The annual cryptocurrency market review : what's left after the hype

Bitcoins have seen a lot of success in 2017 when its price made more than x22. Such growth made crypto investors and enthusiasts reckless. Everyone was waiting for BTC to reach the enormous 50,000 U.S. dollars in 2018, and some predicted the price to hit $1 mln per one coin. However, the hype of the crypto sphere slowly went down, and the bitcoin price followed as well as the total market cap. So what is the aftermath of 2018 at the crypto market? Read about it in our Bitnewstoday report.

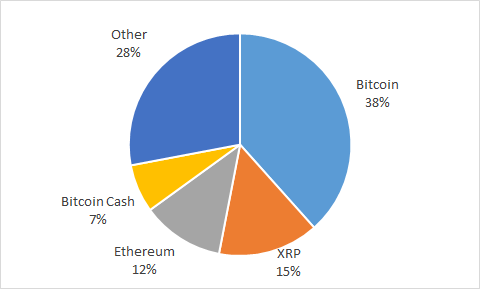

Bitcoin has entered 2018 with the price of more than $13,000, but it started to fall almost immediately. In early February, the price of BTC broke the threshold of $10,000. In mid-February and early March, the first cryptocurrency tried to win back its positions ( its price even reached the level of $11,000), but it was of no great success. By the end of the year, the price of BTC fell lower than $4,000 per one coin.

Pic 1. Bitcoin price dynamic

Source: Coinmarketcap

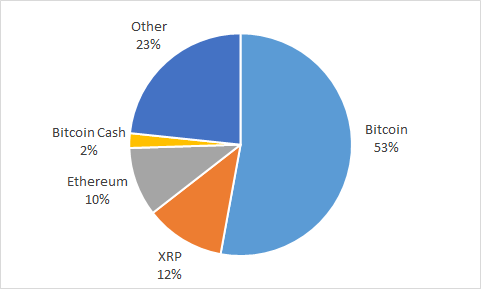

The decline of the Bitcoin price certainly led to a drop in its capitalization. Over the year, the total value of all BTC coins decreased 3.6 times and reached $68.7 bln by December 29.

Pic 2. Bitcoin capitalization dynamic

Source: Coinmarketcap

The bitcoin failures influenced altcoins as well

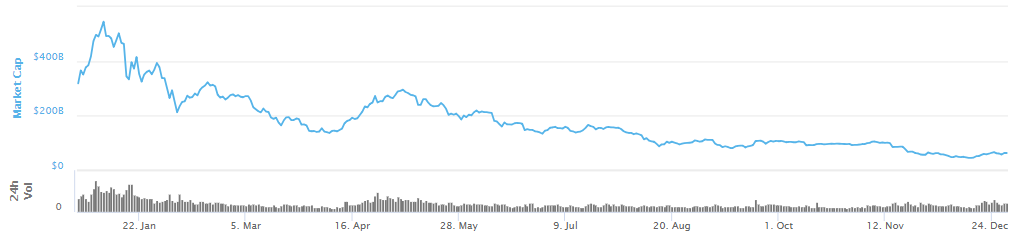

By the end of 2018, the total cap of all cryptocurrencies reached $132.6 bln, which is 4.5 times lower than the level at the start of the year.

Pic 3. Cryptocurrency cap dynamic (total with bitcoin), 2018

Source: Coinmarketcap

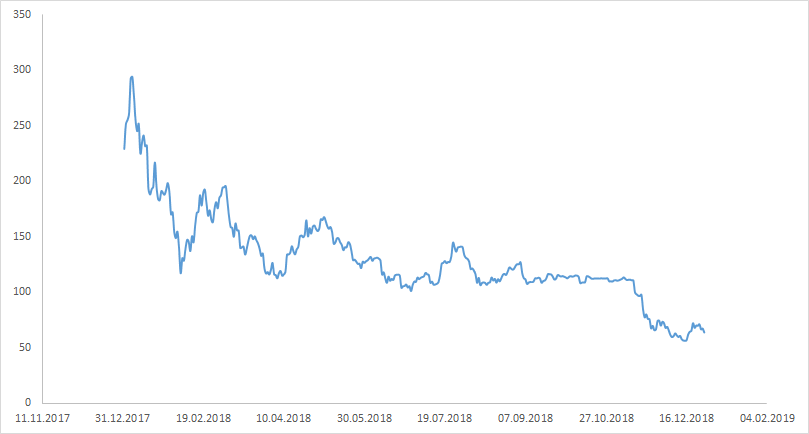

The total value of all altcoins decreased by almost 6 times during the year: from $377.8 bln to $63.8 bln.

