On Saturday (April 10), Charlie Bilello, the founder and CEO of Compound Capital Advisors, compared the one-year return-on-investment (ROI) of Cardano’s $ADA token against various large-cap cryptoassets.

Before founding Compound Capital Advisors, Bilello was “the Director of Research at Pension Partners, where he managed global tactical portfolios and co-authored four award-winning research papers on market anomalies and investing.”

According to Bilello, in the past one-year period, Cardano’s ADA token has gone up 3,290% vs USD as opposed to Bitcoin, which he says went up 728% vs USD in the same period.

Returns over last year…

— Charlie Bilello (@charliebilello) April 10, 2021

Cardano $ADA: +3,290%

BinanceCoin $BNB: +3,058%

Polkadot $DOT: +1,353%

Ethereum $ETH: +1,171%

Uniswap $UNI: +953%

Chainlink $LINK: +875%

Bitcoin $BTC: +728%

XRP $XRP: +532%

Litecoin $LTC: +406%

Bitcoin Cash $BCH: +161%

Gold: +3%

US Dollar Index $USD: -8%

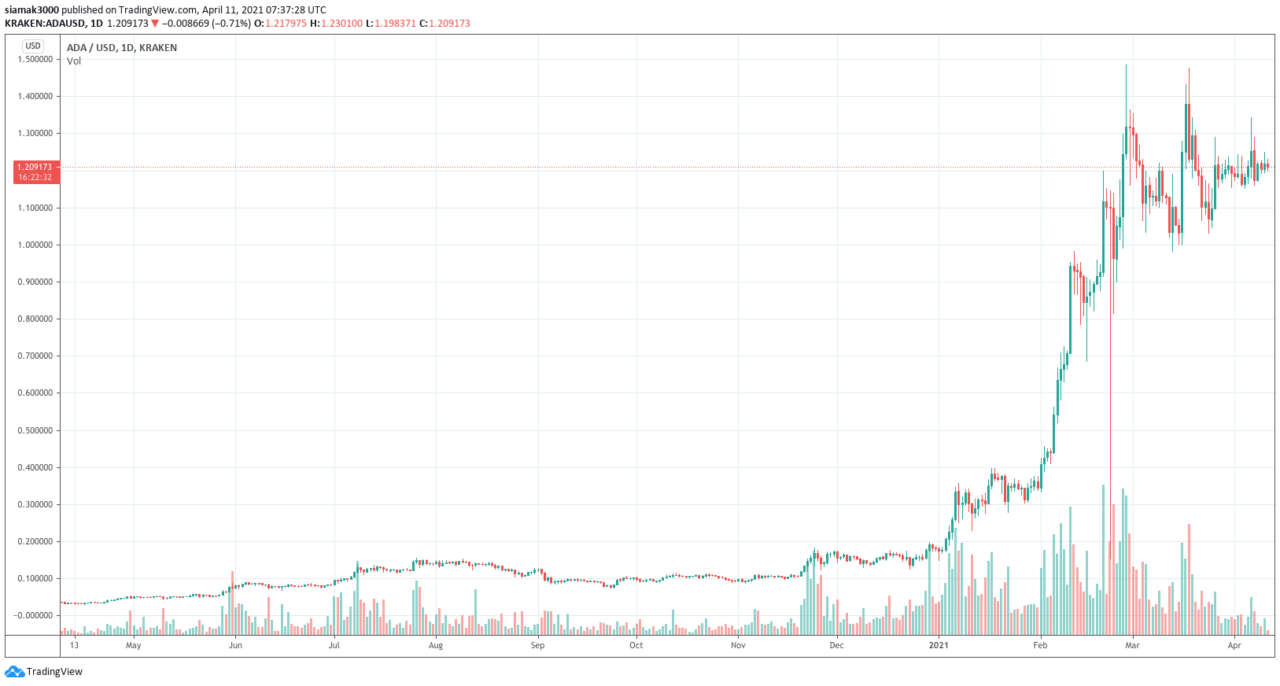

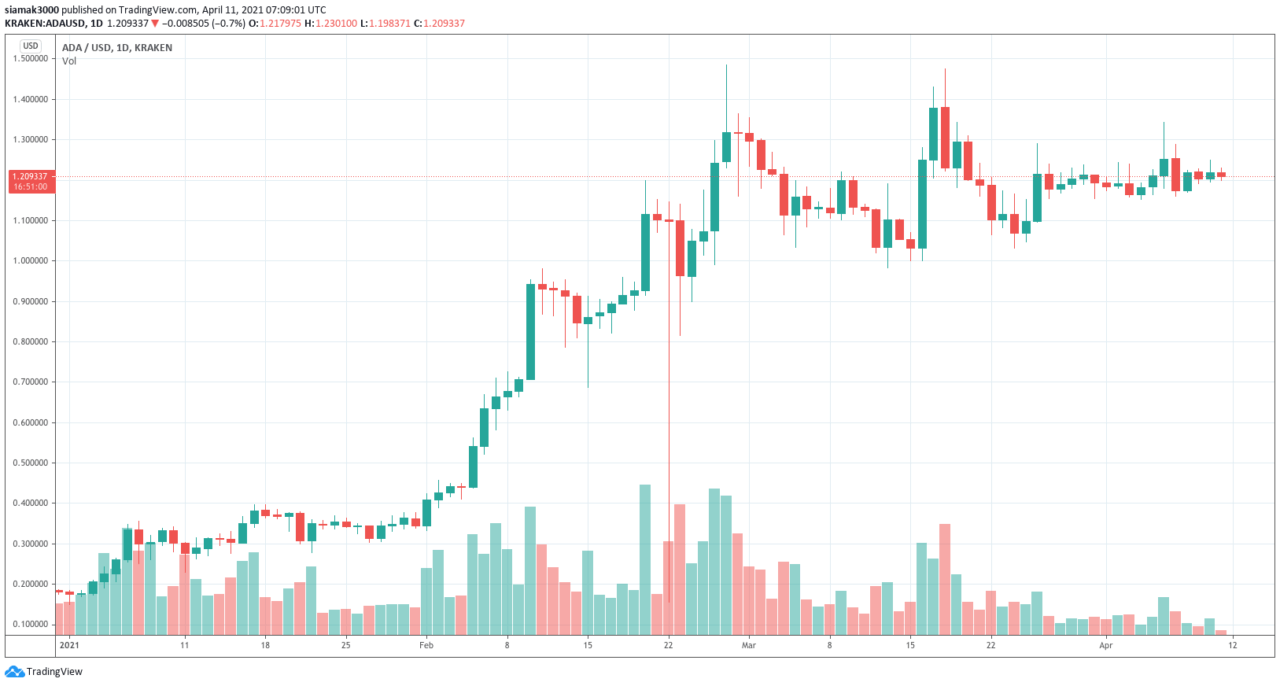

3,290% price in one year seems a little wild. We don’t know the source of his data, but let’s use data from TradingView for crypto exchange Kraken to make sure that Bilello is roughly correct. On 10 April 2020, ADA-USD closed at $0.0331 and on 10 April 2021, it closed at $1.2178, which means an increase of 3,579%.

As for the year-to-date (YTD) period, currently (as of 07:52 UTC on April 11), ADA-USD is up 566%.

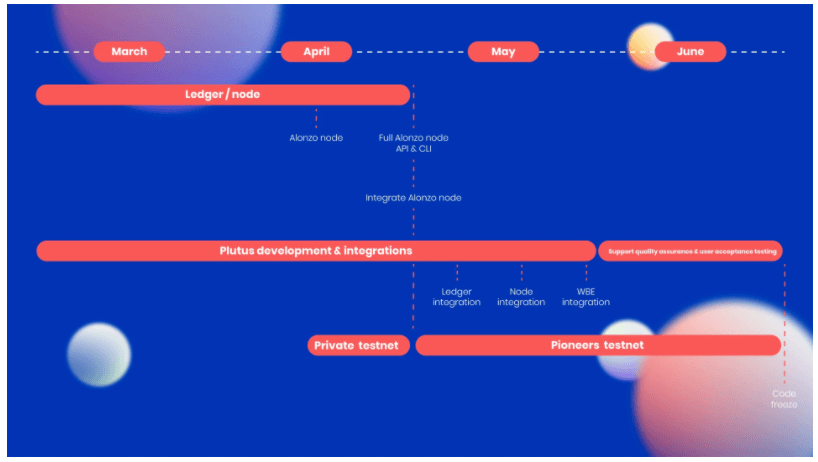

In a blog post published on April 8, Cardano’s primary development company IOHK gave more details about Alonzo, Cardano’s next protocol upgrade, which provides support for smart contracts.

Alonzo Roadmap (via IOHK)

Here are the main highlights from this blog post:

