|

Gone are the days when someone used to talk about cryptocurrencies, and people used to think about a shady place in the dark web. Today, cryptocurrencies or the class of digital assets are widely accepted all over the world. However, altcoins are picking up the pace in crypto adoption.

|

Cryptocurrencies have seen their biggest surge since late 2017, attracting a lot of attention. Investors are looking for the top cryptocurrencies to diversify their portfolios. Bitcoin, the most successful cryptocurrency, recently reached a record high of $63,000 before seeing a surge in sales, providing investors with a window to purchase bitcoins before the price rises again. One bitcoin is currently worth $56,500 at the time of writing.

Despite the success of Bitcoin, altcoins are the ones that are taking all the attention in the crypto space nowadays. All cryptocurrencies other than Bitcoin are referred to as Altcoins. The success of Altcoins has lowered the market dominance of Bitcoin. People are now looking at altcoins more these days for profitable trading opportunities.

Altcoins Rising, BTC Market Dominance Falling

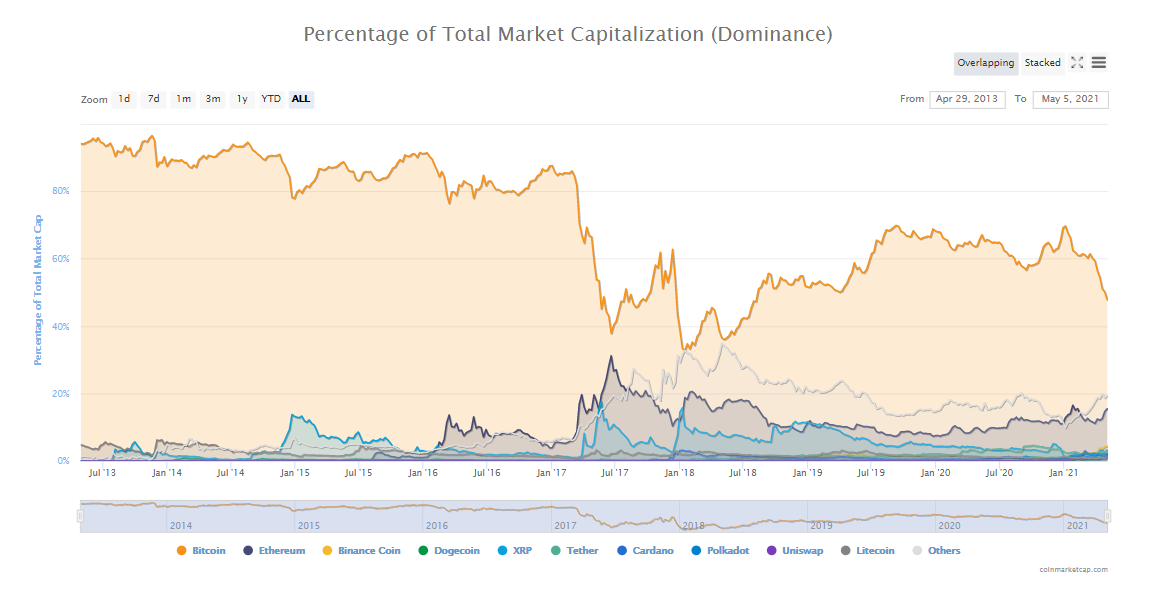

One of the best points to witness the rise and acceptance of altcoins is by examining the downsliding graph of Bitcoin’s market dominance. In January 2021, BTC’s market dominance was above 70%, which has come down to 44% at the time of writing. The market dominance recently fell to a great extent as its next-biggest rival Ether reaches the $3,500 milestone. The chart below shows Bitcoin’s market dominance falling steeply this year.

Other cryptocurrencies have also increased in value. According to CoinGecko, the price of Binance Coin has increased by 3,460% in the last year. Dogecoin, a cryptocurrency that began as a joke in 2013, has since become a social-media darling lauded by Elon Musk. It has risen 15,000% to a market cap of about $75 billion.

Therefore, with a captivating market like this, only a fool would stop themselves from investing. Now is the time to invest if you want to get maximum returns for your money. If you are thinking of investing in Altcoins this month, then this article will help you with the top Altcoins to invest in for May 2021.

Top 10 Altcoins for May 2021

Given the global pandemic that has changed the way we live, the previous year was nothing short of a disaster for the entire planet. It also triggered an economic downturn that is possibly only just getting started, with long-term implications. However, when it comes to the cryptocurrency market, the last 12 months have been the best in its history.

