33 Exahash In December, 105 Blocks Away From The New Level: Mining Destiny

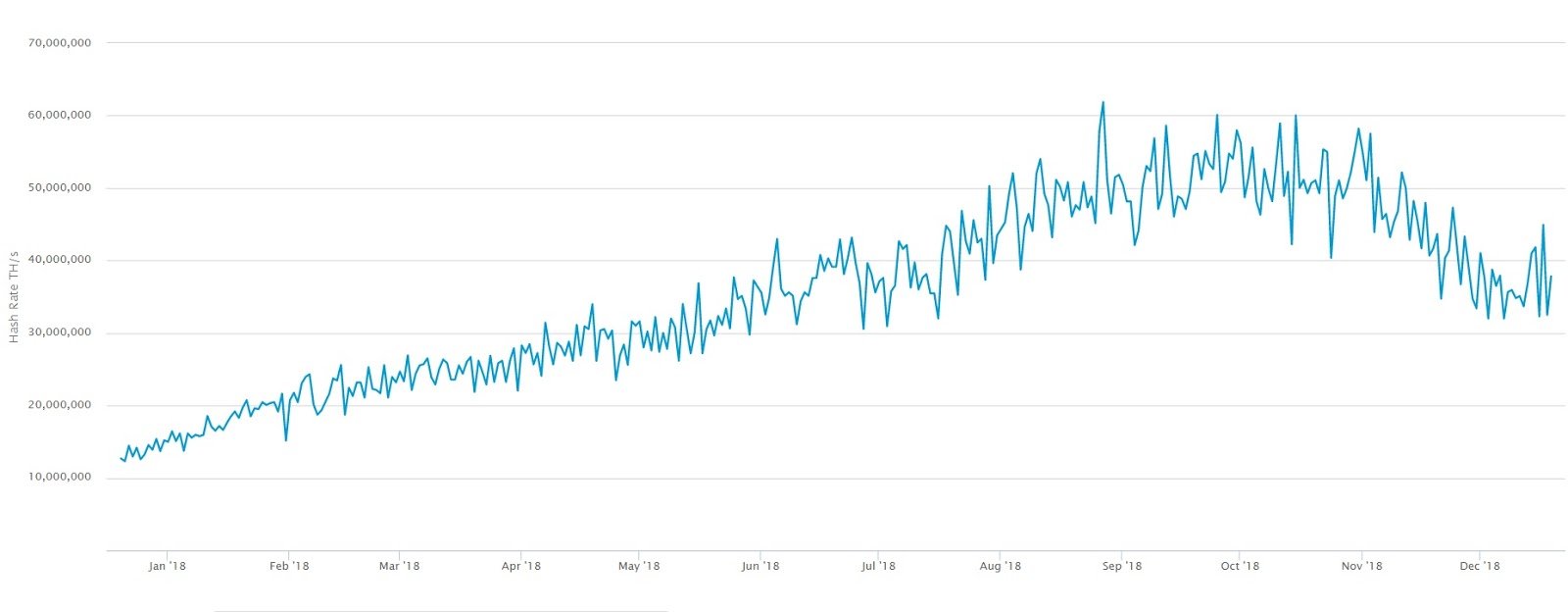

Since the hashrate in the bitcoin network reached a record high in August 2018, noting a jump of almost 2 times comparing to the beginning of this year and reaching the 15 exahash, today the average range varies from 40-60 exahash. The profitability of mining depends on several main factors: BTC prices, mining equipment utility and efficiency, block difficulty. In this regard, the sharp drop in BTC prices in mid-November and the increasing of the block difficulty, as well as the obvious problems of mining giants - all of this forced miners to sell equipment in despair and not wait for the end of the bearish trend, or simply hibernate and humbly prepare for the mining apocalypse.

What is really waiting for mining in next couple of years? Is it maybe high time to put an end for it? Or maybe it’s right time to clean the crypto market not only from short time traders, but also from small miners? In an interview with Bitnewstoday.com crypto analyst and miner Ezra SALAZAR, who analyzed the hashrate of the bitcoin network, tells us in what direction mining is moving, what are the prospects with the increasing block difficulty and impending reward halving in 2020, and how it will affect the price of bitcoin.

