In the wake of FTX’s demise, GMX has matured into a formidable challenger to established companies such as Uniswap. According to Delphi Digital, GMX earned $1.15 million in trading fees on Monday, beating Uniswap’s $1.06 million for the first time.

You might also like

Fidelity Starts Setting Up Retail Bitcoin Trading Accounts

BlockFi Files for Bankruptcy In The Wake Of FTX Collapse

The decentralised exchange, which allows users to trade perpetual or futures with no expiration date and an intermediary via smart contracts, may benefit from the recent demise of FTX, which spurred a trend toward perpetual-focused decentralised platforms.

GMX went live on Ethereum layer 2 solution Arbitrum in September 2021 and launched on Ethereum rival Avalanche at the beginning of this year. It provides relatively minimal transaction fees and no price impact or influence of a single trade on the market price.

BitMEX was the first centralised exchange to begin perpetual crypto trading in 2016, followed by Binance and the now-defunct FTX.

On November 11, Sam Bankman Fried’s exchange FTX filed for Chapter 11 bankruptcy, diminishing investor trust in centralised exchanges.

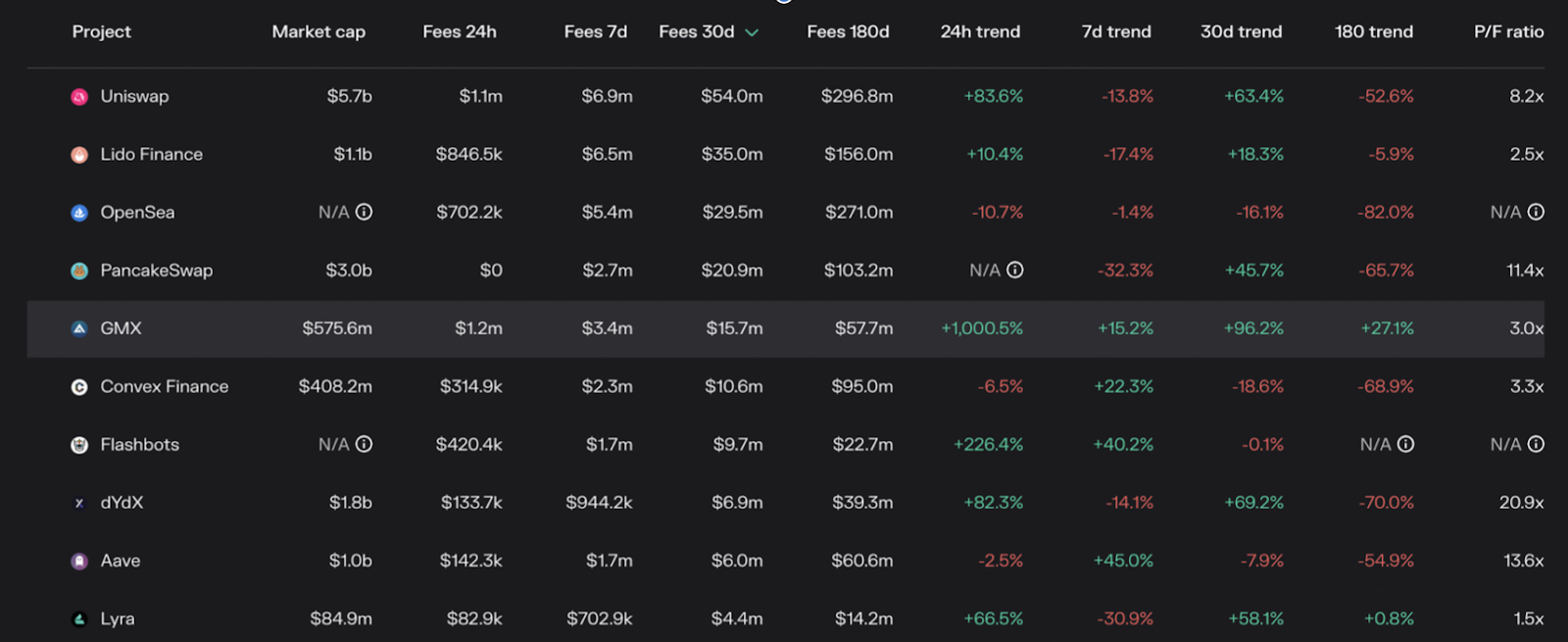

According to Token Terminal, GMX has amassed $15.7 million in trading fees in four weeks, making it the fifth-largest decentralised application, surpassing famous players such as dYdX and AAVE.