Countless altcoins have enjoyed massive price hikes. Ethereum is the largest cryptocurrency today and has already made multiple new ATH records. The launch of new Dapps has also increased the potential of many Altcoins. NFT tokens like Theta and Chiliz have also gained significant importance in the past few months.

At CoinMarketCap, there are over 4,800 cryptocurrencies in circulation, with new coins and tokens launching almost daily. We have listed the top 10 Altcoins best to invest in the month of May 2021.

Note: Altcoins are not given in any particular order, and the price and market cap of all the tokens are as per the research for the article.

XRP (Ripple)

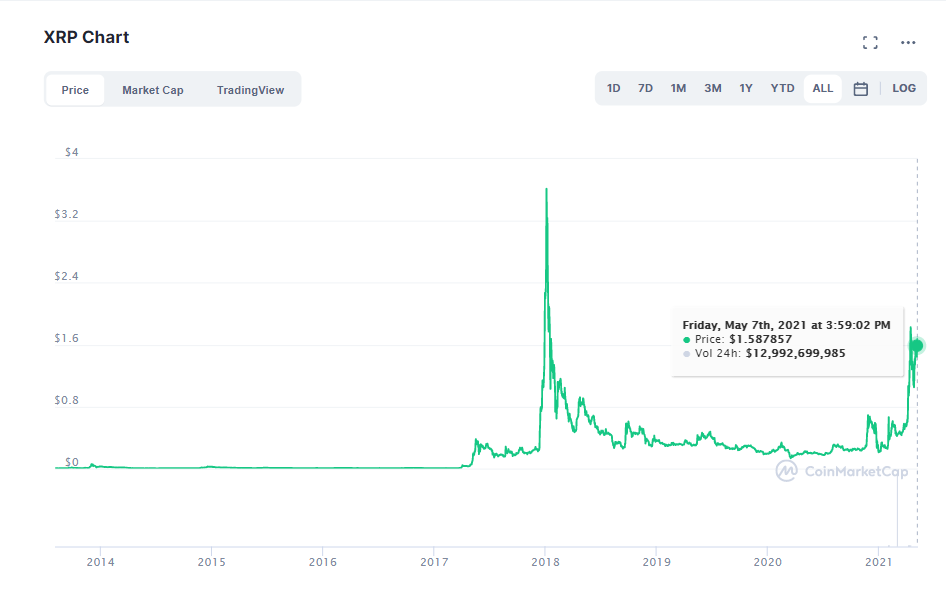

The current XRP price today is $1.69 with a 24-hour trading volume of $13 billion. Ripple built XRP as a faster, less expensive, and more scalable alternative to other digital assets as well as established monetary payment channels such as SWIFT. Ripple was having a hard time last year when the Securities and Exchange Commission filed a complaint against Ripple Labs and two of its executives. The SEC alleged that they earned more than $1.3 billion in an unregistered, ongoing digital asset securities sale. The price of the crypto fell along with its market cap.

However, over the past two months, things have started to look better for the crypto token. After Judge Analisa Torres of the Court for the Southern District of New York granted attorney John Deaton permission to file a motion to interfere in the ongoing case on behalf of a section of XRP holders, the community eventually saw a major victory (that could be a significant point in their favor). And since then XRP has been regaining its position in the crypto space.

From a trading price of $0.55 in March 2021, the token went on to hold a price of $1.42 today. Its global market cap went down to $25 billion in March this year, and now it is $72 billion. This huge increase in number is enough to prove that XRP is ready to flourish once again. And this month will be a good one for the token as it is again the 4th largest cryptocurrency. Its 24-hour trading volume is also witnessing a green chart. Therefore, with the SEC case finally moving towards Ripple’s favor, May will be an important month for XRP.

Solana

Solana is a fully functional open-source project that leverages the permissionless nature of blockchain technology to provide decentralized finance (DeFi) solutions. Anatoly Yakovenko’s proof-of-history (PoH) consensus is one of the critical developments Solana brings to the table. This definition allows for greater protocol scalability, which improves usability. This token has been performing exceptionally well over the past few months. It started the year with a trading price of $1.84, and today the price of the token stands at $42.97. It held a market cap of $85 million in January 2021, whereas today its market value is near $11 billion.

