Ahead of the politically sensitive 100th anniversary of the ruling Communist Party on July 1, China recently took a strong stance against Bitcoin and crypto mining, which sent the prices of the cryptocurrencies crashing.

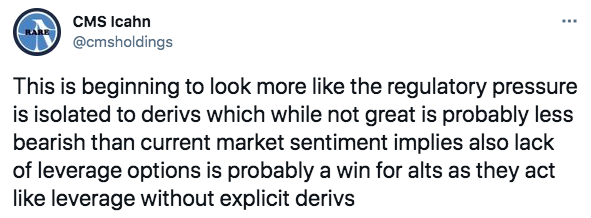

However, things seem to be leaning towards derivatives trading rather than the spot market.

One of the biggest Chinese cryptocurrency exchanges, OKEx, recently clarified that while the regulators are going to be more strict on exchanges and mining operations, people can still hold cryptos.

The exchange noted that the clampdown has been “mainly due to potential risks for consumers and society in China.”

https://twitter.com/QwQiao/status/1399533363938070531

Before the State Council's notice, the China Internet Finance Association also warned the public about the risks of investing in cryptocurrencies, which focused on the fact that institutions should understand the nature of crypto assets, financial institutions shouldn’t engage with them and must abide the existing regulations, and that China does not offer legal protection for crypto-related investment.

Amidst this, China’s largest altcoin exchange MXC announced that new users in China are prohibited from trading futures.

“Due to recent dynamic changes in the market, MXC will be suspending some of our services such as Margin Trading and Futures to new users from a few specified countries & regions. Most users will be unaffected by this change,” said the exchange.

Another exchange BitMart also reported a change in policy as per which it will suspend contract trading services for all Chinese users. While the positions already opened can be closed, no new positions are allowed.

“Chinese state media are severely criticizing high-leverage futures trading,” noted local media, Wu Blockchain.

Binance, Huobi, Bybit, and OKEx are the top four global exchanges, and Huobi, which is most sensitive to China’s policy, has also announced that it has banned new Chinese users from using futures, it added.

Recently, in an interview, Binance CEO Changpeng Zhao revealed that its Chinese market comprises 80% to 90% of retail, unlike the US, where it’s exactly the opposite with institutions accounting for this much share.

Wu Blockchain also noted that Binance has also changed all Chinese related to contracts and leverage to traditional Chinese because it is “worried about mainland China's crackdown on leverage and derivatives trading.”

Another exchange BitMart also reported a change in policy as per which it will suspend contract trading services for all Chinese users. While the positions already opened can be closed, no new positions are allowed.

“Chinese state media are severely criticizing high-leverage futures trading,” noted local media, Wu Blockchain.

Binance, Huobi, Bybit, and OKEx are the top four global exchanges, and Huobi, which is most sensitive to China’s policy, has also announced that it has banned new Chinese users from using futures, it added.

Recently, in an interview, Binance CEO Changpeng Zhao revealed that its Chinese market comprises 80% to 90% of retail, unlike the US, where it’s exactly the opposite with institutions accounting for this much share.

Wu Blockchain also noted that Binance has also changed all Chinese related to contracts and leverage to traditional Chinese because it is “worried about mainland China's crackdown on leverage and derivatives trading.”

China’s Regulatory Crackdown Focused on High Leverage Derivatives Trading

bitcoinexchangeguide.com

01 June 2021 14:15, UTC

bitcoinexchangeguide.com

01 June 2021 14:15, UTC