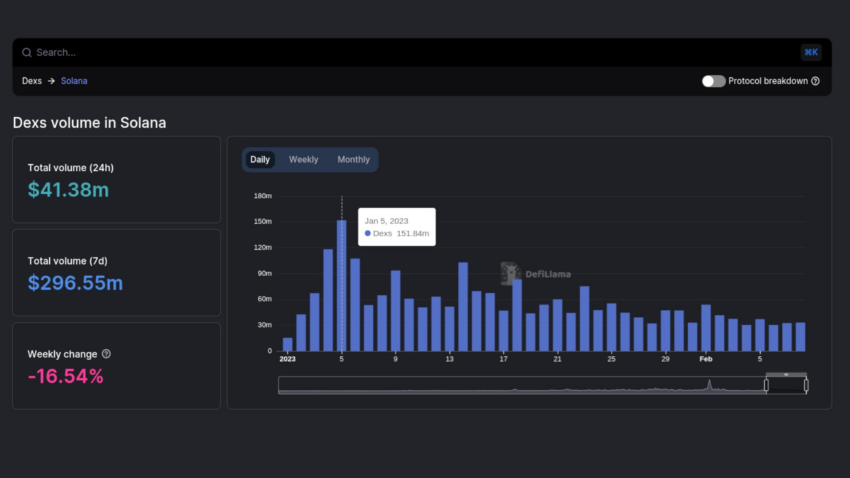

The trading volume of decentralized exchanges (DEX) running on top of the Solana network has rapidly declined from January highs as interest in Bonk (BONK) token wanes.

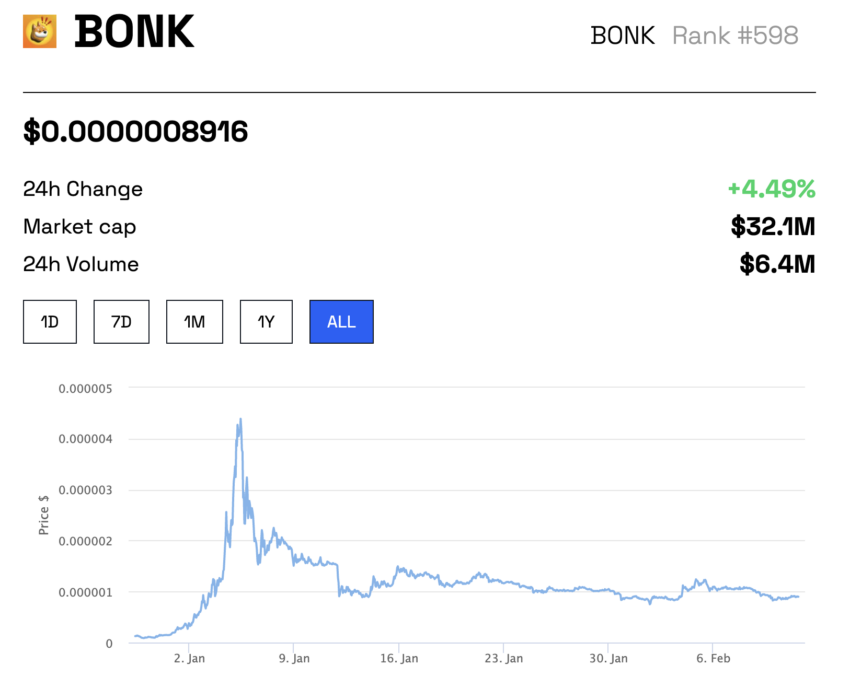

On-chain data from DeFiLlama shows that trading volume on Solana-based DEXs dropped to $41.58 million on February 10, a 27% drop compared to the previous month. At the time, the market value of the relatively new dog-themed token skyrocketed by more than 3,000% to reach a new all-time high (ATH).

The launch of BONK in January also impacted the number of active SOL wallets, bringing them to pre-FTX collapse levels.

The Hype Is Over

Interest in BONK appears to have waned after losing a significant amount of market value. Crypto market data from BeInCrypto shows that BONK is down 81% from its ATH, retracing over 10% in the past 30 days alone.

Still, the Solana-based memecoin has managed to bounce from a critical area of support, posting 4.49% gains in the last 24 hours.

A step correction in the price of Solana’s native token followed BONK’s market value decline. SOL’s price took a 27% nosedive, going from a high of $26.87 on February 2 to a low of $16.66 eight days later.

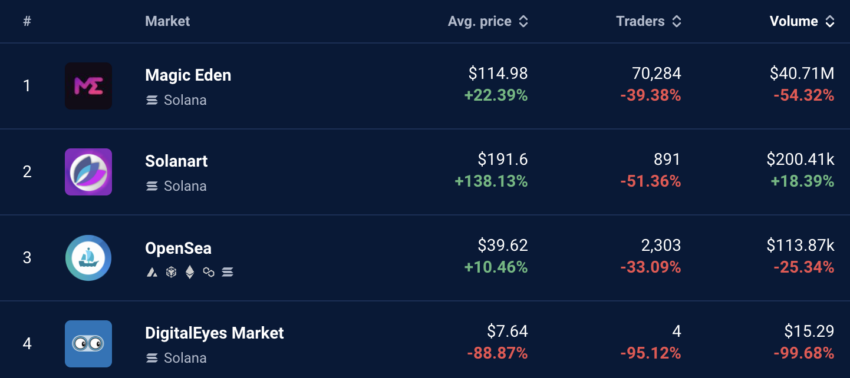

On-chain data from DeFiLlama data also reveals that the total value of assets locked within the Solana ecosystem dropped by roughly 9% in February, from $264 million to $245 million. The same trend can be seen in the trading volume on Solana’s top NFT marketplaces.

Trading volume on Magic Eden is down by 54.32% to $40.71 million over the past month. Meanwhile, the trading volume of Solana-based NFT trades in OpenSea dropped by 25.34% to $113,870.

Despite the significant decline in network activity, founders Anatoly Yakovenko and Raj Gokal believe Solana is showing signs of a promising future in the midst of a volatile crypto market.

beincrypto.com

beincrypto.com