Solana is one of the most rapidly expanding DeFi ecosystems, with a native cryptocurrency coin that peaked in value last month. It was launched in March 2020 and has quickly risen to become the 14th largest cryptocurrency.

“Solana is a very good project. Over the past month, we have seen buying on pullbacks. We would expect people to deploy capital to good projects when the market moves down,” said Todd Morakis, co-founder and partner at JST Capital.

Solana is being considered as a possible Ethereum alternative, capable of faster transactions and higher scalability, with DeFi booming over the last year and the non-fungible token (NFT) craze taking off. Since the Ethereum blockchain hosts the majority of DeFi and NFT creation, the network has become increasingly congested, resulting in higher transaction costs or “gas fees.”

According to the company’s website, Solana’s hybrid protocol allows for substantially reduced confirmation times for both transaction and smart contract execution. Therefore, with so much happening around the token, you cannot miss out on this if you are looking for profitable returns in May.

Polkastarter

Polkastarter is currently trading at $3.27, with a 24-hour trading volume of $63,484,706. It has a market cap of $208 million. Note that its market cap was just $32 million at the beginning of this year. Therefore, this token has recently started to main serious surge and momentum, making it one of the most potential altcoins for May. Polkastarter has the potential for serious growth as it is unique. Instead of using the AMM model popularized by Uniswap, Polkastarter’s key offering is its fixed swap smart contract, which allows projects to quickly launch liquidity pools that execute orders at a fixed price.

Since a lot has been happening on Polkastarter’s blockchain platform, this surge in price is only justified. UnoRe, the world’s first decentralized reinsurance network, has debuted its IDO on Polkastarter, a popular decentralized exchange. Refinable’s IDO, according to Daniel Stockhaus, co-founder and CEO of Polkastarter, is the first step in getting further ventures into the thriving BSC ecosystem.

In the company’s announcement, he said, “We will continue to reinvent the decentralized funding environment while enhancing the experience for our projects and users.” Hence, this token should have your attention in the months to come.

Polygon (Matic)

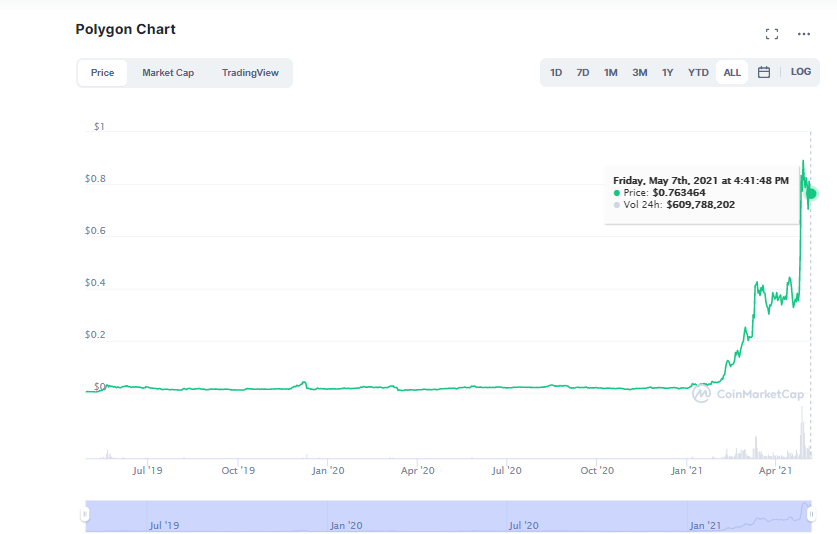

The altcoin has shown significant growth since March. The token was trading at $0.01 at the beginning of the year, and today, it holds the value of $0.76. It has a market cap of $3 billion today. Polygon describes itself as a Layer 2 scaling solution, implying that the project has no plans to update the current basic blockchain layer anytime soon. The project aims to reduce the complexity of scalability and to enable instant blockchain transactions. It also reduces the transaction fees.

In terms of scalability, security, and user experience, Matic/Polygon outperforms other networks. Matic/Polygon collaborates with a diverse range of organizations on a variety of exciting projects. This also adds up to the reason why the taken is currently witnessing a surge in its price. According to data provided by CryptoCompare, MATIC hit a new lifetime high of $0.9459 on April 30th, surpassing the previous lifetime high of $0.92. This month, the token has increased by 150%, outperforming Ether’s 45% increase. Denis Vinokourov, head of research at Synergia Capital, said:

“The ongoing capital rotation into all things Polygon is showing no signs of abating. The layer 2 scaling solution is attracting capital inflows at an astronomical rate, as evidenced by the recent sharp rise in the total value locked through $1.5 billion.”

