Why some altcoins cost thousands of dollars, while others - several cents?

The most expensive and the cheapest coins

As coinmarketcap.com statistics show, cryptocurrencies prices vary from several hundred thousand dollars to one ten-thousandth of a cent.

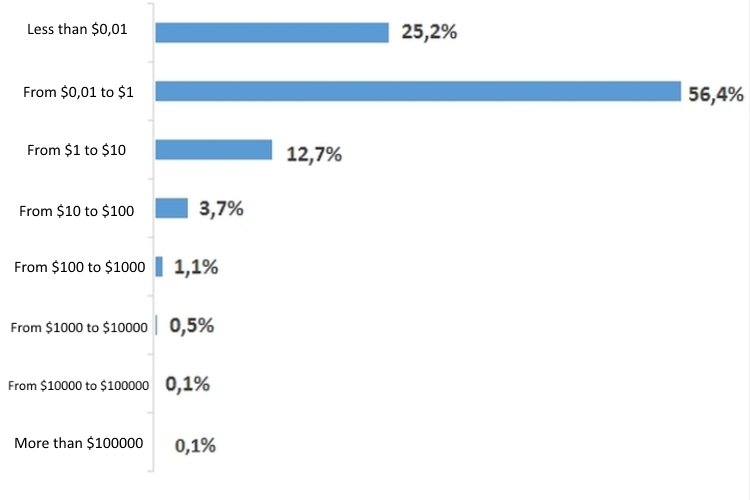

As a part of cryptocurrencies price analysis, Bitnewstoday divided them into several groups.

Pic.1 - Coins grouping based on price

Source: Bitnewstoday based on the data from coinmarketcap.com

The first group is represented by coins with price no more than $0,01. A quarter of all coins and tokens comprises this group, while “the lightest” ones are - DIX, TOKEN, and SPRTS are sold for $0,000003, 0,000002 and 0,000001 per coin.

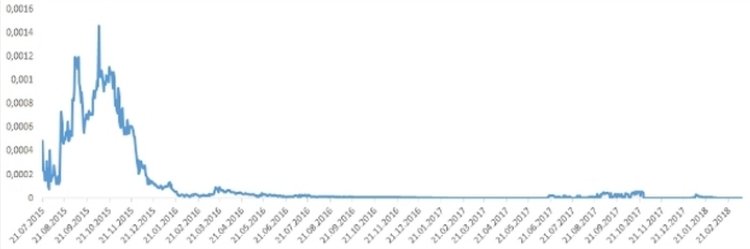

The cheapest coin, SPRTS, belongs to Sprouts and it is one of the long livers of the crypto market. The project was presented to the public in 2015. By capitalization volume, SPRTS belongs to the seventh hundred - an aggregate value of all SPRTS coins is $4,2m. It is also worth noting that SPRTS’s capitalization is one of the biggest in this seventh hundred. The highest level that this coin could reach was 1,5 cents. But this was in 2015, and since 2016 this coin’s price did not exceed $0,0002.

Pic. 2 - Growth dynamics of the cheapest coin

Source: according to coinmarketcap.com

The second and the largest group (56,4% of all coins and tokens) is represented by relatively cheap coins, with prices from $0,01 to $1. This group starts with DTC and FST coins at $0,010096 and ends with TUSD coin with the price at $0,998771.

The third group includes 12,7% of all crypto coins. Their cost range from $1 to $10. The fourth group (3,7% of all) comprises of coins with prices from $10 to $100. The fifth group includes coins, rates of which vary from $100 to $1,000.

The rest three groups are expensive coins. Near 0,5% of the exciting coins and tokens cost from $1,000 to $10,000, including bitcoin. 0,1% of coins have both groups with prices from $10,000 to $100,000 and more than $100,000.

In the following table, you can see top 5 most expensive coins.

| Coin | Price, $ |

| BTWTY | 733 865 |

| NANOX | 134 616 |

| 42-coin | 41 208 |

| BITBTC | 11 134 |

| BTC | 9 618 |

Table 1 - Top 5 most expensive crypto coins

Source: according to coinmarketcap.com

From all cryptocurrencies traded on exchanges, BTWTY, Bit20 project’s token, is the most expensive one. As of March 12, it’s cost was about $734,000 (76 times more expensive than bitcoin). BTWTY is an index of a cryptocurrency fund (similar to S&P 500 index, which monitors prices of 500 largest American companies) and includes 20 biggest crypto coins. Index contents are reviewed on the 21st day of every month. Description of the economy of this token deserves a separate article, that’s why we won’t talk too much about it here, let’s just state that this cryptocurrency is the most expensive one.

