The present-day volatility in Bitcoin’s prices have kept the entire market hooked to the charts. However, some watchdogs in the industry speculate that Bitfinex and Tether have had a hand in toying with the coin’s price. Twitter user, @Silver_Watchdog, presented data about Tether’s volume in the month of June, when the price of Bitcoin [BTC] rose from rags to riches.

The Twitter user informed the community that according to data from CoinGecko, Tether’s volume in June surpassed one trillion dollars in transactions. We independently compared the data to the data available with CoinMarketCap, and found that the approximate value of transactions was one trillion.

Source: CoinMarketCap

The twitter user was one among many who speculated that Tether was driving BTC’s price and trying to manipulate the market. The user said,

“The evidence that Tether not only drives btc, but the entire crypto market is overwhelming. That drop starting in Nov 2018 was the result of Tether losing $850M that couldn’t circulate as volume.”

The user also noted that “Bitfinex/Tether events are correlated to Bitcoin,” along with other cryptos. For the past few weeks, Tether treasury has been wholesale printing USDT. While the Bitfinex CTO, Paolo Ardoino, informed that some of these USDT were for swaps, the rest were not justified to the community.

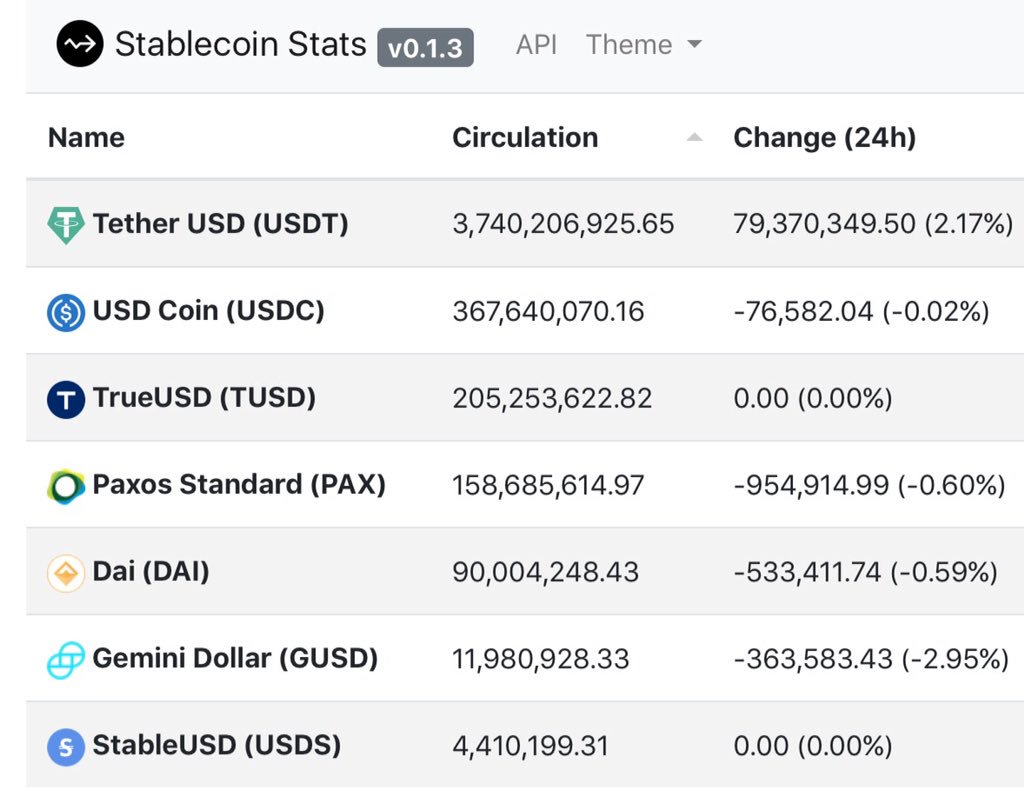

When it comes to redeeming and revoking tokens, every other stablecoin has done it, but Tether.

Source: SilverWatchdog/Twitter

On July 4, Tether printed 100 million USDT following which, Bitcoin noted a significant surge. However, the CTO claimed it to be just a swap of Tether from Omni to ERC20, due to increasing demand. The CTO also said that once the swap flow has stabilized, Bitfinex will burn the excess tokens.

ambcrypto.com

ambcrypto.com