Polygon is gaining popularity as more sites begin to embrace it. As a consequence, its use is increasingly growing, so much that purchases have more than doubled. According to Crypto Briefing, if the network can maintain its current momentum, it can quickly catch up to other players in the room.

Siacoin

Siacoin (SC) is the native utility token of Sia, a distributed, decentralized cloud storage platform built on the Ethereum blockchain. Sia is a safe and trustworthy cloud storage marketplace where users can rent out their unused storage space.

This altcoin is showing significant growth over the past few months, and that is why it should be on the list this month. Its price was at $0.003 in January 2021, and today its price stands at $0.042. Its global market cap stands at $2 billion. Not just that, the crypto was up by 36% in the past week.

Siacoin is one among such altcoins, with a price that has fallen to $0.04 since reaching a high of $0.05. The asset’s price is also more than 60% lower than the peak of the last bull run, which was $0.11 in January 2018. In the case of Siacoin, there isn’t enough liquidity across top exchanges to support volatility. However, if liquidity improves in the short term, Siacoin might make a comeback.

By constructing the infrastructure and outsourcing storage to anyone with an internet connection and a hard drive, Sia has drastically reduced overhead. As a result, it charges a much smaller fee. So, if the charts have to be believed and the bull run lasts in the crypto space, this token is expected to gain further momentum.

Card.Starter

CARD.STARTER (CARDS) is a cryptocurrency and operates on the Ethereum platform. The token is currently trading at $36.56, which is significantly up from $3.31 in April 2021. The price of the token has even gone up to$38. Therefore, even if the price is witnessing a correction at this moment, the graph looks quite promising for the month and the price is expected to continue its upward trajectory. The coin is new and has already gained a lot of attention from the crypto space.

CardStarter (CARDS), which bills itself as the “first insured project accelerator for Cardano (ADA),” is making waves after skyrocketing from $0.159 on March 29th to $10.2 on April 2nd, marking a 6,315% increase in a matter of days. As the Cardano blockchain allows smart contract functionality, CardStarter token holders will be able to get early access to such token launches.

Both teams using CardStarter to crowdfund their projects will be required to donate to the CardStarter treasury, which will be used to protect those who invest in the Cardano network’s participating new projects. Hence, keep your eye on this token.

Injective Protocol (INJ)

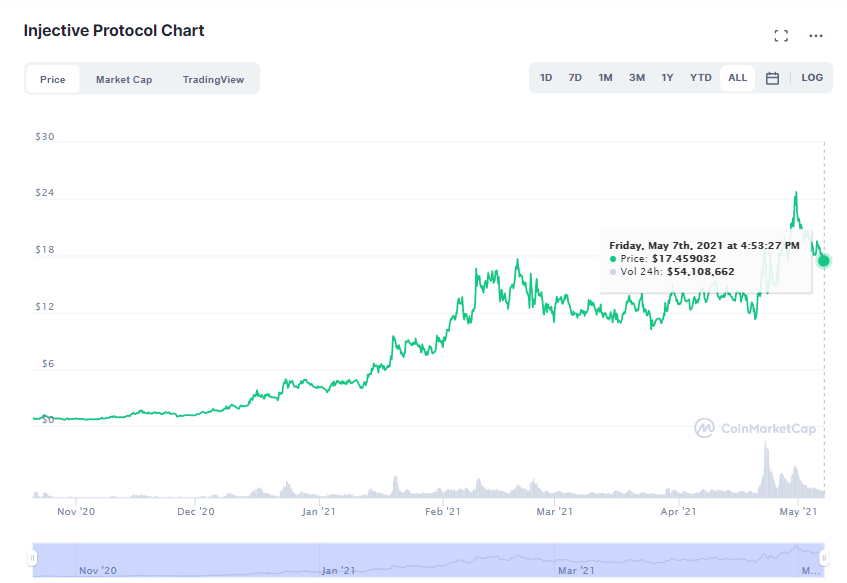

Another potential token of the month, Injective Protocol is a ground-breaking concept that aims to make currency exchanges fully decentralized, public-operated networks. INJ enables investors to take part in a truly decentralized finance (DeFi) organization, where they have the power to make decisions and introduce new ideas. Its token is currently trading at $17.44, which is up from $4.1 in the first week of January. It holds a market cap of $428 million.

