Maker, the company behind the development of the DAI stablecoin, has confirmed the introduction of new collateral for the generation of DAI: Kyber Network (KNC) and 0x (ZRX).

KNC and ZRX have been added to the Maker Protocol.

Both can now be used to generate #Dai.

Read more:https://t.co/GLRPaEIN2l

cc @KyberNetwork @0xProject

— Maker (@MakerDAO) June 28, 2020

Maker is a very open and decentralized protocol and in this view it allows the community to make proposals to add an asset as collateral or to change some parameters: for example only a short time ago the opportunity to add COMP as collateral was questioned.

Kyber Network goes on Maker

Before checking the new parameters for these assets it is necessary to give some more details about these projects.

Kyber Network (KNC) is a protocol that allows having on-chain liquidity and thus exchange and swap different assets and ERC20 tokens. It is a protocol that is often used to convert several tokens and crypto directly on Ethereum without going through a centralized exchange. The value of KNC is around the dollar and holds position 39 on CoinMarketCap.

Turning to 0x (ZRX), this type of protocol allows having liquidity pools and through them it is possible to stake ZRX to receive the fees of the relative pool.

Moreover, the token is used to regulate the governance of the protocol as it is possible to use it to vote the various ZEIPs (ZeroEx Improvement Proposals) and therefore actively participate in the 0x community.

As for the price, ZRX stands at around $0.33 and is at position 38 on CoinMarketCap.

These two tokens were added to Maker after the vote which involved the community approving the proposal and its parameters.

KNC risk parameters:

- Risk Premium: 4%

- Debt limit: 5,000,000,000

- Liquidation Ratio: 175%

- Auction lot size: 50,000

- Minimum supply increase: 3%

- Duration of the offer: 6 hours

- Maximum duration of the auction: 6 hours

- Liquidation penalty: 13%.

- Dust: 20 Dai

ZRX risk parameters:

- Risk Premium: 4%

- Debt limit: 5,000,000,000

- Liquidation Ratio: 175%

- Auction lot size: 100,000

- Minimum supply increase: 3%

- Duration of the offer: 6 hours

- Maximum duration of the auction: 6 hours

- Liquidation penalty: 13%.

- Dust: 20 Dai

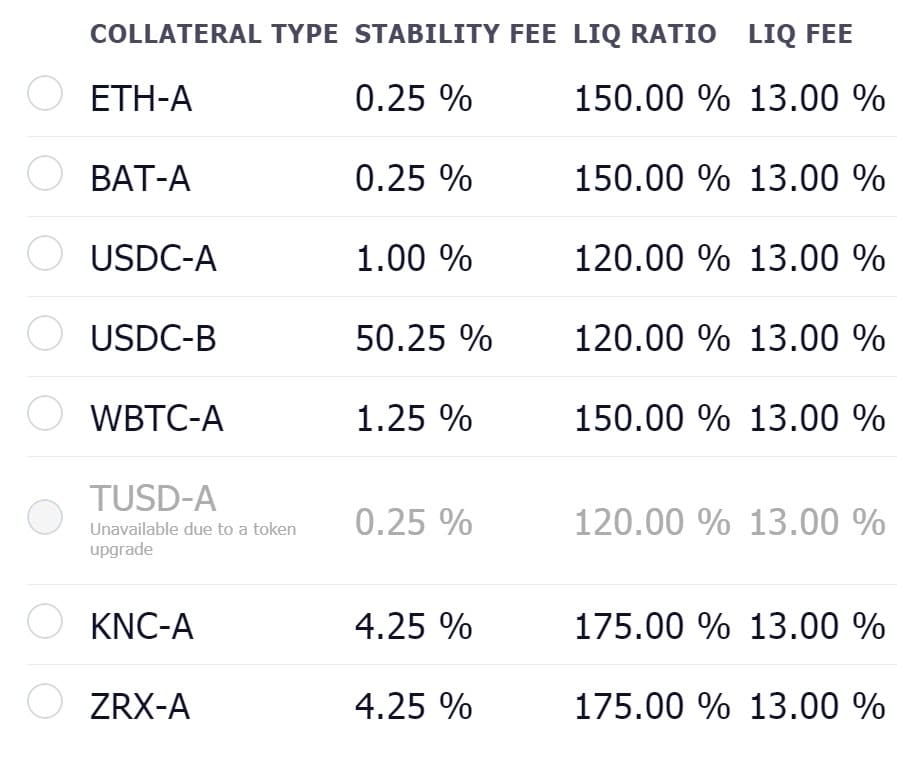

As can be seen from the Maker vault, there are now many tokens that can be used to generate the DAI stablecoin and they all have different risk parameters.

This is a small summary of the parameters taken directly from the platform.

en.cryptonomist.ch

en.cryptonomist.ch