Aug 5 and proceeded to reach a high of $26.6 on Aug 26.

However, it has been moving downwards since. Despite the drop, CAKE has validated the previous resistance line of the channel as support (green icon). The line also coincides with the 0.5 Fib retracement support level at $18.75.

Despite the bullish re-test, technical indicators in the daily time-frame are bearish. The MACD and RSI are both decreasing, and the latter is below 50.

The shorter-term six-hour chart indicates that a bounce is likely since there is a bullish divergence in place in both the MACD and RSI.

However, there is also a short-term descending resistance line in place, which coincides with the 0.618 Fib retracement resistance at $23.50.

Due to the bearish readings from the daily time-frame, the trend cannot be considered bullish until CAKE manages to reclaim this line/level.

Highlights

- CAKE has broken out from an ascending parallel channel.

- It is following a short-term descending resistance line.

CertiK

CTK had been decreasing alongside a descending resistance line since April 6. This led to a low of $0.75 on June 22. However, CTK initiated an upward movement afterwards and managed to break out on Aug 17. This led to a high of $3.08 on Aug 25.

While CTK initially moved above the 0.618 Fib retracement resistance level, it failed to sustain its upward movement. To the contrary, it created a double top (red icons) and fell almost immediately afterwards.

It is currently trying to find support above the $1.75 support area.

Technical indicators in the daily time-frame are bearish. The MACD and RSI are both decreasing and the latter is below 50.

Despite the bearish reading from the daily time-frame, the six-hour chart is bullish.

It shows a descending channel, which often contains corrective structures.

Furthermore, both the RSI and MACD have generated bullish divergences right at the support line of the channel.

Therefore, an upward movement towards the resistance line of the channel would be likely. The resistance line also coincides with the 0.618 Fib retracement resistance level at $2.72.

Highlights

- CTK has broken out from a descending resistance line.

- There is support and resistance at $1.75 and $2.70, respectively.

beincrypto.com

beincrypto.com