Elrond EGLD/USD has two unique features that make it stand out.

First you have adaptive state sharding, which is the process of splitting the Elrond infrastructure to support more transactions as well as programs.

Second, you have secure proof-of-stake (SPoS), which is the consensus mechanism used to sync separate network components into a common ledger.

As such, this is a blockchain that attempts to offer fast transaction speeds through the use of sharding.

If you’re curious, sharding works in the way through which it splits the network into pieces or shards, for nodes to only have to really process a fraction of all of the transactions. Furthermore, once every 24 hours, a third of the nodes validating the transactions within each of the shards are reshuffled in a new shard, and the intention here is to prevent collusion.

New EGLD coins are minted through the SPoS consensus mechanism that validates the transactions. It is used to select validating nodes to produce blocks within a shard, rather than the entire network, keep this in mind.

By owning and staking EGLD, users can vote on network upgrades and are rewarded with EGL as a result, proportional to the amount which they staked.

Elrond Developments

On May 20, Holoride, the Audio spinoff which creates in-vehicle XR passenger entertainment experiences, announced that it will be deploying blockchain technology and NFTs as the next stage in its preparation for a 2022 market launch. To do this, they will be integrating the Elrond blockchain into its tech stack with the intention of bringing transparency to the ecosystem.

On June 7, Maiar, the blockchain app that is powered by the Elron Network, joined the Huawei Ecosystem. After the announcement Maiar is available to download on the AppGallery.

It is a digital wallet as well as global payments app that allows users to exchange and securely store more on their mobile devices. The value of EGLD here was $100.

We can clearly see that development for Elrond is active throughout various industries and a lot of companies might jump on the bandwagon to take advantage of all of the features on offer through its blockchain. This could potentially make the price of EGLD rise as a result.

In the long term, once Holoride actually launches their line of products in 2022 with Elrond, the price has the potential to truly sky-rocket even upwards of $200 as it would receive some mainstream appeal and will raise its popularity. However, for now, one of the main pushing forces of its value is the AppGallery implementation of one of the apps developed on its blockchain known as Maiar, which, when it gains more downloads and usage, could drive the price of EGLD up to $100 potentially.

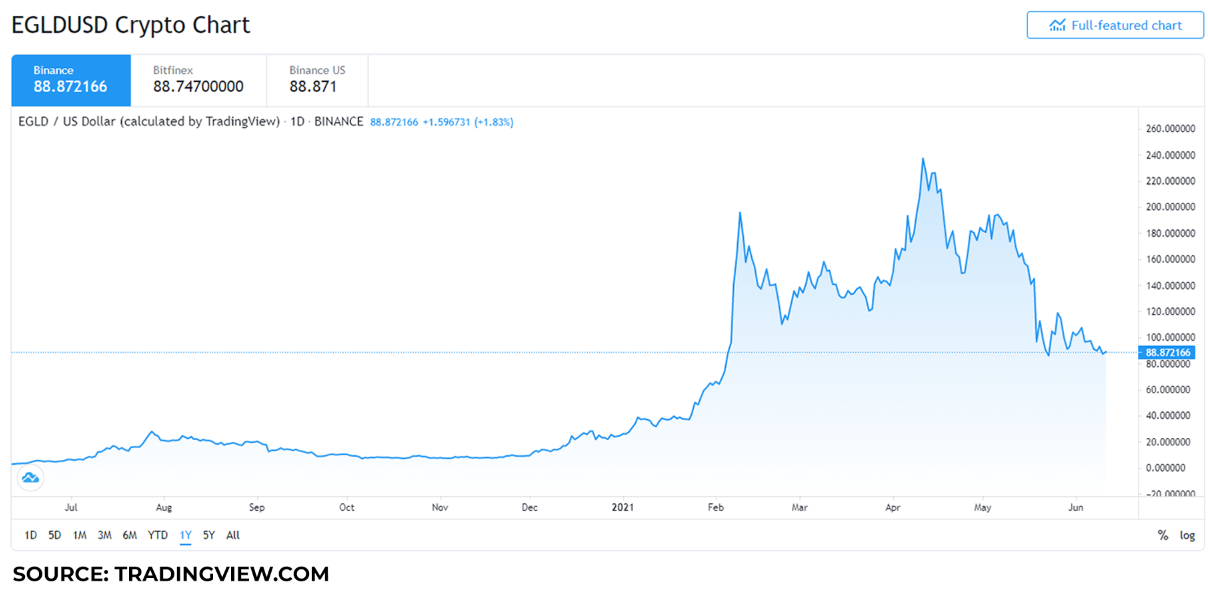

On June 11, EGLD has a value of $88. Ultimately, given the fact that it has been floating over the $100 mark throughout most of April and half of May, it could potentially get back up to that value. At this time, at $88, it’s a bit of a tough sell, however, once the ecosystem kicks back up its pace it has a real chance of getting over the $100 mark again, which might make it a worthwhile investment.

invezz.com

invezz.com