Come Again And Play the Bitcoin Game! TOON #20

Crypto exchanges are one of the main pillars in the digital economy ecosystem. However their unique positioning within the market leaves them extremely vulnerable to the various methods or malicious intent and various shenanigans like wash trades or market manipulation. Throughout the first half of 2018 exchanges have lost $1.1 bln because of the hackers. On the other hand - crypto exchanges are not exactly eager to step into the “light” of the regulators, since even the biggest ones have something to hide, so getting data about their financial activities quite often becomes a massive chore.

This gives a proper reason to question their honesty, despite the fact that these days pretty much any big exchange asks its clients to perform the ritual dances of KYC and AML. Furthermore - more and more people are thinking that exchanges are messing up the market for their own mysterious gains, while counting their sweet-sweet crypto fees because of the constant transactions back and forth. This is a sole reason why a lot of people suspect a foul play, since by simple imitation of active trading they can create a real “explosion” of transactions.

Wash-trades that are a guilty pleasure of many exchanges are not even their biggest sins. For example, Bitfinex is still under the SEC investigation for their meddling with the now infamous Tether Ltd and their stablecoin USDT.

TOON by Maxim Smagin

Exchange Transparency SWOT-Analysis: Consider It Before You Deposit

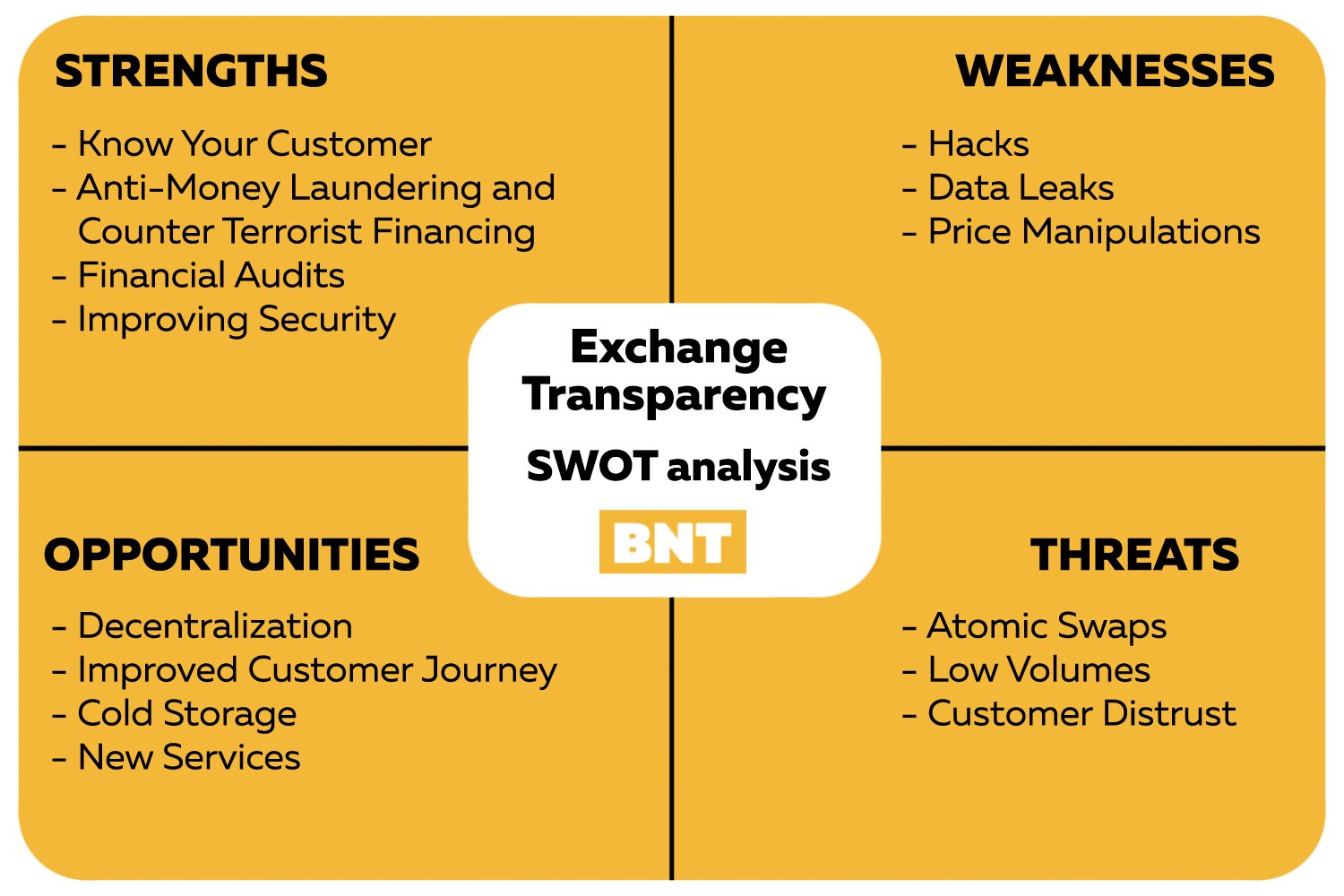

Cryptocurrency exchanges have faced an uphill battle over the past several years. Hacks, scams, corporate shutdowns, and more are all symptoms of one huge underlying problem in the industry: transparency. As exchanges fail to keep users and local regulators informed of their business practices, security, and finances, it leaves the door open for the entire market to wonder about the validity of their statements. Let’s take a look at transparency being a cornerstone for the development of the crypto exchange business as a whole, and undertake a SWOT-analysis of exchanges going fully transparent: what is the advantage and where is the possible vulnerability? (read more)

The Rise of Merger & Acquisition Due To The Fall Of Crypto Prices

“Get rich quick” schemes are not working anymore, scammers have been restrained by new regulations of KYC & AML as well as increased awareness among investors of how to identify scam ICOs. The regulators have been working hard to alert celebrities to eliminate their influence from obscure ICOs, have issued guidelines for blockchain startups to follow, and are creating online content to help investors spot fraudsters. A lot of milestones achieved, but the cryptocurrency prices suffered a great downfall. The situation looks gloomy for some of the projects trying to survive desperately. However, this is a great opportunity for M&A activities to make the current market much healthier than it is (read more)