BNT: What tendentions have you observed in the bitcoin network recently?

ES: The one thing that I’ve noticed during this icy winter in the crypto world is, without a doubt, the loss of network hashrate. As the price continued to fall, so did the hashrate. We fell to as low as 33 exahash this month. Miners like Gigawatt filed for bankruptcy, and it simply wasn’t a good time to mine bitcoin to say the least.

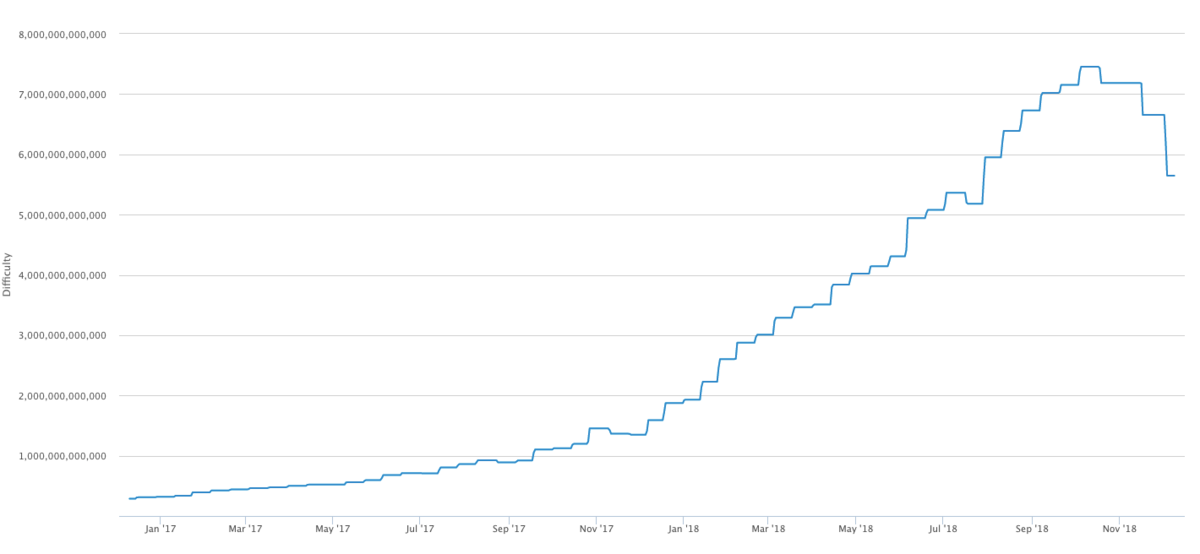

ES: The network hashrate is what determines the difficulty of the algorithm to go either up or down. And with hashrate plummeting in recent months it’s definitely been wreaking havoc on the block difficulty.

BNT: What is evidenced by the fall of the hashrate and what can it lead to?

ES: Seeing block times as long as 45 minutes to an hour to solve, it’s obviously not ideal for blockchain network. Because you essentially have to wait long periods of time for a transaction to post which in part scares investors into believing that the system is failing. But in more recent days, especially like today, I’ve been watching a large spike in the network hash. As if it was coming back to life. However it also raises some questions as well.

Today (Dec, 18) the network has risen by over 4 exahash. And only 105 blocks away from the new difficulty. Could it be that miners are returning or that the CPU is being manipulated so that the blocks can still be difficult while the power falls? We will wait and see.

BNT: What is the situation with block difficulty for now?

ES: Block 554322 and Block 554323 should be a primary example of block time difficulty - 1.5 hour block time. See, the massive rise in block difficulty is a part of the original programming of Satoshi Nakamoto and it keeps bitcoin decentralized. The computer “forces” our blocks to help compromise new block difficulty, and it’s an amazing feature to the original Satoshi and Bloom protocol.

BNT: What will happen, when the next reward halving takes place?

ES: Well, the big party is gonna occur sometime in July-June 2020 when the computer decreases the reward to 6.25 BTC per block. Currently the block reward is 12.5 BTC per block.

BNT: Do I understand you correctly that increasing of block difficulty impacts the value of bitcoin? And what is a correlation between the bitcoin rate and the mining reward?

