Compute North’s bankruptcy filing was caused by trouble dealing with one of its biggest lenders – Generate Capital – along with market headwinds and supply-chain disruptions, according to the newly appointed chief financial officer of the operator of data centers used by crypto miners.

The company’s Chapter 11 case, revealed Thursday, has rocked a mining industry already under pressure due to the crypto bear market and a global energy crisis, which raises the cost to mine new tokens. Compute North, which makes most of its revenue by hosting the computers of miners, is a well-known name in the industry with clients such as Marathon Digital Holdings (MARA), Bit Digital (BTBT) and BitNile (NILE). The shares of all three miners fell on Friday.

Read more: Crypto-Mining Data Center Compute North Files for Bankruptcy, CEO Steps Down

Compute North’s long-term debt stands at $128.3 million, CFO Harold Coulby said in a filing. About $99.8 million of that is in the form of a senior secured promissory note to renewable energy prodiver NextEra, another $21 million in a similar note to miner Marathon and $7.5 million lies with an equipment financing loan with digital asset mining and staking firm Foundry (which is owned by CoinDesk’s parent company, Digital Currency Group).

The big lender

In explaining the bankruptcy in a filing Friday, CFO Harold Coulby pointed to one of the firm’s biggest creditors. In February, Generate Capital agreed to lend up to $300 million to Compute North to finance projects in Nebraska and later Texas, the CFO said. As part of the financing agreements, the lender received a “a right of first refusal to finance all of Compute North’s future projects and the right to appoint a director” to its board of directors.

Out of the $300 million credit facility from Generate Capital, about $101 million is currently outstanding, according to Houlby's filing.

Generate Capital did not respond to CoinDesk’s request for comment at the time of publication.

In July, the lender asserted several “technical events of default,” which led to taking control of Compute North assets. Generate Capital exercised its voting rights to take over Compute North subsidiary that owned the two bitcoin mining sites the two firms were developing. That included the Wolf Hollow site in Texas, slated to run at 300 megawatts (MW) capacity initially and 600 MW at a later stage, which would make it the miner’s biggest operation. Because Generate Capital has already seized assets, it is not counted among the current creditors.

Also in the second quarter, Generate Capital stopped the funding for new sites other than the ones in Texas and Nebraska, according to Coulby.

The hosting firm couldn’t find an alternative source of funding and therefore couldn’t complete the buildout of its mines, the CFO said. In the weeks that followed it tried to come up with a solution with Generate Capital and other prospective investors, but couldn’t find one in time.

Making matters worse, supply-chain disruptions, soaring energy prices and the decline in bitcoin prices squeezed Compute North’s already tight liquidity. The firm put down $30.9 million in 2021 and $41.4 million in 2022 on deposits for fixed assets like transformers, which take a long time to be delivered, said Coulby.

“Facing the threat of ongoing degradation to the value of its business, including the potential termination of contracts that Compute North may be able to assign in a sale transaction, Compute North had no choice but to commence these Chapter 11 Cases in order to preserve and maximize the value of its assets,” he wrote.

Read more: Foundry Starts New Service to Reduce Supply-Chain Lag for Bitcoin Miners

Corporate Structure

At the time of the bankruptcy filing, Compute North operated 259 MW of bitcoin mines, the CFO said. Last year, the firm brought in $34.1 million from hosting mining machines, $19.1 million from selling equipment and $12.1 million from self-mining.

