Northern Data Group reported a net revenue of €77.5 million for the 2023 fiscal year, down from €193.3 million in 2022.

The firm’s total income for the period stood at €111.0 million, compared to €249.5 million in the previous year. The company’s adjusted EBITDA stood at negative -€5.5 million, aligning with market expectations, following substantial investments in HPC applications and infrastructure.

Northern Data said it expects revenue to grow 3x in 2024 to €200 million and €240 million. It further projected another 2x growth to €520 million to €570 million in 2025.

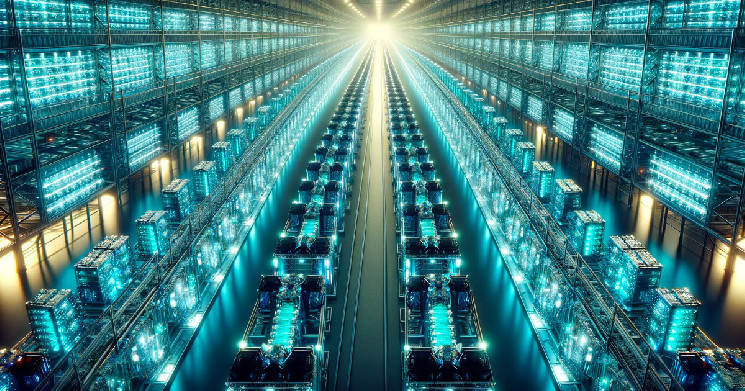

The group also described plans to invest €140 million in its Bitcoin mining company, Peak Mining. Outside of crypto mining, the company plans to invest €730 million in NVIDIA H100 Tensor Core GPUs and €110 million to increase its data center footprint in the US and EU.

Founder and CEO Aroosh Thillainathan called 2023 an “inflection point” focused on positioning Northern Data in AI and high-performance computing and investing strategically in 2024. He added that the firm is “well capitalized with significant cash on hand.”

Bitcoin mining results

Northern Data said Peak Mining and its Bitcoin (BTC) activities were “again responsible for the majority of revenue in the fiscal year” alongside newly significant cloud revenue.

Peak Mining produced 2,298 BTC in 2023. It continued its existing strategy of mining for its own account and selling all mined Bitcoin daily.

Peak Mining also increased its self-mining hardware devices 10% to a peak of 40,643 installed devices and 3.78 exahashes per second (EH/s) in 2023 in May 2023. By the end of 2023, the company had installed 35,639 self-mining ASIC servers with a hash rate of 3.34 EH/s; the firm shut down sites with high energy costs.

Northern Data is the largest Bitcoin miner in Europe. Recent reports indicate that the firm intends to launch an initial public offering (IPO) in the US with an expected valuation between $10 and $16 billion.

cryptoslate.com

cryptoslate.com