The recent collapse of Silicon Valley Bank, Silvergate Capital, and Signature Bank, and the subsequent government intervention has sparked concern and confusion. Today, we’ll shed some light on the situation.

On Monday, bank stocks experienced significant drops, with midsize and smaller regional banks being hit particularly hard. This had a ripple effect on other financial markets despite the emergency aid provided by U.S. policymakers to the depositors at the affected banks. Despite the government’s best efforts, calmness wasn’t restored to the system.

The collapse of SVB, although relatively small in size (16th largest U.S. bank with roughly $200 billion in assets as of January 2023), has the potential to cause wider repercussions.

When one bank fails, it can lead to a loss of confidence in the wider financial system, triggering panic and the withdrawal of funds from other banks and investments.

This can result in a classic bank run, which can escalate into a broader financial and economic crisis. Even healthy banks may not have sufficient reserves to meet the demands of all their depositors during a bank run.

To prevent a further downturn in confidence, the Biden administration and the Federal Reserve took measures to stabilize the financial system and prevent a wider crisis. Here’s why it matters for crypto investors.

The Collapse of SVB

As the Fed ramped up its money printing in 2020 and 2021, startups took advantage of the mountain of cash. Because Silicon Valley Bank’s customer base was primarily tech startups, its deposits swelled.

However, because of those same mountains of cash, few companies needed loans, which are the primary methods banks use to make money on deposited cash.

Thus, despite its focus on cutting-edge technology, the bank invested its clients’ money in less thrilling investments like U.S. bonds (considered very safe) due to the government’s history of paying its debts.

However, SVB’s experience demonstrates that even the safest investments may have unexpected risks.

When SVB purchased these bonds, interest rates were low, but since then, the Federal Reserve has raised them aggressively to combat rising prices, leaving newer bonds with higher payouts. The bank failed to follow basic financial advice of diversifying its portfolio, which was an extremely risky strategy.

On Wednesday, March 8, the bank reported a $1.8 billion quarterly loss along with the need to raise more capital. Normally, it would have sold the Treasury bonds it was holding. Sadly, it could only do so at a discount, incurring a loss.

The fact that the bonds held by SVB were worth less than when purchased led rating agency Moody’s to issue a warning that it was considering downgrading SVB. This caused the bank to scramble for alternate sources of funding.

In an effort to bolster its finances, the bank’s parent company announced the sale of $21 billion in securities from its portfolio and plans for a $2.25 billion share sale.

However, this news created concerns about SVB’s ability to pay its depositors. Shares of SVB tumbled, creating further concerns about the stability of the bank. In turn, venture capitalists and other wealthy customers began talking online, discussing the situation at SVB.

By Thursday, many had issued warnings to their clients to withdraw any deposits from SVB, leading to a classic bank run. SVB customers attempted to withdraw $42 billion (a quarter of the bank’s total deposits) in a single day.

The bank run had begun. Once a run starts, little can be done to stop it.

Venture Capitalists Make Things Worse

The FDIC has clear protocols for such a crisis. The agency quickly announced they would get all the federally insured depositors their money by Monday, search for a buyer of the bank over the weekend, and if none was found, auction off the bank’s assets and operations.

That should have calmed everyone, but the FDIC hadn’t factored in Twitter.

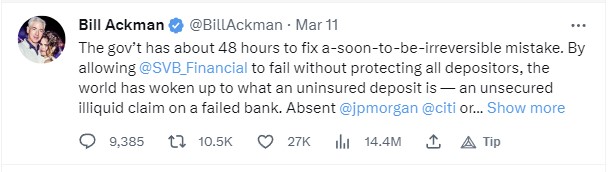

What followed were a series of online tantrums from prominent investors that only stoked the fires. These VCs either didn’t understand the protocol or were looking for ways to shift blame while protecting their interests.

Early Saturday morning, the famous activist investor Bill Ackman used his Twitter Blue subscription to pen a 649-word rant predicting an economic apocalypse if every single depositor was not made completely whole.