SEC vs DEX: Two Lessons To Learn From EtherDelta Case

Decentralized exchanges, or DEXes, were called the true route of “cryptonomics” development by the enthusiasts. These entities operate without a central authority acting as a third party. “One of the core features of blockchain was the removal of the need for centralized control, trading on a centralized exchange goes against that,” says Adam FUNNELL, Investor and blockchain consultant from the UK. DEXes provide increased privacy to traders, lower trading fees, etc — we described the benefits in our analysis. It is also about protecting the users, says Pier TUPIER, an investor from France: “Many people lost funds due to the exchanges getting hacked, owners running away with funds. So over time, as more people encounter bad experience, they will move to decentralized exchange.” For some traders and investors, the main appeal was the reduced risk of government regulation. Well, here is the “risk”, running full speed. Robert COHEN, chief of the SEC’s new cyber unit, stated that if an exchange doesn’t employ central HQ or governing body, it still cannot avoid the responsibility. “The focus is not on the label you put on something or the technology you’re using. The focus is on the function and what the platform is doing. Whether it’s decentralized or not, whether it’s on a smart contract or not, what matters is it’s an exchange,” he stressed (read more)

Bitcoin, Exchange and Two Bot Wallets or How Bitfinex Manipulates The Market

As we expected, after a short break, Bitcoin continued to fall over the weekend, breaking through another level of support - $4,000 and updating its annual minimum of $3,593 per coin. Apparently, the crypto market decided to join the Black Friday madness and hold a sale for all virtual assets. Bitcoin has already started to recover, and while it is entering a phase of positive price correction, we decided to find out who were the main organizers of the last weekend promotion.

Institutional investors are the first actors that come to mind. First of all, ICE announced the postponement of the launch of the long-awaited platform Bakkt, which is expected to attract significant amounts of liquidity to the market from institutions. The launch date is moved to the end of January of the next year, which minimizes the chances of the last December's boom to reoccur this year. This news led to the strengthening of bearish sentiments, and a bigger number of large investors could take advantage of this opportunity to buy cryptocurrencies at the lows (read more)