ES: In regards to the recent block`s time difficulty the system actually doesn’t care if the block time difficulty changes. It’s going to stay on schedule for 10 minutes in average. But, yes, the block halving will more than likely increase the price of bitcoin because generation will be halved. Even exchanges will feel the pressure of a lesser block reward.

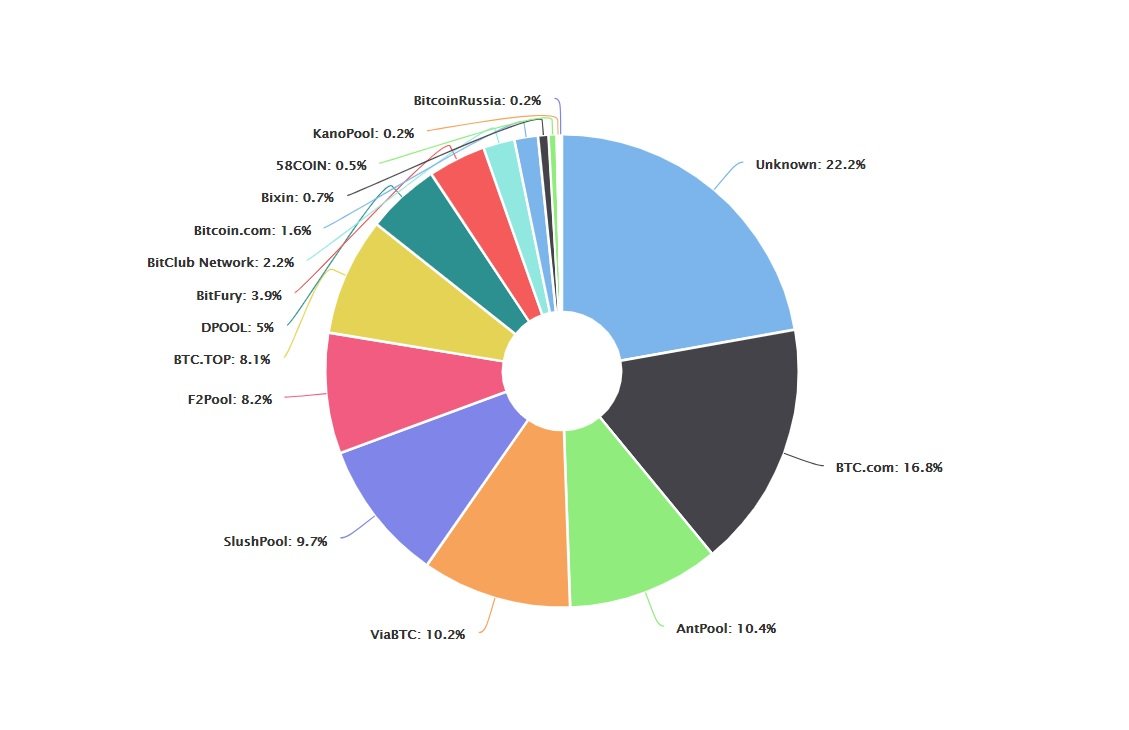

According to the latest statistics, more than 70% of the hash power is controlled by the top 7 largest individual miners, which indicates a significant degree of centralization, becoming dangerous for the existence of the entire network. Thus, the share of BTC.com accounts for about 16.8% of the hash rate yet, Antpool - 10.4%, ViaBTC - 10,2%, SlushPool - 9.7%, F2Pool is 8.2% and almost the same share has BTC.TOP. At the same time, the unknown pool, as we can see, concentrated more than 22% of all capacity.

This applies not only to one of the central philosophical problems associated with the Bitcoin network. But such consolidation can also tell about the threat of collusion and market manipulation in the hands of individual miners.

There are a lot of different viewpoints on the future of mining and Bitcoin network itself. Some experts notice the growing impact of Proof-of-Work algos on the market and believe, that one day the killer app will replace all the platforms at all. But some of them consider that Proof-of-Stake will change the crypto market - as the owner of several online platforms based on DLT Jeremy KHOO commented for Bitnewstoday.com: "I think PoS will eventually takeover. Mining only applicable to old tech like BTC and its variants."