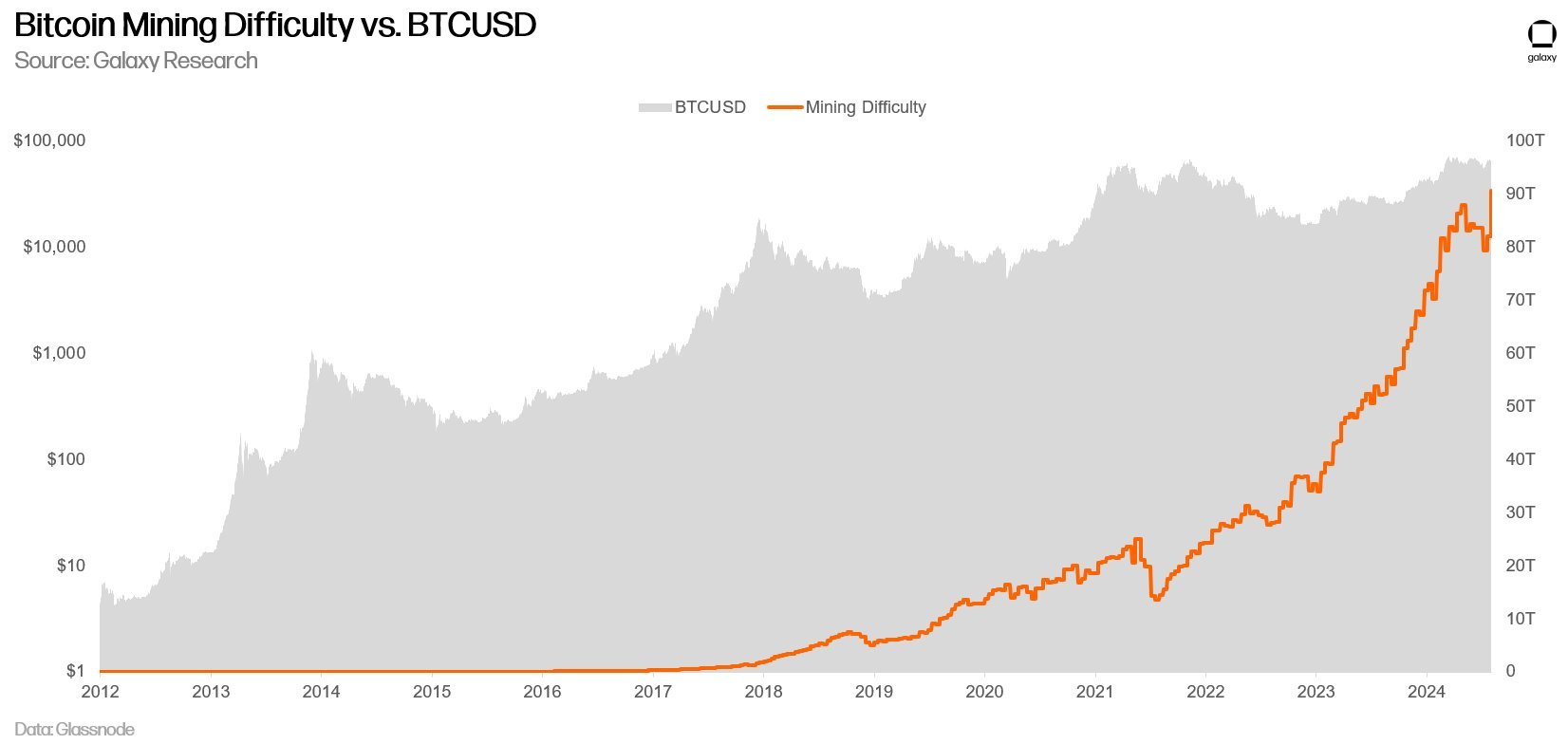

Yesterday, Aug. 1, 2024, Bitcoin (BTC) mining difficulty reached a historic peak following a significant increase of 10.5%, reports Galaxy's Head of Research Alex Thorn. In percentage terms, this rise is the 24th largest since 2016, the 73rd since 2012 and the 119th largest of all time. However, in absolute terms, says Thorn, this marks the largest difficulty increase ever recorded.

The latest difficulty adjustment shows that competition among miners is on the rise as the Bitcoin network expands and becomes more complex after this year's halving.

Higher mining difficulty usually means a tougher environment for miners, which can affect Bitcoin's overall network security and the efficiency of mining operations. This could lead to higher operational costs for miners, which might influence the future dynamics of Bitcoin's price.

Price of Bitcoin

Meanwhile, as of today, Bitcoin's price stands at $62,800. In the past 24 hours, the trading volume reached $44.90 billion. Quotes of the main cryptocurrency have experienced a decline of 3.9% since the start of the new trading session, with the daily high recorded at $65,600 and the daily low at $62,600.

The big change in difficulty could have an impact on how stable Bitcoin's price is and how people on the market make their decisions.

It is not straightforward how the difficulty of mining affects the price of Bitcoin. On the one hand, it could make mining more difficult, but on the other, it could signal that the network is more secure, which might affect how investors feel about it and how the market moves.

u.today

u.today