BTWTY and NANOX have one common feature: they represent a single coin, therefore their pricing is very specific. And this is the reason why they are so expensive.

BTWTY nearest price rival is NANOX, which is 5 times cheaper than the leader of this group, but still 14 times more expensive than bitcoin. NANOX belongs to Project-X, that became listed on the stock exchange at the end of May last year. It is worth noting, that it entered the market with the price about $440,000, but later after a prolonged correction, it’s price settled to the level of a little more than $130,000. By the capitalization, NANOX takes the 1208th place.

Price is not important

Even though there are completely different crypto coins - very cheap ones, that are traded at the price of less than a cent, and very expensive, which are bought for several thousand dollars, the experts agree that cryptocurrency price is not that important. There are other major parameters that we need to look at.

“I think, that coin’s price itself is not something really important. We need to look at the market capitalization, which represents a multiplication of one coin value to a total number of coins in circulation. For example, Monero is traded on $283 level, but its capitalization is 1,3 times less than the capitalization of Cardano, which is traded at about $0,233”, - noted Safa Mahzari, Founder & CEO of Alluxo.

Ian Kane, Cofounder Ternio, agrees with the previous speaker. “A coin with a price at $3 is not considered more valuable than a coin with a price at $0,30. Market capitalization is the ultimate factor in the value assessment. Apart from that, you also need to consider a real usefulness of this coin’s project”.

Michael Foster, co-founder of localethereum.com, thinks that in the most cases the real usefulness of new cryptocurrencies does not correspond to the hype around them.

What determines cryptocurrencies prices and capitalization?

“In fact, nobody knows what stimulates coins market capitalization, but what is really important, is the coin network usage, its project quality, and future growth potential”, argues Fred Montagnon, the co-founder of regulatory compliant cryptocurrency exchange Legolas.

Furthermore, Eiland Glover, CEO and Co-Founder of Kowala, believes that market psychology also plays its role. Some investors expectations can positively influence a coin’s price, at least at the initial stage. For example, investors who put their money in tokens at ICO pre-sale stage at the price of several cents can hold coins until their market value will be up to several dollars. It is similar to expectations of shares growth of IPO-companies, which stimulate the growth of securities in order to correspond to investors expectations.

Experts also claim that the restriction on the total number of coins influences the price of cryptocurrency. In other words, if developers have initially set a limit on coins that can be mined, then the price of this cryptocurrency will be higher than of those with no limits. Let’s check this assumption.

Please, look at the price and emission of 20 biggest coins (see the following table). The table shows, that as a general rule, the less limit has the coin, the higher price it has.

| Coin | Price, $ | Emission |

| Dash | 545,0 | 0,019 |

| Bitcoin | 9845,0 | 0,021 |

| Bitcoin Cash | 1125,0 | 0,021 |

| Litecoin | 190,0 | 0,084 |

| NEO | 91,6 | 0,1 |

| Lisk | 15,1 | 0,12 |

| Nano | 11,7 | 0,13 |

| VeChain | 4,2 | 0,87 |

| EOS | 6,1 | 0,9 |

| Tether | 1,0 | 2,3 |

| IOTA | 1,4 | 2,8 |

| NEM | 0,4 | 8,9 |

| Cardano | 0,2 | 31,1 |

| Ripple | 0,8 | 99,9 |

| TRON | 0,03 | 100 |

| Stellar | 0,3 | 103,7 |

| Ethereum | 738,0 | - |

| Monero | 283,0 | - |

| Ethereum Classic | 26,6 | - |

Table 2 - Prices and limitations

Source: according to coinmarketcap.com

In conclusion, the usefulness and limitation of a coin define its price. Nevertheless, the major factor for cryptocurrency is not its price, but its capitalization, in other words, an aggregate value of all coins in circulation. This what reflects the coins value.