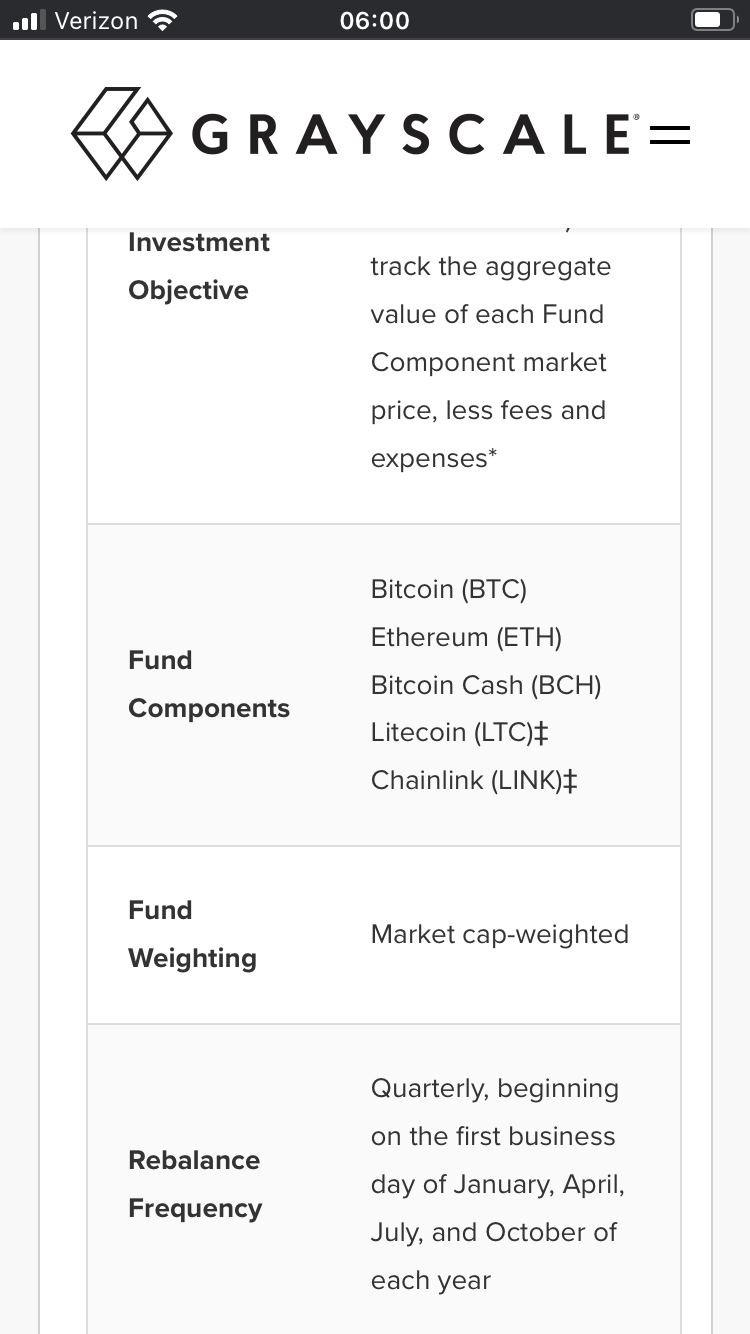

Grayscale Investments, the world’s largest digital asset manager, has added the Chainlink (LINK) cryptocurrency to its Digital Large Cap Fund, providing a possible tailwind to the coin.

- The native token of decentralized oracle network Chainlink fills the void left in the fund after the removal of XRP, the native token of Ripple Labs in the wake of that company's being sued by the U.S. Securities and Exchange Commission.

- Chainlink's oracles act as a bridge between cryptocurrency smart contracts and off-chain data feeds.

- Becoming a component of a popular fund often creates demand for an asset and thus its price. In the last 24 hours, the price of LINK is up 4.29% is currently trading at $32.25. It's risen more than 190% this year, according to the CoinDesk 20.

- The Digital Large Cap Fund has assets under management (AUM) of $538.2 million, according to Grayscale.

- Private placement in the fund is only offered at certain times of the year and is currently closed. Grayscale is owned by Digital Currency Group, the parent of CoinDesk.

Read more: Chainlink Hits Record High, Altcoins Rally Amid Bitcoin Consolidation

coindesk.com

coindesk.com