Coinshares’ Q3 mining report, led by researcher James Butterfill, highlights mounting costs and challenges impacting the bitcoin mining industry in 2024.

How Bitcoin Mining Industry Giants Are Battling Rising Prices

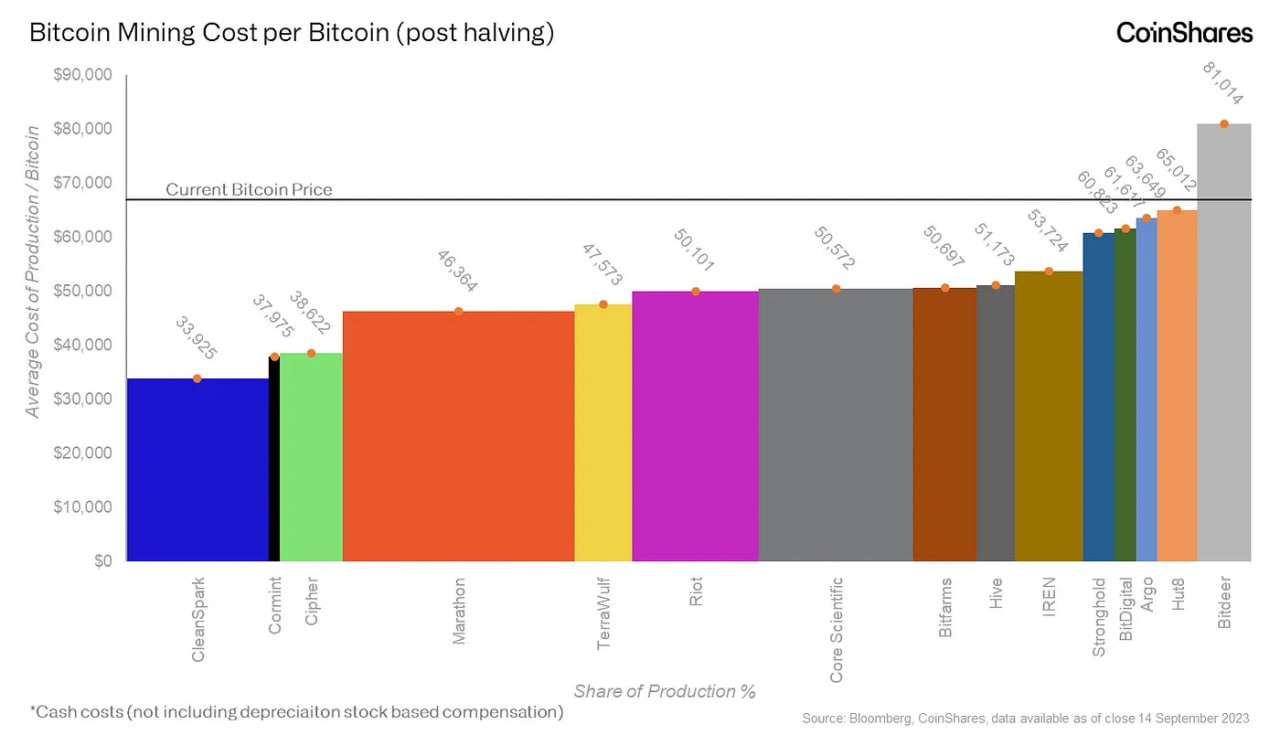

The Coinshares Q3 mining report, with research led by James Butterfill, reveals that bitcoin mining costs are rising, reaching an estimated $49,500 per bitcoin (BTC) when accounting for cash expenses alone. Including additional costs like depreciation and stock-based compensation, the production cost averages $96,100. This heightened cost environment stems from an increased mining difficulty and infrastructure expansion, which have collectively driven up expenditure.

Butterfill notes:

Despite this, miners have continued to roll out new infrastructure and have committed to further expansion, anticipating future price increases.

One significant hurdle outlined by Coinshares is restricted access to financing options, exacerbated by rising interest rates and reduced credit availability following recent cryptocurrency market disruptions. Many miners have resorted to issuing shares to finance operations, a move that has diluted shareholder value.

Butterfill’s report also notes a correlation between the price movements of bitcoin and miner stocks; however, while bitcoin has seen price boosts from U.S. bitcoin ETF developments, miner shares have not fully capitalized on these gains.

“Recently, the prices of listed miners have tracked bitcoin’s price more closely; however, they have missed substantial gains earlier in the year as they did not benefit from the U.S. spot bitcoin ETF launches that drove bitcoin’s price,” Butterfill said.

Coinshares’ analysis anticipates sustained growth in bitcoin’s hashrate, which measures mining efficiency, projecting it will rise from the current 684 exahash per second to 765 exahash by year-end. Butterfill’s team employs a unique model factoring in the limitations of stranded gas as an energy source, theorizing that miners may eventually reach an energy-saturation point by 2050. Should this happen, Coinshares projects a potential 63% reduction in carbon emissions, as miners shift to converting flared gas into usable energy.

Profitability projections by Coinshares further indicate that under present market conditions, direct investment in bitcoin could yield higher returns than bitcoin mining. Butterfill’s report advises miners to diversify revenue streams, such as investing in artificial intelligence (AI) technologies, as additional miner fee revenue is unlikely to meet profitability targets. Coinshares concludes that for the mining industry to remain competitive, efficiency and cost management will be crucial.

news.bitcoin.com

news.bitcoin.com