Pic 4. Altcoin cap dynamic, 2018

Source: Coinmarketcap

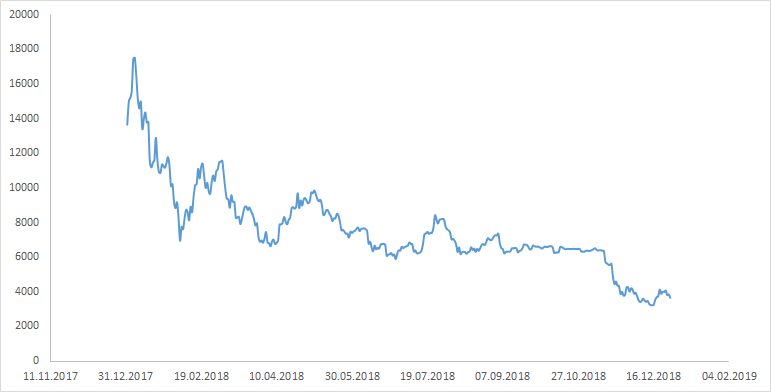

Bitcoin market share is growing

During the past year, the share of Bitcoin on the cryptocurrency market increased by more than 15%. At the start of 2018, the share of bitcoin was about 38%, and by the end of the year, this number reached 53%. The share of XRP decreased by 3% — from 15% to 12%. Ethereum has lost 2 points during this year (share decreased from 12% to 10%). The share of Bitcoin Cash decreased significantly: from 7% to 2%.

Pic 5. The structure of the cryptocurrency market at the start and the end of 2018

|

Start of 2018 |

End of 2018 |

|---|---|

|

|

|

Source: Coinmarketcap

What are the TOP-10 coins?

The leaders of the cryptocurrency market in terms of capitalization, are the above-mentioned Bitcoin, XRP, Ethereum and Bitcoin Cash, and this list also includes EOS, Stellar, Litecoin, Tether, Bitcoin SV and TRON.

Table 1. TOP-10 cryptocurrencies by capitalization

|

Cryptocurrency |

Capitalization |

Price |

|---|---|---|

|

Bitcoin |

$68,6 bln |

$3 930 |

|

XRP |

$15,3 bln |

$0,4 |

|

Ethereum |

$14,3 bln |

$137,86 |

|

Bitcoin Cash |

$3 bln |

$171,19 |

|

EOS |

$2,5 bln |

$2,71 |

|

Stellar |

$2,3 bln |

$0,12 |

|

Litecoin |

$1,9 bln |

$32,42 |

|

Tether |

$1,9 bln |

$1,03 |

|

Bitcoin SV |

$1,6 bln |

$92,36 |

|

TRON |

$1,4 bln |

$0,020522 |

Source: Coinmarketcap

Despite the fact that the key cryptocurrencies lost their positions during 2018, the market experts do not lose hope. “ICOadm.in specialists predict a positive trend regarding the growth of the main cryptocurrencies which are Bitcoin and Ethereum. Even now we can see that the point of bifurcation is passed. There is the reverse of the negative trend. Interest to the industry grows and its a positive trend as well, unique blockchain-based solutions emerge and develop every day. Therefore, we should not worry about the future of the market,” said Vladislav Petrov, the representative of ICOadm.in.

Victor Argonov, the analyst at EXANTE, also believes in a chance of the main cryptocurrencies’ price growth. “The main premise is the shortage of supply which is noted by many experts. There aren’t many investors who are ready to sell currencies, for there are the expectations of growth. Some can say that the expectations were during the fall too. But then there were declines just because some influential investors wanted to enter the market. Now, this argument for the decline is not anymore, and there are even more people interested in the growth. Probably, this growth will be fast — it would be enough for the majority of investors to believe in the stability,” the expert noted.

Bitnewstoday will follow the market developments in 2019.