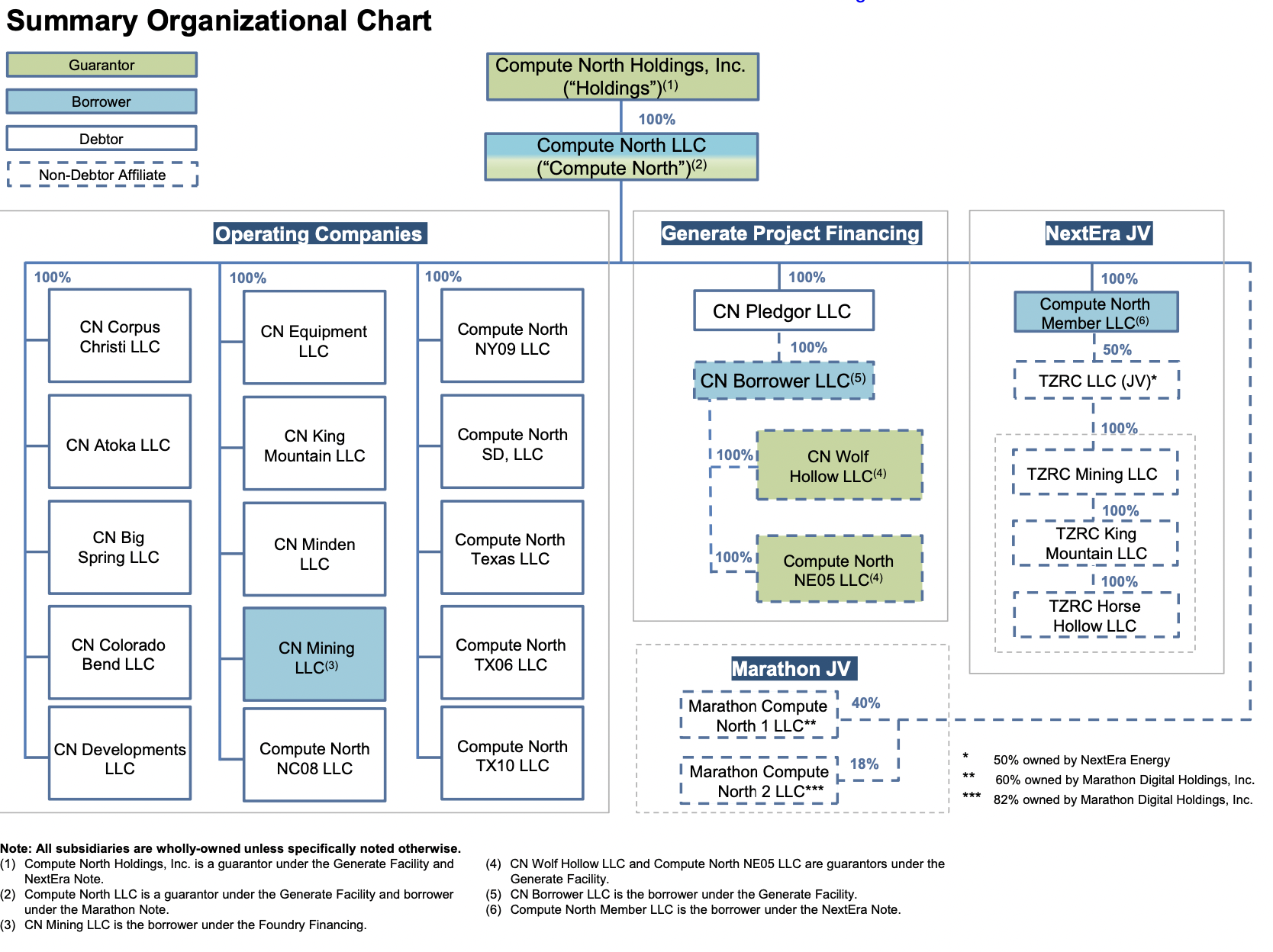

Compute North’s organization structure. (Harold Coulby/Compute North)

In the filing, Coulby described a complex system of subsidiaries under which Compute North managed its operations. Bitcoin mining facilities were handled by different subsidiaries, some of whom were owned in part by its creditors.

The bear market is taking a heavy toll on the crypto mining industry, as miners with heavy debt loads keep falling victim to the crypto winter. Most recently, Celsius Network's mining unit, which said in March it planned to go public, also filed for Chapter 11 bankruptcy protection, along with its parent company. Meanwhile, Poolin Wallet, the wallet service of one of the largest bitcoin (BTC) mining pools, has announced on Sept. 13 it will issue IOU (I Owe You) tokens to affected customers after it froze withdrawals prior week.

coindesk.com

coindesk.com