Not a week has gone by recently without another DeFi protocol attempting to usurp Ethereum by starting up on a rival blockchain. The latest to do so is Flamingo Finance on NEO which, like all those before it, aims to leech liquidity from its rivals.

It was only a matter of time before NEO jumped onto the DeFi bandwagon with its own offering and it came in the form of Flamingo Finance, launched on Sept 23. NEO has been touted as the ‘Chinese Ethereum’ but it has failed to gain much traction despite its increasing research and development efforts.

Its new DeFi protocol is an all-encompassing, cross-chain asset gateway called Wrapper, a Uniswap-like liquidity provider called Swap, and an AMM called Perp. Additionally, there is a Vault asset manager, a synthetic stablecoin called FUSD, and a DAO for platform governance.

The Flamingo Finance FLM token will be distributed to liquidity providers and used to mint FUSD which can then be used for margin trading on perpetual contracts. There will be a total supply of 150 million NEP-5 standard FLM tokens with 20% getting listed on Binance’s Launchpool on Sept 27.

The latest post from Flamingo Finance claims that liquidity has now reached $1.6 billion which is equal to that deposited in Uniswap’s four ETH pools.

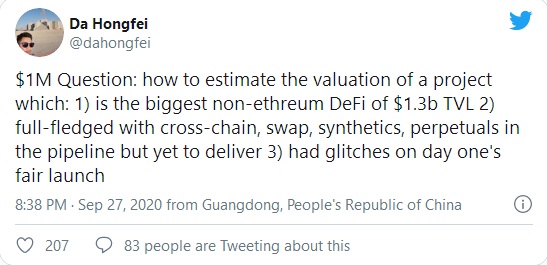

NEO founder Da Hongfei has been following in Binance’s footsteps and actively shilling the platform as of late:

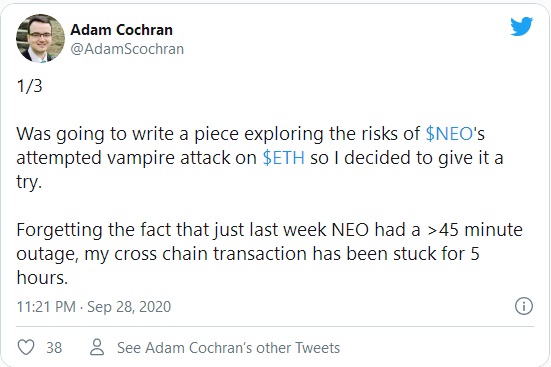

Cinneamhain Ventures partner and DeFi industry expert Adam Cochran has labeled the move as a vampire attack on Ethereum. His Twitter thread started off by pointing out that NEO experienced a recent outage with transactions getting ‘stuck’ on-chain:

Cochran also pointed out that Flamingo is highly centralized due to its involvement with two of the largest companies in crypto, Binance, and OKEx, adding that 50% of the emissions of their new ‘DeFi’ system go to NEO, BNB, and OKB holders.

He commented that any liquidity that does go into FLM will return as there is little point holding ETH in an alternative network where it cannot be used; “This is the most sophisticated ETH attack we’ve seen and it’s an utter flop.”

Another factor that Cochran did not mention is the prevalence of yield hopping, which results in the same money continually circulating around the DeFi ecosystem and flowing into the latest and greatest thing only for liquidity providers to move on once earnings dry up. This has been most notably seen with SushiSwap and Uniswap.

At the time of press, FLM was trading at $0.83 after hitting a top of $1.19 on Sept 28. NEO is currently trading hands for $19.90, down 23% from its September high of $26.

beincrypto.com

beincrypto.com