Bitcoin mining stocks really gained prominence in 2021. Due to the increase in the price of the digital asset, mining profitability shot up, and investors used this as a way to gain exposure to the market. As the market has retraced, though, the mining stocks have struggled. However, they continue to be in operation, and data shows that some of these bitcoin mining stocks remain largely undervalued.

The Most Undervalued Companies

Some bitcoin mining companies have not been in the public eye compared to others. Mainly, these have been in the shadows due to not having as high a valuation as others and their stocks not performing quite as well, but this does not mean that these companies are not good in any way.

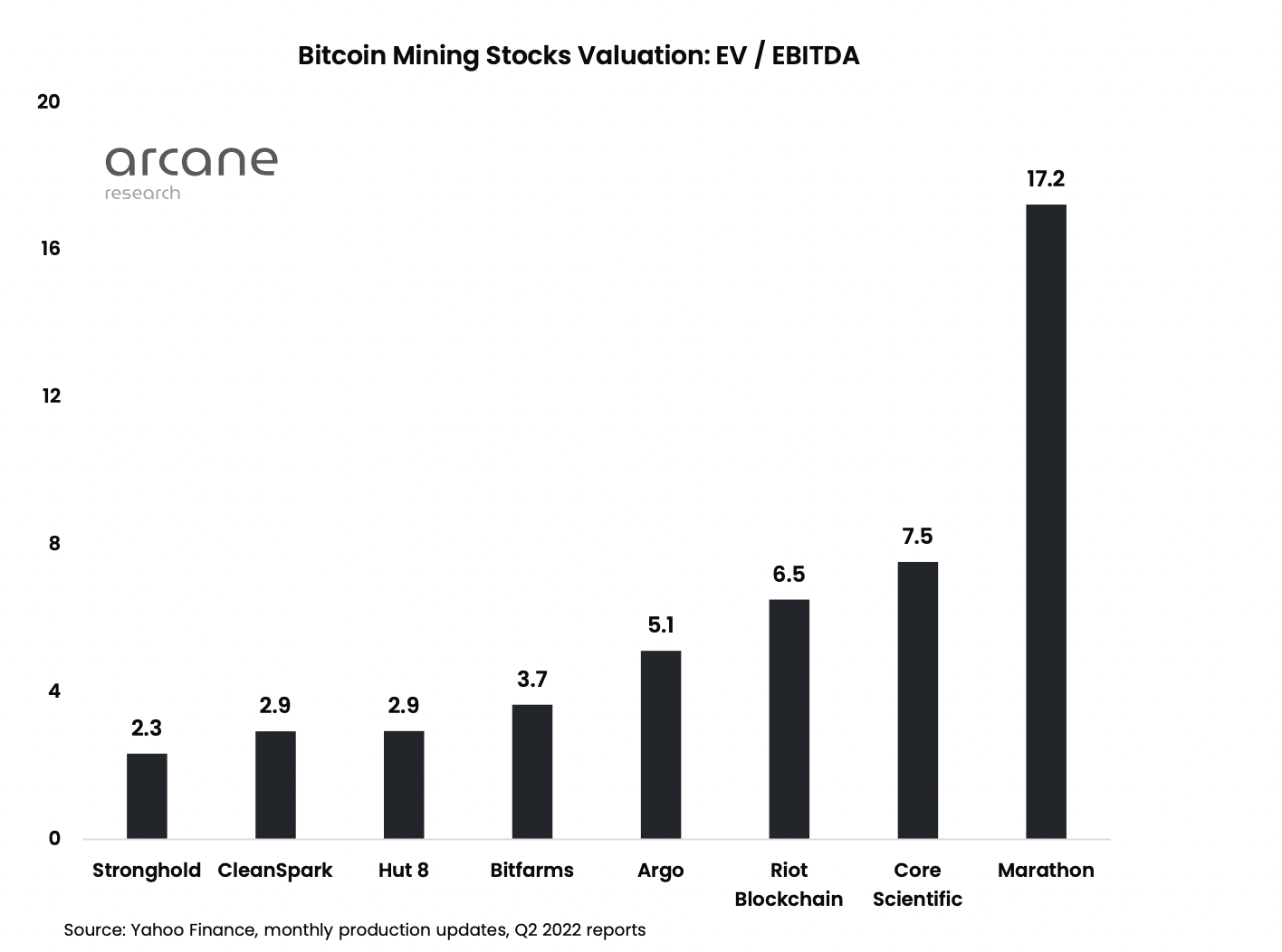

An example of a company like this has been Stronghold. The bitcoin mining company has been operating in the shadows while its valuation remains undervalued. Using the EV/EBITDA metric as opposed to the EV/ASIC value, Stronghold shows one of the most promise in terms of its undervaluation.

It is important to note that companies who score less than 10 on the EV/EBITDA metric are considered to be undervalued, and Stronghold has one of the lowest of all bitcoin mining companies with a score of 2.3. Another is CleanSpark which is sitting at 2.9, as well as Hut 8 with a score of 2.9. These companies have the lowest valuations even though they hold a lot of promise.

Mining stocks largely undervalued | Source: Arcane Research

Bitfarms is also in the same category with a score of 3.7. These mining companies are a mark for higher returns. However, it should also be noted that these companies also have other things weighing them down, such as debt, which increases their chances of going bankrupt.

Bitcoin Miners With Higher Valuations

Not all bitcoin miners have been undervalued in these times. Some have received high valuations even through the bear market. The largest bitcoin minger according to valuation is Marathon Digital which has received a 17.2 EV/EBITDA score. This means that the company is operating at a normal valuation and has more chances of maintaining a more stable value over time.

BTC recovers above $21,000 | Source: BTCUSD on TradingView.com

Others have also received a high valuation but have not crossed the 10 mark yet. Core Scientific has received the second-highest score after Marathon Digital. The public miner is currently sitting at a score of 7.5 on the EV/EBITDA scale, making it slightly undervalued.

Next is Riot Blockchain, with a score of 6.5, with Argo following right behind with a score of 5.1. However, one thing that separates these two has been the quality of the companies, making a play on such undervalued companies quite beneficial over time.

Featured image from GoBanking Rates, charts from Arcane Research and TradingView.com

bitcoinist.com

bitcoinist.com