Mark Cuban expressed frustration that FDIC insurance caps at $250K, which he called “too low.” He also insisted the Fed buy up all SVB’s assets and liabilities.

Rep. Eric Swalwell, a California democrat, joined the chorus and tweeted, “We must make sure all deposits exceeding the FDIC $250K limit are honored.”

There were additional tweets asking the government to bail out SVB and warning of a spreading bank run that could take down the financial system.

Per CNBC, Ryan Falvey, a former SVB employee who launched Restive Ventures in 2018, pointed to the highly interconnected nature of the tech investing community as a key reason for the bank’s sudden demise.

“When you say, ‘Hey, get your deposits out, this thing is gonna fail,’ that’s like yelling fire in a crowded theater,” Falvey said. “It’s a self-fulfilling prophecy.”

Another venture investor, TSVC partner Spencer Greene, also criticized investors who were “wrong on the facts” about SVB’s position. “It appears to me that there was no liquidity issue until a couple of VCs called it,” Greene said. “They were irresponsible, and then it became self-fulfilling.”

Bank runs are self-fulfilling prophecies, so on Sunday, the FDIC announced it would be backstopping SVB and providing full access to depositors’ funds on Monday.

The Fed Steps In

To prevent further bank runs, regulators have implemented an emergency backstop to ensure depositors of the failed banks have access to all their funds.

This is not the same as a bank bailout, which occurred in 2008. In that case, it was the stockholders of the banks that were protected, but in this case, it’s the depositors being protected (shareholders are out of luck).

