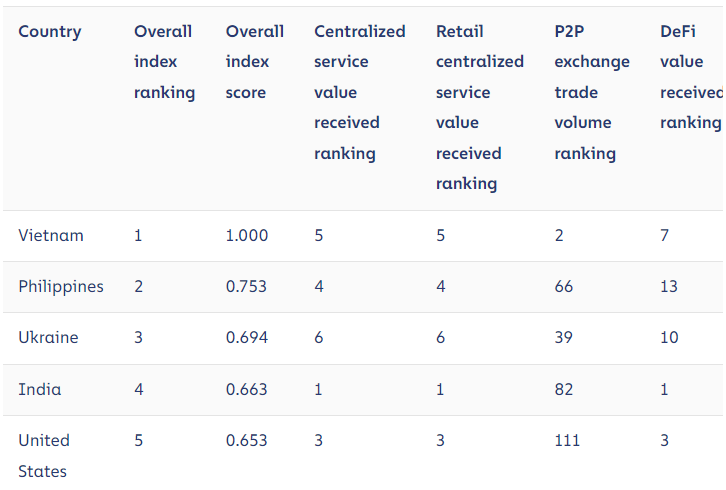

As per a recent report by blockchain analytics firm Chainalysis, Vietnam remains the top country in terms of cryptocurrency adoption. To assess grassroots crypto adoption, Chainalysis weighted purchasing power parity (PPP) against on-chain retail value on CEXes, P2P exchanges’ volume, and DeFi dApps.

Higher Low After Fed’s Pulldown

As covered in Gemini’s report, the Fed’s interest rate hikes melted total crypto market capitalization by -53% in 2022. In November 2021, it reached its peak at $2.88 trillion, now flatlining, having returned at just above the Q1 2021 level.

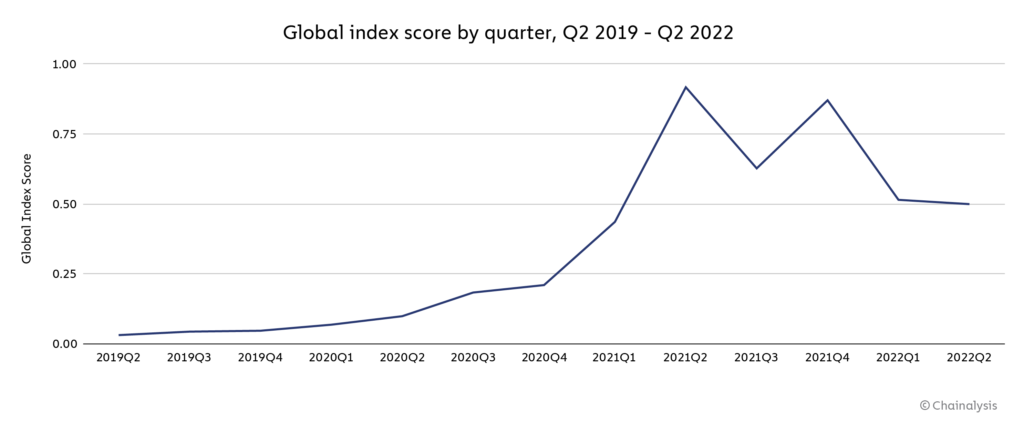

Across 154 countries, the Chainalysis quarterly adoption index matched this growth and subsequent deflation. Nonetheless, the global adoption level is still well above the summer of 2020 investing frenzy.

Based on this data, it appears that rising digital asset valuation attracts retail investors like moths to a flame. We have seen this phenomenon many times with meme stocks. In fact, even blue-chip stocks like Tesla (TSLA) have experienced the same growth spurt during the same period.

The burning question is, how many have stuck around in the digital asset arena after the deflation? Chainalysis data shows that big cryptocurrency holders are continuing to hold. Therefore, although their portfolios are at a loss, those losses are yet to be realized.

Effectively bolstering price support levels, this optimistic market sentiment is exceedingly important to keep the crypto market healthy and sustainable.

Join our Telegram group and never miss a breaking digital asset story.

Emerging Markets On the Crypto Adoption Upswing

Although there is no clear definition of “emerging markets”, the IMF picked 40 in the 2021 World Economic Outlook. In short, emerging countries are in the middle ground between high income and low income. Specifically, those countries that show an increase in exports, GDP per capita, integration into global indices by international financial institutions and their share of issued international bonds (government debt).

According to these metrics, countries with lower middle income have experienced the highest crypto adoption: Vietnam, Philippines, Ukraine, India, Pakistan, Nigeria, Morocco, Nepal, Kenya, and Indonesia. First among them is Vietnam, for the second consecutive year.

One of the major drivers of Vietnam’s positioning is the rise of play-to-earn (P2E) games, exemplified by the top-earner Axie Infinity, from the Sky Mavis team based in Vietnam’s Ho Chi Minh City. This is not surprising given that the P2E blockchain sector received 59% of all gaming investments this year.

After Vietnam, the next three countries are also emerging markets: the Philippines, Ukraine, and India. The US is ranked fifth for global crypto adoption.

Among the top 20 crypto adopters, only two are developed nations, the US and UK (17th rank). In the upper middle income are Brazil, Thailand, Russia, China, Turkey, Argentina, Colombia, and Ecuador. As the Gemini report showed, many of them have trouble with hyperinflation, making the fiat money seem unsustainable.

Outside of the US/UK, emerging markets prefer Bitcoin for long-term savings against double-digit inflation rates and stablecoins for international remittances. Interestingly, China, which banned cryptocurrency trading and mining last September, ranked 10th, a step-up from last year’s 13th place.

This is all the more surprising as the Chainalysis index highly rated China’s reliance on centralized exchanges, suggesting loose enforcement.

Holding the Line Against the Bear Market

In conclusion, the Chainalysis report remains optimistic. Although there was a liquidity reset this year, the new pool of users has expanded the global crypto foundation beyond the pre-2020 bull market. Some portion of retail investors was spooked by the decline, but a critical mass remains, expecting a new bull cycle. And by doing so, the crypto ecosystem resurgence is more likely than not.

Do you think P2E income will become even more important than DeFi? Let us know in the comments below.

tokenist.com

tokenist.com