The biggest rating agency in the world, S&P Global Ratings, downgraded Coinbase on Wednesday, citing negative profitability due to decreasing trading volumes and regulatory uncertainties.

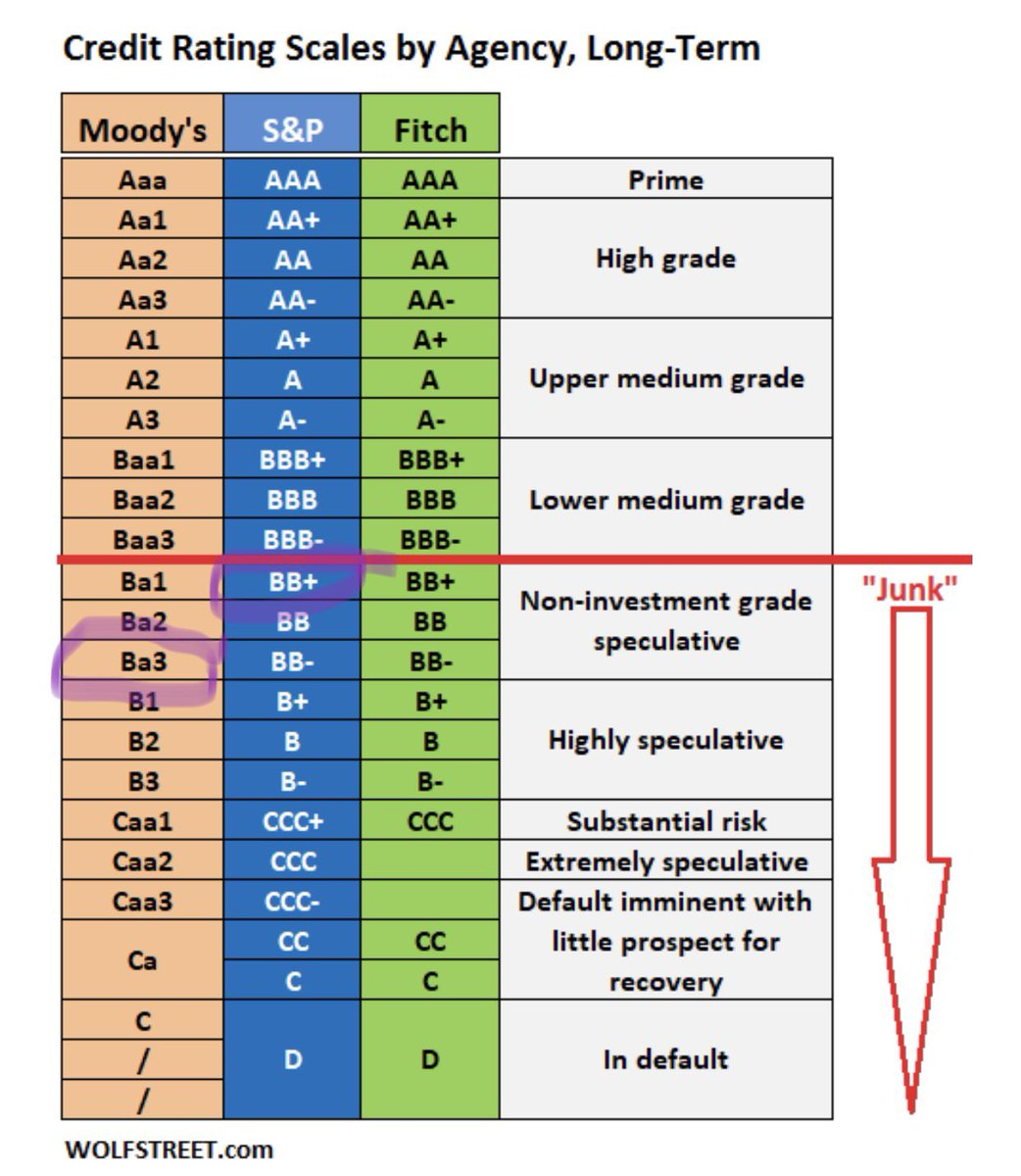

The downgrade from BB to BB- significantly reduces Coinbase’s creditworthiness and puts it in the junk bond category. The ratings indicate significant ongoing risks regarding poor commercial, financial, and economic circumstances. In any case, the bonds in question have a low credit rating.

Coinbase joins MicroStrategy as one of only two issuers of junk bonds. The price of Coinbase stock did not move at all in the after-hours trading session on Wednesday.

According to the rating agency, the primary reasons for the downgrading were the reduced trading volumes, the impact on Coinbase’s profitability, and regulatory risks.

S&P speculated that the lack of retail participation in the crypto market was due to the industry’s diminished reputation following FTX’s bankruptcy filing in November. Trading volumes on all exchanges, including Coinbase, have plummeted.

Most of Coinbase’s income comes from retail trading fees, but trade activity has been falling rapidly in recent weeks, causing the exchange’s income to fall even further. Therefore, S&P predicts that the U.S.-based exchange’s profitability will remain squeezed in 2023, adding that it might record minor positive S&P Global adjusted EBITDA in the current year.

Lower trading volume was the primary factor in the 44% decline in Coinbase’s third-quarter revenue in 2022 compared to the second quarter.

coinculture.com

coinculture.com