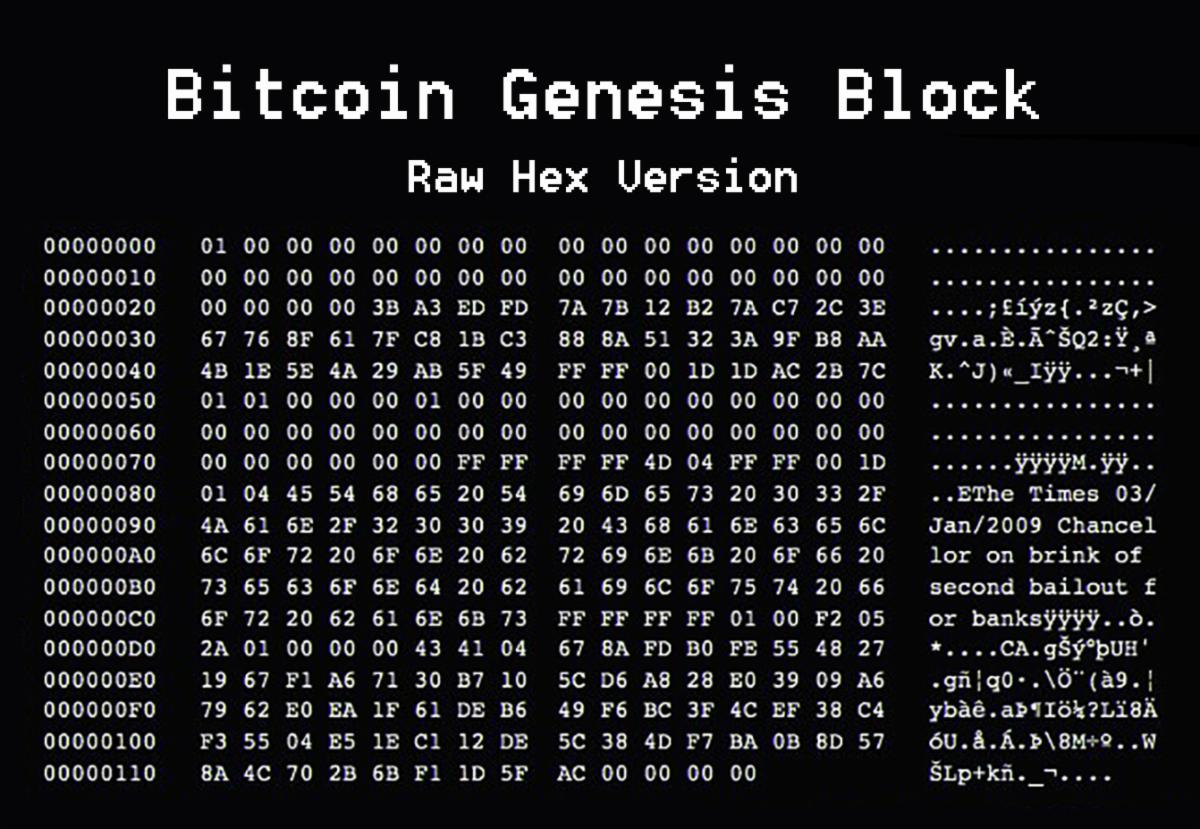

Bitcoin, of course, was created in the aftermath of the 2008 banking crisis.

In addition, the Fed established a new program called the Bank Term Funding Program (BTLP), a $25 billion initiative that will provide loans to financial institutions using high-quality securities (like Treasuries) as collateral instead of selling securities at a loss during times of stress.

The goal of the program is to restore confidence in the financial system and minimize any adverse effects on businesses, households, and taxpayers. By making additional funding available, the BTLP ensures banks can meet the demands of depositors. Here are the details:

Loans

The program enables banks, credit unions, and other institutions to receive loans for up to a year using qualifying assets like bonds and mortgage-backed securities as collateral. This helps banks avoid selling their bonds at a loss to meet customer withdrawals, which is what happened to Silicon Valley Bank.

Par

The main benefit of the program is securities used as collateral will be valued at par (or the original issue price) rather than market value. Bond prices have fallen significantly due to the Fed’s rate hikes, which sought to curb inflation. By valuing assets at par, banks have greater borrowing capacity.

Treasury Protection

The Federal Reserve will offer loans backed by $25 billion in credit protection from the Treasury Department. This means if banks fail to repay loans, the central bank can access the reserve, though it doesn’t expect to do so.

While the FDIC guarantees deposits of up to $250,000 at every insured bank, most of SVB’s (and Signature Bank’s) deposits were uninsured, with many tech companies holding much more than $250,000. It’s estimated that roughly 89% of the deposits at SVB were uninsured. Nevertheless, the FDIC has pledged to make all depositors at the two banks whole, regardless of account size.

The three banks that failed this month had unusually high concentrations of deposits from tech and crypto companies. While average consumers were unlikely to hold accounts there, they’re also less likely to have uninsured deposits of $250,000 or more.

Congress established the $250,000 insured limit to protect average Americans, not venture capitalists in Silicon Valley. Nonetheless, if companies are at risk of losing millions in deposits, individuals are at risk of losing paychecks, making damage control critical to contain further contagion.

Read more:

- The Fed – Bank Term Funding Program – Federal Reserve Board

- Factbox: Which companies are affected by SVB collapse?

- Fed Steps-In With Massive Bank Lending Plan To Stem Contagion From SVB Collapse

Universal Uninsured Deposit Guarantee

Could a universal uninsured deposit guarantee be the next step?

Implementing such a policy would be admitting the regulatory framework established by Dodd-Frank in 2010 failed. However, providing a nationwide guarantee for uninsured deposits, even if only for a limited time, would mean it becomes the default policy during any financial crisis.

