London and NASDAQ-listed miner, Argo Blockchain, has revealed a drop in monthly Bitcoin (BTC) production and revenue. Despite these setbacks, Argo is enhancing its total hash rate capacity and signals a stronger outlook for the future.

Argo Blockchain’s Bitcoin Production Falls in June

In June 2023, Argo mined 139 Bitcoin or Bitcoin Equivalents, averaging 4.6 BTC daily. This represents a decrease of 17% from the 5.6 BTC mined each day in May 2023. During the previous month, the total number of tokens mined was 173 BTC.

June’s decline is attributed to increased network difficulty and a scale-down of operations at the Helios facility in Texas. While this curtailment limited the number of Bitcoin mined, Argo anticipates additional cash inflows from specific power trading activities that Helios' operator undertook.

The Company's revenue in June totalled $3.84 million, marking a drop of 19% from May 2023's figure of $4.75 million.

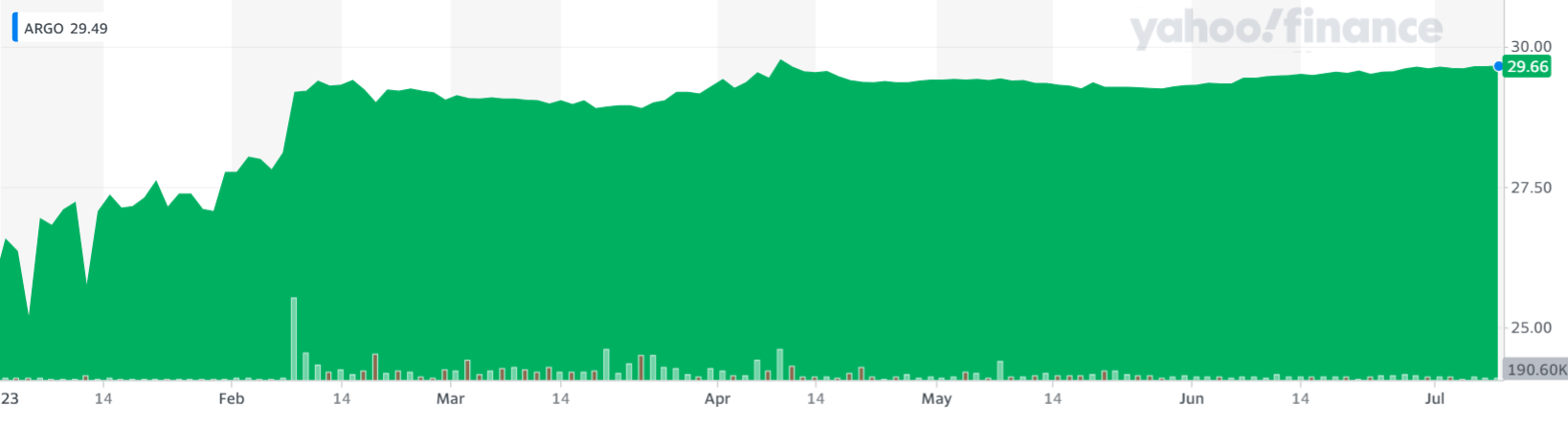

Despite declining production and revenue over the past month, ARGO shares on Wall Street are at relatively high levels. The company tested the April highs during yesterday’s (Tuesday’s) session, closing the day at almost $30 per share.

Enhancements to Hash Rate Capacity

As of 30 June, Argo held 44 BTC. The firm maintained its total hash rate capacity at 2.5 EH/s and began to equip its Quebec facilities with new BlockMiner machines. Once fully operational, these machines are projected to boost the company's total hash rate capacity by 12%, raising it to roughly 2.8 EH/s.

Despite the short-term challenges reflected in the June report, the company's efforts to bolster its mining capacity underline a strategic response to an increasingly competitive cryptocurrency mining landscape.

Cryptocurrency Winter Hurt the Company

Unaudited financial results for the first quarter of 2023 from Argo Blockchain were published last month. Argo reported a significant revenue boost in Q1 2023, which saw an increase of 15% from the fourth quarter of 2022, totalling $11.4 million. Regardless of this growth and an adjusted EBITDA of $1.6 million, the company sustained a net loss of $8.7 million.

What is more, the company's 2022 financials revealed a contrasting picture. The publicly-listed mining firm reported a year-end revenue of $58.6 million, marking a substantial 36% decline. The year saw the company suffering a net loss of $240.2 million, a situation primarily influenced by the falling value of cryptocurrencies.

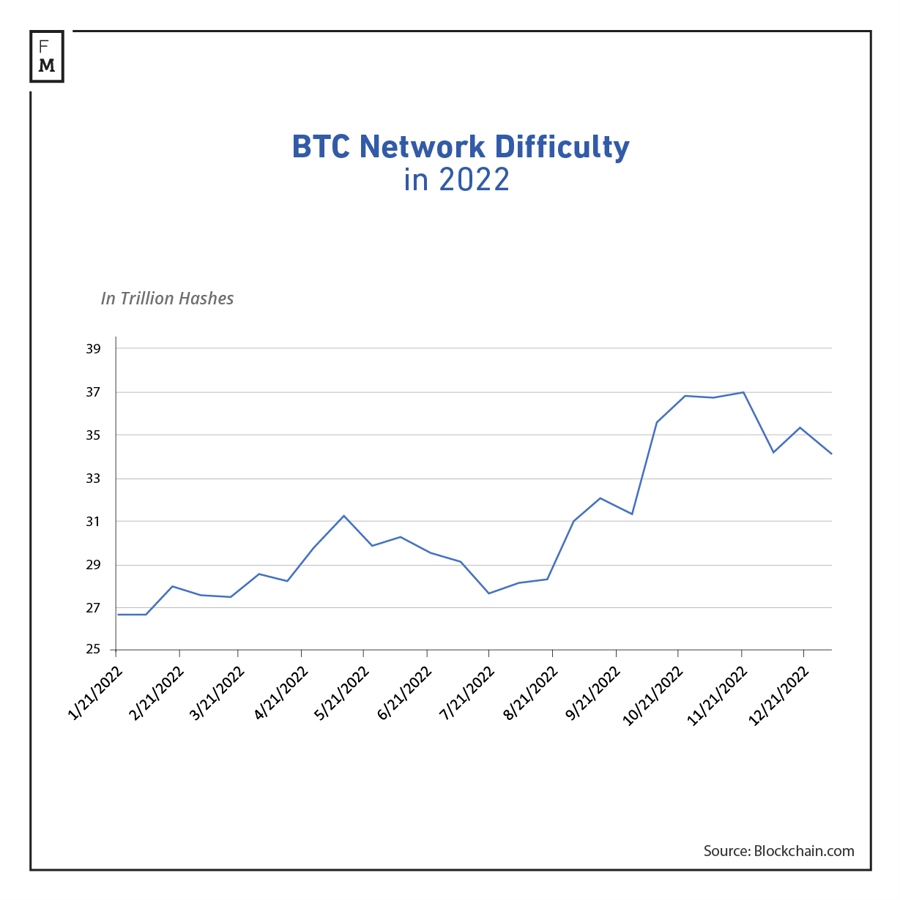

As you can see from the chart below, 2022 was a challenging year overall for Bitcoin miners. After a record-breaking 2021, they earned $6 billion less. This was mainly due to the ever-increasing difficulty of mining.

Despite the adverse net results, Argo appears to be regaining stability. Despite the threat of bankruptcy, a decisive agreement with Galaxy Digital Holdings Ltd., a finance company with expertise in digital assets, successfully averted the impending closure, setting Argo back on track.

financemagnates.com

financemagnates.com