Bitcoin difficulty hits an all-time high of 95.67T, which coincides with a record hashrate that went above 700 EH/s for the first time.

The 3.9% jump in difficulty becomes the 13th positive adjustment for 2024.

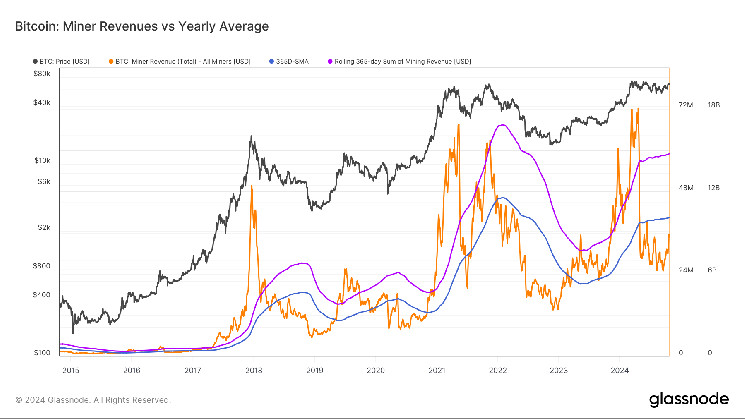

Once the 365-SMA total miner revenue is claimed, this typically coincides with bull runs in bitcoin.

Bitcoin's (BTC) mining difficulty hit an all-time high of 95.67 terahashes (T), rising by 3.9%, on Tuesday, Glassnode data shows.

Mining difficulty measures how hard it is to mine a new block on Bitcoin. So far, in 2024, there have been 22 difficulty adjustments, with 13 being positive. As a result, the difficulty has jumped from 72T to 92T, a 27% increase, year-to-date.

The network automatically adjusts every 2,016 blocks, which is approximately every two weeks, to ensure that blocks on average are mined every 10 minutes.

Read more: Mining New Bitcoin Is More Difficult Than Ever. Here's How it Could Impact BTC Prices

The surge in mining difficulty has coincided with record hashrate, which also made all-time highs of over 700 exahashes per second (EH/s). Hashrate is the combined computational power to mine and process transactions on a proof-of-work blockchain.

As difficulty increases, the mining industry faces further pressure as it becomes harder to generate profits. Therefore, operational costs increase as more computational power is needed to invest in more efficient mining equipment.

Weak miners being purged

Part of the downward pressure on bitcoin, since the April halving, has come from unprofitable miners selling holdings. These miners, mainly small private miners, couldn't sustain themselves due to higher costs. After the halving, these miners started to unplug from the network leading to a 15% decrease in hashrate or started selling bitcoin in order to fund operating costs.

Looking at Glassnode data, we see that miner balances dropped this year as weaker miners knew the halving was approaching and were trying to fund operations to get ahead of the game.

From November 2023 to July 2024, we saw over 30,000 bitcoin leave miner wallets, one of the longest distribution periods from miners on record. However, we can now observe that since July, miner balances have been relatively flat and have shown signs of accumulation, telling us remaining miners on average can handle the new environment.

The mining industry will continue to consolidate into stronger hands, with public miners controlling a record share of almost 30%.

Bitcoin bull run commencing soon

Bitcoin bull runs and surging miner revenue coincide; as price increases, so does mining revenue. Glassnode data shows that on a 7-day moving average (7-DMA), the total dollar mining revenue is over $35 million, an increase of over $10 million since the September low.

Since the halving in April, the mining revenue has been below the 365-simple moving average (SMA), currently priced at $40 million. Historically, once the total miner revenue climbs above the 365-SMA, this coincides with a bitcoin bull run, which has been seen historically.

coindesk.com

coindesk.com