On Monday (14 November 2022), Binance Co-Founder and CEO “CZ” explained why the call he had on 8 November 2022 with Sam Bankman-Fried (aka “SBF”), Co-Founder and former CEO of insolvent crypto exchange FTX, was a “very expensive” one.

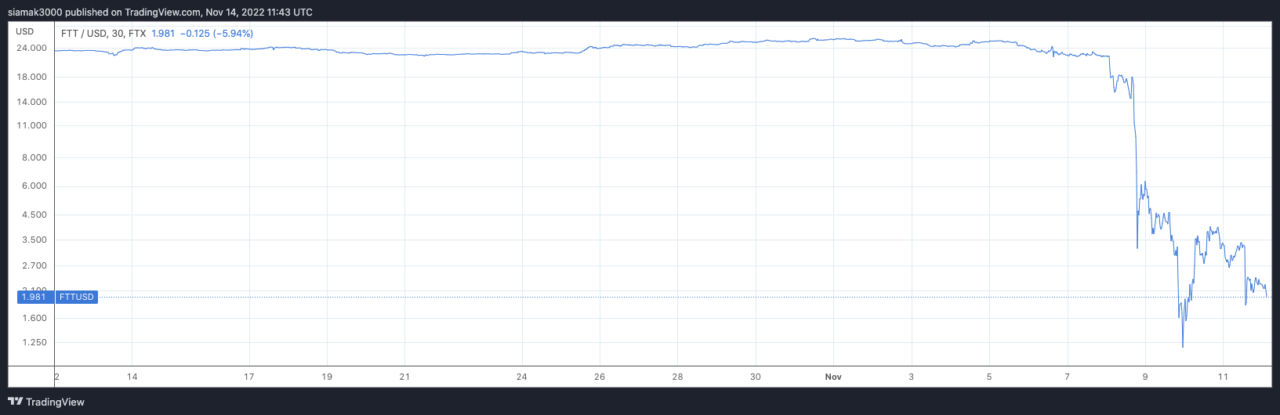

On 2 November 2022, the collapse of SBF’s FTX empire started when CoinDesk published an article (titled “Divisions in Sam Bankman-Fried’s Crypto Empire Blur on His Trading Titan Alameda’s Balance Sheet”) , which stated that the now bankrupt Alameda Research “had $14.6 billion of assets as of June 30, according to a private document CoinDesk reviewed” and that “much of it is the FTT token issued by FTX, another Bankman-Fried company.”

On 6 November 2022, CZ announced that Binance had decided to sell its remaining $FTT holdings:

We will try to do so in a way that minimizes market impact. Due to market conditions and limited liquidity, we expect this will take a few months to complete. 2/4

— CZ 🔶 Binance (@cz_binance) November 6, 2022

Then, last Tuesday (8 November 2022), SBF announced that FTX and Binance had “come to an agreement on a strategic transaction with Binance” for FTX:

1) Hey all: I have a few announcements to make.

— SBF (@SBF_FTX) November 8, 2022

Things have come full circle, and https://t.co/DWPOotRHcX’s first, and last, investors are the same: we have come to an agreement on a strategic transaction with Binance for https://t.co/DWPOotRHcX (pending DD etc.).

A few minutes later, CZ took to Twitter to announce that FTX had asked Binance to help it with “a significant liquidity crunch”, and that Binance had decided to protect FTX’s customers by signing a non-binding letter of intent (LOI) to fully acquire FTX:

This afternoon, FTX asked for our help. There is a significant liquidity crunch. To protect users, we signed a non-binding LOI, intending to fully acquire https://t.co/BGtFlCmLXB and help cover the liquidity crunch. We will be conducting a full DD in the coming days.

— CZ 🔶 Binance (@cz_binance) November 8, 2022

The next day, Binance announced why it was not able to go ahead with the plan to fully acquire FTX.com, pointing out that although it was hoping to “support FTX’s customers to provide liquidity”, the issues it discovered — as part of its due diligence process and via the various news reports about FTX — were “beyond” its “control or ability to help”:

As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged US agency investigations, we have decided that we will not pursue the potential acquisition of https://t.co/FQ3MIG381f.

— Binance (@binance) November 9, 2022

Well, earlier today, CZ said that Binance had never shorted $FTT and that it still holds $FTT tokens, which it stopped selling after SBF called (on 8 November 2022) to ask CZ to help FTX with its “liquidity” crisis:

Full disclosure: Binance never shorted FTT. We still have a bag of as we stopped selling FTT after SBF called me. Very expensive call. https://t.co/3A6wyFPGlm

— CZ 🔶 Binance (@cz_binance) November 14, 2022

On 11 November 2022, CZ shared his thoughts on the collapse of the FTX empire at the 4th Indonesia Fintech Summit (10-11 November 2022).

CZ said:

“This problem wasn’t created in the last three days… FTX is misappropriating user funds… From our perspective, the deal did not make sense from a number of fronts… So, our original intention was let’s save the users, but then the news of misappropriating user funds and especially US regulatory agencies’ investigations, we’re like, ‘okay, we can’t touch that anymore’… And then as soon as I understood we couldn’t touch it anymore, I said let’s make that announcement as quickly as possible because we don’t want to do a slow no…“

cryptoglobe.com

cryptoglobe.com