Miner’s revelations

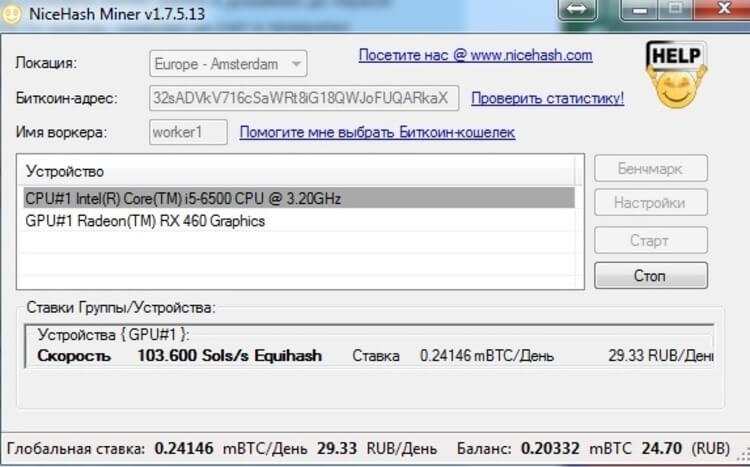

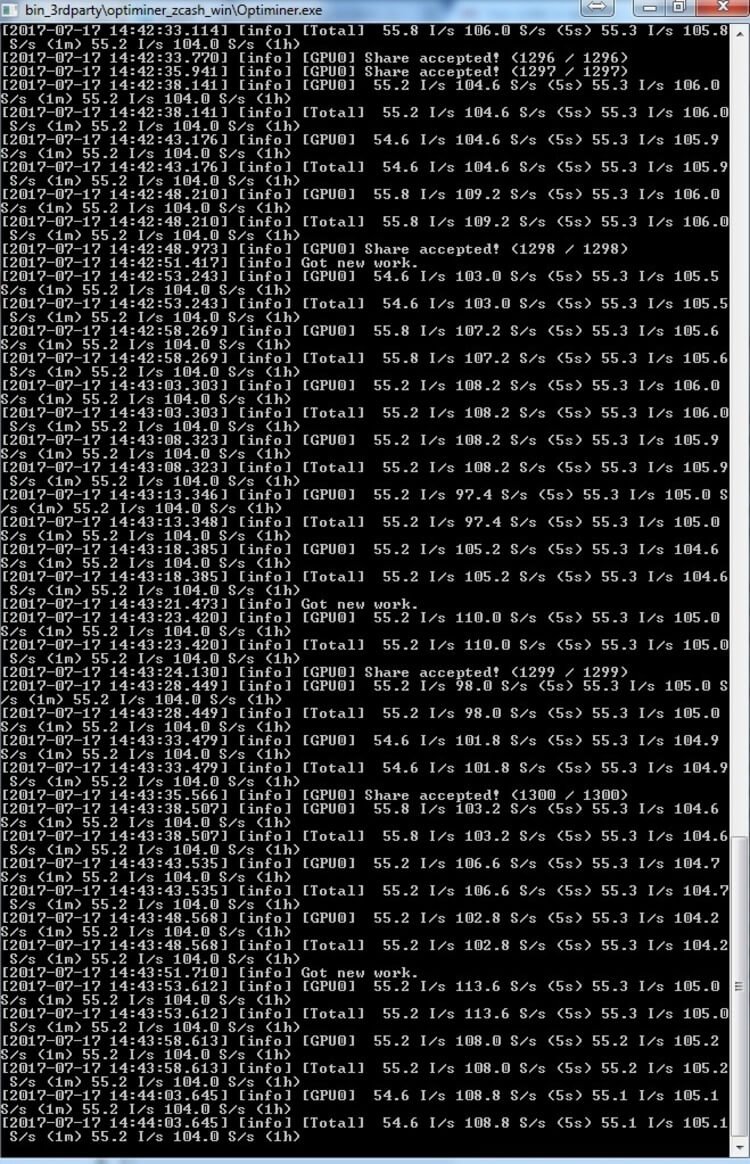

Igor started to mine just out of pure interest. He chose the ZCash (ZEC) cryptocurrency that has become available for mining less than a year ago. The choice was simple — it allowed mining via RX 460 2GB GPU that he already had in possession. Apart from the graphics card, he needed to download the software and register a Bitcoin wallet. After card testing, the program has automatically launched the most beneficial algorithm for this GPU model. In doing so, he started to create cryptocurrency, a part of which returns to him as a reward.

