The minimum trading price of top Ethereum NFT collections, including the Bored Ape Yacht Club and CryptoPunks, have plunged over the last 24 hours, continuing a trend of sharply falling prices for so-called “blue chip” NFTs.

The floor prices of CryptoPunks and Bored Ape Yacht Club dropped by nearly 8% and 7% respectively over the last 24 hours, per CoinGecko data. Nansen’s Blue Chip 10 index of the top 10 NFT collections has dropped 31% year-to-date.

In recent weeks, the Bored Ape Yacht Club has sustained sharper losses, with the “floor price”—or the cheapest listed NFT on a secondary marketplace—falling nearly 19% over the last 30 days when measured in ETH. A Bored Ape starts at 36.4 ETH, or about $68,200.

That’s the lowest Bored Ape floor price, in ETH terms, measured by NFT Price Floor since November 2021, when the project was just taking flight. Meanwhile, Mutant Ape Yacht Club prices are down 26% in ETH terms over the past 30 days, now starting at 7 ETH or $13,150. CryptoPunks prices have fallen less than 3% in the same timeframe.

The Bored Ape price floor peaked at 152 ETH in April 2022—which was worth $429,000 at the time—just before the drop of NFT-based land for creator Yuga Labs' Otherside metaverse game. The NFT market has broadly lost momentum since then, although Ape prices have fallen harder than some other notable projects in the space.

Blur’s impact?

Some NFT traders believe that the main factor in the floor price crash is the influence of the leading NFT marketplace Blur on trading and lending volumes.

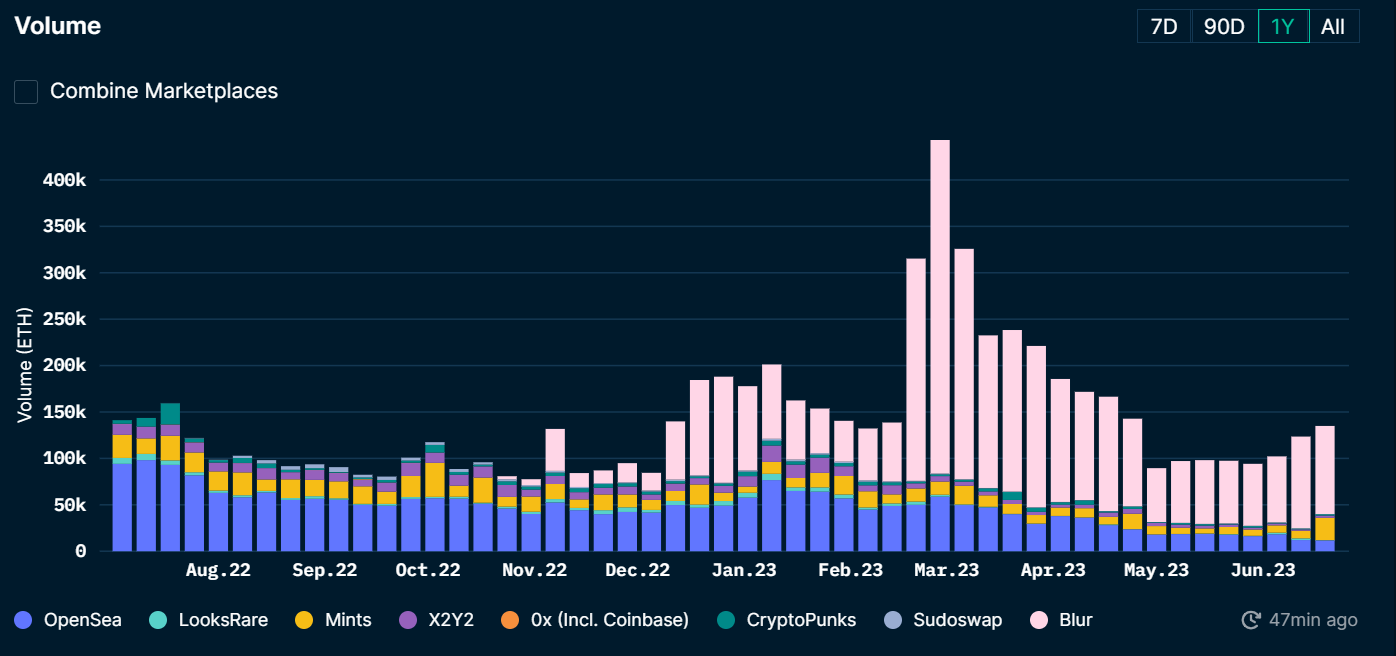

Data from crypto analytics firm Nansen shows that NFT trading volume has declined considerably over the last two months. The adverse effects of Blur on NFT trading volumes and prices were first seen towards the end of April, about two months following the first allocation of the Blur token airdrop that helped the marketplace overtake OpenSea.

The decline in NFT trading volumes since May can likely be attributed to the end of doubled trading rewards on the Blur marketplace.

Notable pseudonymous trader and Wumbo Labs co-founder Cirrus pointed out that traders are also letting their NFTs sell for knock-down prices in order to maintain a high trading volume to farm more tokens on Blur, further suppressing floor prices.

On May 1, Blur launched its NFT lending platform Blend, which quickly attracted significant volumes as users rushed to farm BLUR tokens. According to a Dune dashboard by pseudonymous developer Beetle, the total amount of loan volume on Blend has surged to $929 million to date, dominating over 95% of the NFT lending space.

Imagine walking into a watch store and seeing 10 dudes repeatedly chuck all the Rolexes back and forth at each other

That's what it feels like logging onto Blur and seeing how farmers are treating these "Luxury digital assets"

No real new buyers are gonna want this crap

— Cirrus (@CirrusNFT) June 16, 2023

The founder of DeFi analytics platform DeFiLlama, 0xngmi, wrote in a tweet that Blur rewards incentivized users to “churn loans as much as possible, inflating loan volume by a lot.”

The loans also add liquidation risk in the market, which can push their prices down. For instance, Cirrus highlighted a risky leveraged position on Blend worth over $2 million, backed by 32 Bored Ape NFTs as collateral. Cirrus wrote that the user has already incurred losses of around 100 ETH from the loans, which they used to “keep farming Blur.”

decrypt.co

decrypt.co