Ethereum OGs Are Out: Why Blockchain Devs Tighten Their Belts

The cryptocurrency market continues to fall: its market capitalization fell by 15% this week. Prices for virtual assets were also declining, and Ethereum Classic was no exception. Since Monday, the value of the coin has decreased by 30% - from $5.3 to $3.7, and the negative dynamics is only gaining momentum. On Sunday, it seemed that ETC began to gradually regain its position. So, what happened?

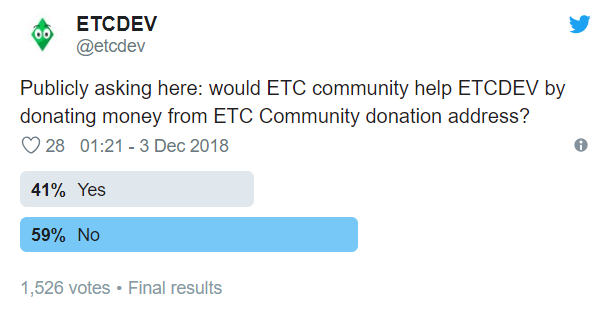

The thing is that on December 3, one of the developers of the network ETCDEV announced the shutdown of its activities. The Founder and CTO of the company Igor ARTAMONOV declared that the market crash in conjunction with the cash crunch in the company were the main reasons for it to be closed down. All attempts to attract funding from investors in the ecosystem and from the external ones were not successful, as well as appeals for financing to the ETC community.

Can this event cause the imminent collapse of the Ether ancestor? Not really.

First of all, as an open source project, Ethereum Classic has other organizations that are engaged in the technological development of the protocol, such as, for example, IOHK, ETC Co-op, ETC Labs. Yes, ETCDEV was one of the leading developers, which has managed to launch the Classic Geth client, the Emerald platform and the Emerald Wallet, introduced a standalone implementation of an Ethereum Virtual Machine called SputnikVM, and its shutdown is “never a good sign, but not entirely unsurprising. Such teams of developers usually operate through donations, advertising and self-funding. Hence the market downturn, investors are less likely to sponsor projects, and therefore in conditions of limited resources teams will suspend their activities. This does not mean the project is dead. It’s far from it as it’s open source and there are many more teams that can work on and contribute to the ETC code and its development”, - tells us the Director of the Australian crypto managed fund Egor SIDELSKA.

Secondly, unlike its more famous and popular hardfork, it seems that ETC does not claim to be the most technologically advanced decentralized platform. “Ethereum Classic stands more for conservative values (stays true to the philosophy of the immutability of the blockchain after the attack on the DAO, - ed. note) and less for innovation, and does not necessarily need constant new technological updates”, - points out our other expert Sandris MURINS, the Co-founder of a company, developing a blockchain protocol for decentralised financial derivatives.

And finally, Ethereum Classic has serious supporters in the crypto community, among which is Barry SILBERT, the Founder and CEO of the investment fund called Digital Currency Group, which owns the crypto OTC broker for the institutions Genesis Global Trading, and the investment company Grayscale Investments. By the way, the latter offers an opportunity to invest in digital assets by purchasing shares in its crypto-funds, and Ethereum Classic Investment Trust was the second to be launched after the Bitcoin Investment Trust. Moreover, DFG finances another developer ETC Labs, and according to Igor ARTAMONOV, they together seek to subdue the network and take control over it.

The businessman himself became one of the first ETC investors. He informed his Twitter community about the purchase of coins on July 25, 2016 - immediately after the hard fork, held the day before, and then repeatedly published posts about the ETC currency. Such an activity attracted attention of the SEC, which suspected the investor in the market manipulations and organisation of pump&dump with ETC. In the future, the coin will continue to be the object of these fraudulent operations, according the Founder and CEO of the Chinese company that provides consulting services in the blockchain, Stephane LAURENT: “Ethereum Classic is likely to become a ghost coin with not much happening on it and its price pumped and dumped every once in a while.”

Egor SIDELSKA notes that the news about the ETCDEV shutdown will affect the price of the virtual currency only in the short term: “Unless there is a snowball effect, it’s unlikely to make a major difference on ETC.” It turns out that the ETC future will not change in the most drastic way, except for the possible project takeover by Barry SILBERT. But is this disband of the development team the only precedent recently? Unfortunately not.

Last Friday, employees of the software-production studio ConsenSys received a letter from the CEO Joseph LUBIN about the change in the company's strategy: “We must retain, and in some cases regain, the lean and gritty startup mindset that made us who we are”, - the letter said, meaning the work optimization, cost reduction and possible staff reduction.

Due to the boom in 2017, ConsenSys took under its wing a huge number of projects, which by the current moment exceeded the mark of 50. In this regard, since February, the company's workforce has doubled to more than 1,100 people, spread across 29 countries. Decentralization, worker autonomy and project variety have come to prevail over efficiency. Joseph LUBIN, whose investment in ConsenSys has made such unprecedented growth possible, admitted that the company as a whole has become very unwieldy, despite the fact that individual projects within ConsenSys remain agile. Sending the letter coincided with another fall of the Ether, which today updated the annual minimum, falling below $90 per coin.

"Naturally, there is a trend to cut the fat in times of decline. Out of 2050 projects that we can see, over 90% will fail to gain any traction at all by having developers committing their codes", - thinks Egor SIDELSKA. The expert notes the limitations of the charity business model when working with decentralized open source networks, where donations from the community remain the main source of income, unless a large investor such as Barry SILBERT is personally interested in the team.

In the conditions of the long bear trend, the community itself becomes poorer and the last tool in its arsenal becomes speculative operations with coins: “Many development teams unless actively incentivised will fail to continue operating. The main reason they're still contributing is experience, brand name, gravitas and belief. There is also a possibility that they hold large amounts of these coins and are financially self-incentivised for the crypto to do well”, - the expert suggests.

As for ICO-projects, they should have hedged the raised funds, which could be “enough money to pay 8 years worth of costs, which is more than enough to make it through the bear trend”, the expert continues: “But it is safe to say that 80% did not do this, and now they are running out of money”. In turn, Sandris MURINS suggest projects to reduce costs, apparently, to take an example from Joseph LUBIN, and asks the projects that successfully held ICO at the end of the last year and the beginning of the current year and which have financial opportunities to engage in mergers and acquisitions with other projects or invest in new blockchain startups that will help to achieve their strategic goals.

Summing up, it should be noted that the technological development of the market depends on the prices of digital assets. Therefore, all these calls not to pay attention to their fall from the founder of the largest incubator for developers Joseph LUBIN sound kind of ridiculous, given the fact that he is thinking about reducing the staff of his company. The ETCDEV shutdown is a wake-up call and could mark another, new or already existing, negative trend. The crisis in the market is testing the strength of the idea of decentralized projects, which do not seem to do well without the money of large investors.