Recently, a new funding round of $10 million has been secured by Injective Protocol. With the private token round, Injective Protocol’s cumulative funding to date exceeds $17 million. Previously, the protocol raised $7.1 million. Several investors, including Pantera Capital and billionaire Mark Cuban, contributed to the funding for its DeFi protocol, which is said to combine the best of both centralized and decentralized markets. The aim of Injective is to create a decentralized competitor of Robinhood.

Injective has collaborated with many blockchains to enhance the user experience. It has confirmed partnerships with API3, Harmony, Staked, Litentry, Persistence, Big Data Protocol, and Klaytn so far in April. And with so many projects happening, it can not take the price of the token upwards and onwards.

Band Protocol

This altcoin is currently trading at $18.62. And holds a market cap of $383 million. Band Protocol was initially introduced as an ERC-20 project on the Ethereum blockchain in September 2019, but with the introduction of Band Protocol 2.0 in June 2020, it was moved to the Cosmos network. The new protocol is based on BandChain and was created with the Cosmos SDK.

After reaching a new all-time high of $23.40 on April 15, Band Protocol experienced a major correction. Its market value fell by more than half in three days, losing more than 12 points. Despite the disastrous dowsing, it appears that major “whale” investors used the confusion to buy BAND at a discount.

According to the Band Protocol supply distribution table, the number of addresses with 1,000 to 100,000 BAND increased by 4.90% in the last week. During that time, approximately 16 whales joined the network. Therefore, one can now expect the price of the token to reach new highs soon.

Band Protocol announced on April 15 that Google Cloud has integrated its standard dataset to allow for accurate and instant insights into “financial time series data,” according to a Medium post. So with news around the token, this is the right to invest in the token.

VeChain (VET)

VeChain (VET) is a blockchain-powered supply chain network. It is unique in that it uses transparent technology with no single point of weakness or control, allowing for greater protection, performance, and ease of tracking goods in a given supply chain while reducing costs through trustless automation. The price of the token stands at $0.24 and has a market cap of $15 billion, which is up from $412 million.

After the developers discussed the Enterprise Non-Fungible Token (eNFT) strategy, the VeChain price has risen recently. They argued in the paper that NFTs could also be used to create “unprecedented and sustainable value for businesses.” They also defined the critical building blocks for this eNFT to function.

The VeChainThor blockchain network, according to developers, would be the best option for enforcing eNFTs due to its solid proof-of-authority consensus, cheaper transactions, and fee delegation. VET’s price appears to have developed an ascending triangle pattern, which is usually a bullish signal. And it should be like that because with projects landing on its blockchain, the price of the token will go up.

Chainlink

This token probably should top this list of potential Altcoins. The growth it has shown in the past month is magnificent. It is currently trading at $47.2, which is up from $33.1 in March this year. The global market cap of the token is $20 billion, which is up from $12 billion the previous month. And not just that. On the LINK/USDT pair, the price reached an all-time high of $51.20 earlier today before a corrective pullback brought it back below the $50 mark.

This transition follows the news of yet another integration. This time, the integration comes from SmartZip, which uses a Chainlink node to carry real estate data to the blockchain. Moreover, this node allows SmartZip to provide predictive analytics across multiple blockchain markets.

The Chainlink node not only broadens SmartZip’s scope as a data provider by expanding its high-quality datasets into emerging blockchain industries but also opens up new real estate products and markets.

Chainlink has been in the news recently for various other reasons. eToro, an Israeli social trading and multi-asset brokerage firm, has added the crypto assets Uniswap (UNI) and Chainlink (LINK) to its portfolio. Chainlink has released a whitepaper that examines the future of its decentralized oracle networks. Chainlink’s hybrid smart contracts, according to co-founder and CEO Sergey Nazarov, will determine the industry’s future. Therefore, with new upgrades, Chainkink is sure to surge further, making it worth noticing this month.

Conclusion

The cryptocurrency markets appear to be overheating in the short term, however individual coins may continue to perform well. Some investors, for example, have shifted their holdings from Bitcoin to ether. Given the high volatility of cryptocurrency prices, analysis by oneself and the level of risk appropriate of a portfolio is particularly essential. However, if we go by the graphs, numbers, and statistics, the above-mentioned altcoins are expected to bring you good returns this month.

cryptoknowmics.com

cryptoknowmics.com