Bitcoin (BTC) miners are preparing for another difficulty adjustment this week, as the computational power required to mine new coins reaches its highest level ever.

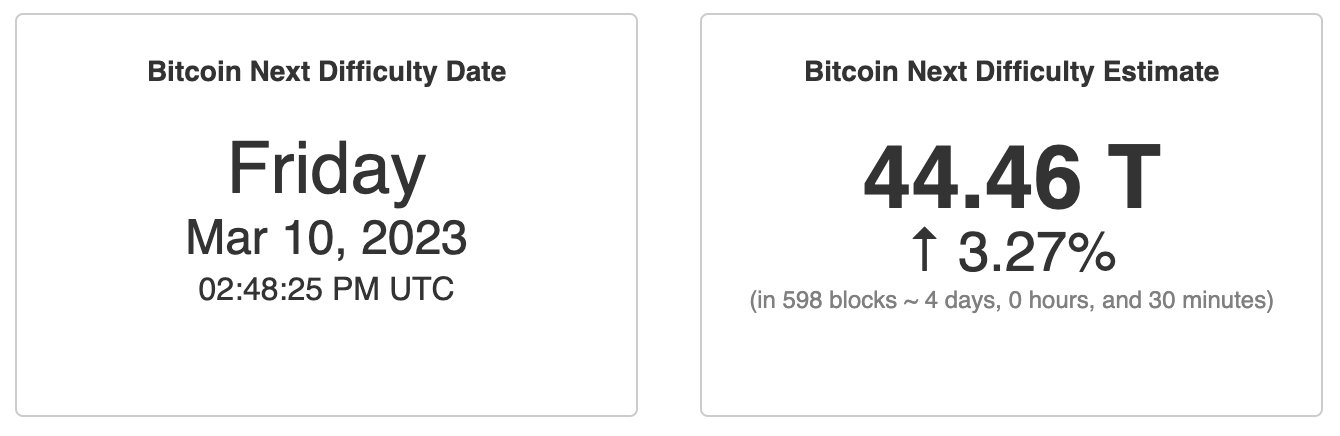

The next difficulty adjustment, which is expected to occur on Friday March 10, will take the difficulty level from 43.05 T to 44.46 T, according to estimations from the crypto mining data provider CoinWarz.

The expected increase will take the difficulty of mining new bitcoins to yet another all-time high. This is despite the fact that we are already at a record high level, after a consistent rise in the difficulty level since the second half of 2022.

Hashrate continues to rise

Increases in the difficulty level of Bitcoin mining generally follows increases in the hashrate on the network – the amount of computational power that is dedicated to mining Bitcoin globally. When the hashrate rises, difficulty also rises to ensure the blockchain maintains an average time of 10 minutes between each block mined.

Since June of 2021, the Bitcoin network’s hashrate has risen consistently. It first crossed the 300 EH/s mark in late January this year, and then reached another all-time high of close to 400 EH/s in late February.

As recently as on March 2, the hashrate once again got close to its all-time high, reaching 385 EH/s, data from CoinWarz showed.

A rising hashrate is viewed as a sign of network adoption, and increases the Bitcoin network’s security and resilience against various forms of attacks. Bitcoin is for this reason considered by far the most secure cryptocurrency in the market.

Struggling miners

As a direct result of the increase in difficulty, miners will necessarily get their margins squeezed even more. Not surprisingly, this could be difficult for many of the largest mining firms, after a bear market that has now lasted more than a year.

Earlier this month, the major publicly listed Bitcoin miner Riot Blockchain reported earnings that revealed the firm lost more than half a billion dollars on its mining operation in 2022. The loss was much larger than the $15.4m loss the firm reported for 2021, despite the fact that it produced far more BTC in 2022.

It remains to be seen how Riot and other major mining firms will deal with the continued rise in the Bitcoin mining difficulty this year, unless spot prices start to rise in a meaningful way.

cryptonews.com

cryptonews.com