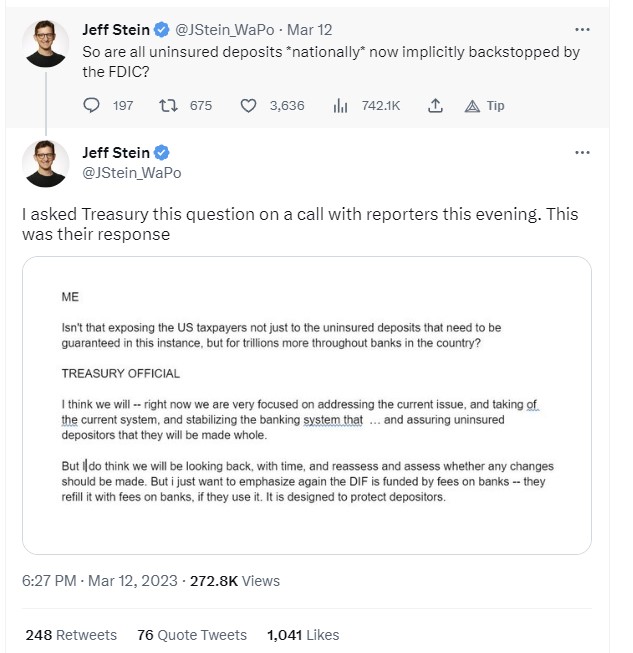

On the other hand, some argue the FDIC’s recent actions have stabilized the market and prevented runs on other regional banks. A senior U.S. Treasury official has stated these actions will safeguard depositors while also providing additional support to the broader banking system. “The firms are not being bailed out. The depositors are being protected,” the official said.

Nonetheless, officials and regulators continue to monitor the stability of the financial system.

That answer from the Treasury is conspicuously ambiguous. Even if the guarantee of deposits helped to stabilize the markets now, it creates a new problem. With deposits fully insured by the government, depositors will naturally be tempted to place their money with banks making risky investments promising high returns knowing that if the bank loses their money, the government will step in and make them whole.

Crypto Impacted by TradFi Event

You might think crypto markets would have avoided any fallout, but due to the increasingly interconnected nature of TradFi and crypto, that wasn’t the case.

The FDIC’s actions created uncertainty in the market, leading to speculation about the stability of the USDC stablecoin. Circle, the parent company of USDC, had deposits of around $3.3 billion in SVB, which accounts for 8.25% of USDC’s $40 billion market cap.

The sudden event raised doubts about Circle’s ability to process withdrawals and maintain the 1:1 peg. With the integrity of the USDC reserves in question, USDC also saw a run over the weekend as panicked USDC holders began withdrawing or converting their holdings. These rapid, massive withdrawals caused USDC to deviate from its peg to the U.S. dollar.

Due to Circle’s presumed inability to access the funds kept at SVB and potential contagion, the reference price of USDC dropped to just under $0.90 (based on CoinMarketCap data) before recovering over the following days. It’s the first time USDC lost its peg since the financial upheaval seen in the early months of 2020 (that’s when the COVID pandemic first emerged).

The DAI stablecoin tracked USDC’s price movement likely due to DAI’s collateral pool composition, which includes approximately 42% of USDC.

Conversely, Tether (USDT) and BUSD, two other stablecoins, were seen appreciating in price above their par value as market participants swapped their funds into stablecoins they perceived to be safer due to their lack of existing relationships with SVB.

Other cryptocurrencies also experienced sharp declines over the past weekend. Since then, not only have they recovered, but they’ve also moved to new short-term highs. Bitcoin is up more than 15% over the past seven days, and Ethereum has also increased by more than 12% in the same period.

Investor Takeaway

Despite the warnings of contagion and crisis from the online VC and tech communities, the failure of SVB may be more of an inconvenience than a crisis in the long term.

Here at Bitcoin Market Journal, we always preach the virtues of having a long-term investment horizon (at least five years). That helps smooth the inevitable bumps in the road.

In the short term, we’d avoid buying the stocks of smaller regional banks as they’re under the most stress. The smart investor might also look into buying the bigger banks (JPMorgan, Wells Fargo, Bank of America, etc.), as they could potentially see a massive uptick in deposits as a result of the SVB failure.

bitcoinmarketjournal.com

bitcoinmarketjournal.com