The following guest post comes from Bitcoinminingstock.io, the one-stop hub for all things bitcoin mining stocks, educational tools, and industry insights. Originally published on Sept. 3, 2024, it was penned by Bitcoinminingstock.io author Cindy Feng. In the piece, Feng follows up on her first report on how bitcoin miners are branching out into high-performance computing (HPC) and artificial intelligence (AI) cloud services.

Part 2: How Bitcoin Miners Are Tapping Into the AI Gold Rush

Following community feedback from the last report, we missed a few Bitcoin miners who also allocate resources into AI/HPC hosting: APLD, MIGI and SLNH.

While none of these have reported revenue from this sector in their Q2 2024 reports, here are the latest updates on their operations.

Applied Digital Corporation (APLD)

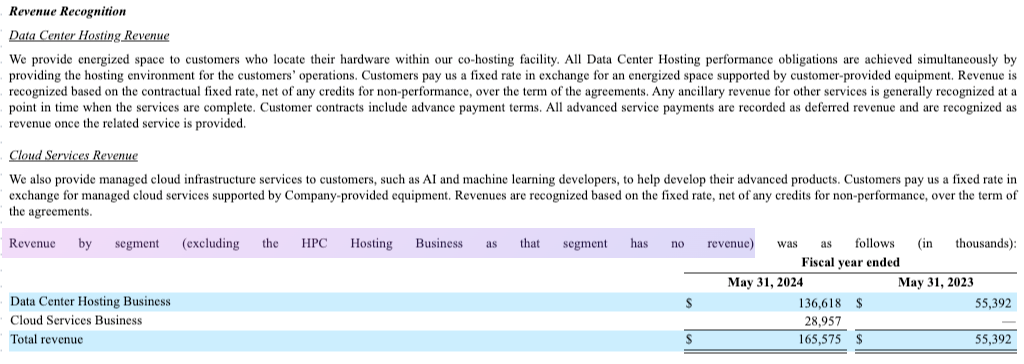

Applied Digital is actively building two HPC-focused data centers: a 7.5 MW facility in Jamestown, ND (near completion) and a 100 MW facility in Ellendale, ND. Since May 2023, APLD’s Cloud Services Business has focused on providing cloud services to AI and machine learning developers. The company offers GPU computing solutions designed to handle critical workloads in AI, machine learning, rendering, and other HPC tasks. They’ve deployed several GPU clusters (1,024 GPUs per cluster) and secured contracts with colocation service providers to ensure the necessary space and energy for hosting. However, as of their Q2 2024 10-K report, no revenue has been generated from their AI/HPC initiatives.

According to a community note, Applied Digital is in talks with a hyperscaler to sign a 400-MW deal. Though the conversation was extended at least once, they said at least 90% of the deal was done in their earnings call. This will be like the CORZ/CoreWeave deal if true.

Mawson Infrastructure Group (MIGI)

Mawson Infrastructure didn’t detail AI in their recent quarterly report, but on August 12, they announced a significant move in the AI and HPC space. Mawson secured a major colocation agreement with BE Global Development Limited to provide 20 MW of digital infrastructure for AI/HPC services, expected to be operational by Q1 2025. This deal is projected to generate $92 million in the first two years and approximately $285 million over six years. The agreement also has the potential to expand overall capacity to 144 MW, which would multiply their AI/HPC capacity sixfold.

Soluna Holdings (SLNH)

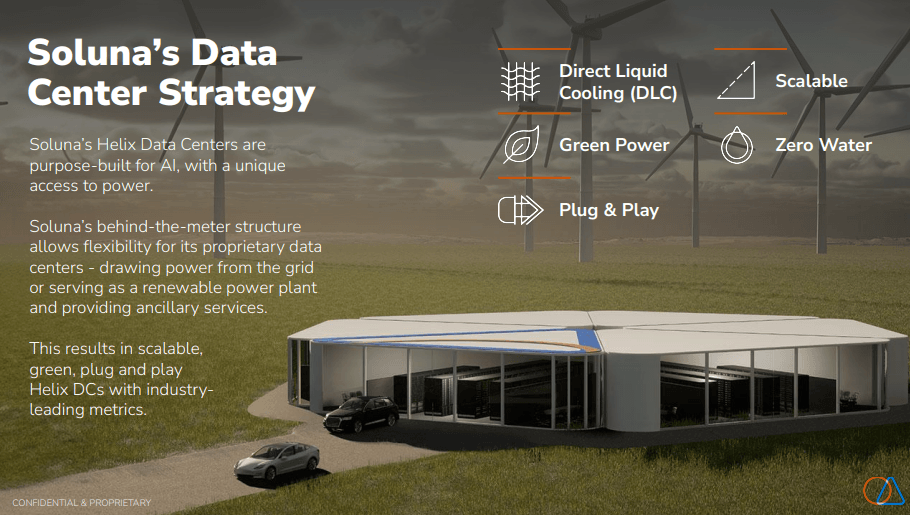

Soluna is also embracing the AI trend. On June 18, 2024, through its subsidiary CloudCo, Soluna entered into a $34 million agreement with Hewlett Packard Enterprise (HPE) to provide data center and cloud services for AI and supercomputing using Nvidia GPUs. The 36-month contract, with an initial $10.3 million pre-payment, may be expanded by mutual agreement. To support this venture, Soluna secured a $12.5 million credit facility on June 24, 2024, and an additional $1.25 million on July 17, 2024. This partnership allows Soluna Cloud to offer more than just bare-metal infrastructure by including HPE’s AI software solutions, positioning Soluna as a key player in HPE’s Partner Ready Service Provider program. Revenue from this HPC hosting is expected to appear in Soluna’s upcoming quarterly reports.

Quite a few publicly traded Bitcoin miners are embracing the AI/HPC trend. It will be interesting to see how this contributes to their revenue and potentially shapes the Bitcoin mining industry in the near future.

news.bitcoin.com

news.bitcoin.com