In thirty days, the hosts of GMX, Arbitrum, and Avalanche received $985,600 and $540,500 in trading fees, respectively. Uniswap has amassed $54 million in trading fees, maintaining its position as the market leader.

The UNI token of Uniswap has decreased by 16% this month, while the GMX token has increased by 4%.

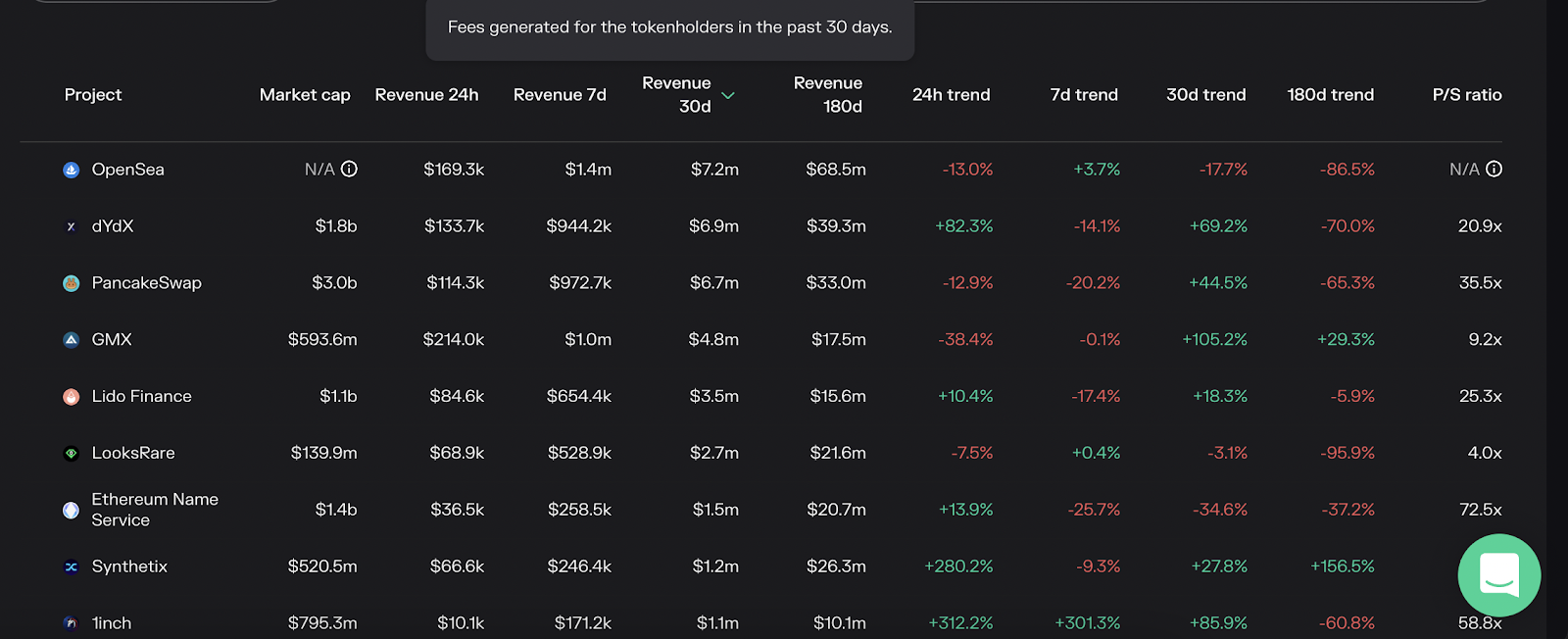

The outperformance of GMX is likely because GMX token holders earn 30% of all trading fees, while UNI token holders do not receive any trading fee revenue.

asIn the last 30 days, GMX has distributed $4.7 million to token holders, the fourth-largest payout among all decentralised applications.

coinculture.com

coinculture.com