Unavailable bitcoins

“The first mistake the press and TV both make is that people mine Bitcoin. This is not correct. All the hype is not around it, it’s become unobtainable through regular mining a long time ago. Bitcoin cannot be mined with the help of regular graphic cards as the block generation process is too difficult, the process is done by ASICs – special mining rigs, and in China they even build large mining farms made of them,” says Igor.

However, Bitcoin is a reference cryptocurrency, all other digital currencies’ calculations and conversion values are connected with it.

Igor believes that it was Ethereum that has accelerated the growth of interest towards cryptocurrency, as it still can be mined through regular GPUs, and its value has increased 20 times since the beginning of this year, which caused a real rush. Ethereum aside, there are many other cryptocurrencies available for mining without special equipment — more than 370 of them are in the public domain.

Ethereum rush

Igor notes that Ethereum mining equipment — AMD chips — has completely disappeared from the market. The price has increased from 14,000 to 50,000 rubles. “Chinese were the first people to buy them from the market, straight from production lines, then Russian speculators intercepted those cards moments after they arrived in stores,” Igor tells.

In their rush, miners were also buying out cards compatible with other algorithms, and prices for those GPUs have increased as well. GeForce 1060 6GB, average mining GPU, costs around 30,000 rubles, while in April and May it cost several times cheaper:

“Even for those prices people couldn’t buy it, any shipment was immediately tracked and the goods bought out. Once, I’ve witnessed the full repurchase of the entire delivery belonging to a vast consumer electronics retail chain just in 30 seconds or so. The motherboards with a number of riser slots enough to create a farm could be sold out in thousands just in a few minutes. People complained that even if they managed to be quick enough to order a card, managers called and cancelled orders, because they intercepted all that others did not before. I’ve seen cars fully loaded with GPUs in Moscow”, Igor describes.

A story of a miner from the unrecognized Donetsk People’s Republic in the Eastern Ukraine has become popular on YouTube. That miner bought a flat 130 kilometers outside of Donetsk for 500 euro (then 35,000 rubles) specifically for mining. He noted that energy costs, which is a big expense item for all miners, was only 50 kopecks (half of ruble) for 1 kW.

This is not exactly a top channel, the number of views of his video is less than 40,000. But in his latest video he stated that through his reference link, people bought cards for a total sum of more than 1 million euro, which gave him a 18,000 euro bonus he intends to spend on new, high-end 1080 Ti GPUs.

The bubble blowout

Cryptocurrency prices went down at the end of this June. The payback time for a mining farm consisting of six GTX 1060 6GB, as the miner calculates, has increased to 2 years in comparison to the previous period of 4-6 months. In August, GPU prices started to decrease amidst the faltering demand. In October, the average price of GTX 1070, beneficial for mining, is around 30,000 rubles, and the payback time has returned to approximately 12 months.

“I, for one, don’t think the bubble has already burst, some serious fluctuations in the mid-term are possible, but the market will grow and there’s still an opportunity to get a bite from this pie,” Igor says.

The fact that cryptocurrencies have entered the real world is proven by the news about the TenX service (it connects Bitcoin wallets to Visa credit cards) that is now fully functioning. At the same time, the United States Securities and Exchange Commission has reacted to the request from investors and it is now developing the market regulations to set the rules of the game for participants.

In October 2017, Igor has built a full-fledged mining farm made of five GTX 1070 8GB and of one 1080 Ti 11GB — in total, the rig gets 3100 Sol/s on Zcash. After the summer downfall, the price of this currency has stabilized on $300 per coin, although there are spikes both to $200 and $400. Thus, in mid-October 2017, a rig of 6 video cards mines around 1.20-1.40 Zcash coins which can be converted to $400 at the right time. The farm consumes 24 kW per day, at a price of 3.57 ruble per one kW or 2,500-2,800 rubles per month. The equipment cost is around 220,000 rubles, and the payback time, if the market conditions are good ($300 for a coin), is approximately 9 months.