- The name “Alonzo” comes from American mathematician and logician Alonzo Church.

- “Alonzo extends the basic multi-signature scripting language (multisig) used in Cardano Shelley. Multisig will be upgraded to the Plutus Core language for more powerful and secure scripting options. The Alonzo ledger implements the extended unspent transaction output (EUTXO) accounting model, using Plutus Core to provide powerful scripting.“

- “A smart contract platform must be both secure and reliable. That’s why we chose Haskell as the basis for writing Plutus Core smart contracts. Haskell is a high-level language that developers will use to write code and then compile it to Plutus Core.“

- “From mid-April into early May, the team will continue working on Plutus development to launch a private testnet. During this phase, our partners (advanced developers) will be testing out the platform, creating and deploying non-fungible tokens (NFTs), marketplaces, or DApps running smart contracts on Cardano.“

- “In May, we’ll start working with our Plutus pioneers. These certified program trainees will continue testing the platform by writing Plutus applications and putting them into production for DApps and DeFi. During this phase, the team will be performing the ledger, node, and wallet backend integration.“

- “May and June will be a time for quality assurance and testing with users, which will be followed by a feature freeze lasting for four weeks. This will provide crypto exchanges and wallets with the time to upgrade and prepare for the Alonzo protocol update. We expect the Alonzo upgrade (hard fork) to happen in late summer, and we will announce a firm date in April’s Cardano360 show.“

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

cryptoglobe.com

cryptoglobe.com