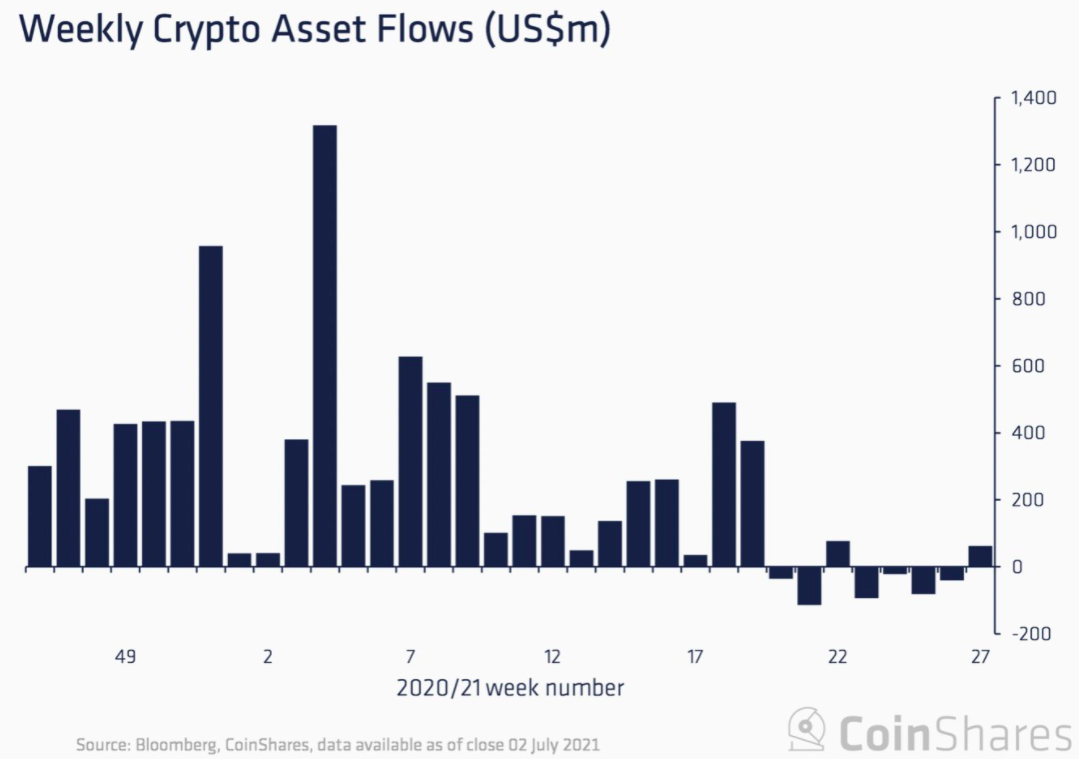

After five weeks of consecutive outflows, digital asset investment products finally saw inflows last week totaling $63 million in the week ending July 2nd, according to CoinShares’ data.

It was also the first time in nine weeks that inflows were seen across all individual digital assets, “implying a turnaround in sentiment amongst investors.”

Bitcoin saw the most inflows at $39 million, a minor update to the previous weeks’ data highlighting a two-week run of inflows now.

Compared to Bitcoin’s (BTC) two consecutive weeks of inflows, Ethereum (ETH) had three weeks of inflows totaling $18 million. [coin_stats_table symbol="BTC"][coin_stats_table symbol="ETH"]

While inflows have finally come in, Bitcoin investment product trading turnover was the lowest since November 2020. According to CoinShares, a similar observation was seen more broadly across the whole of the Bitcoin ecosystem, with volumes down 38% relative to the average for 2021.

Among altcoins, Polkadot (DOT) had the highest inflows of $992.1 million followed by XRP and Cardano (ADA) at $512 million and $90.7 million respectively. [coin_stats_table symbol="DOT"][coin_stats_table symbol="XRP"][coin_stats_table symbol="ADA"]

Inflows of $0.6 million were seen into multi-digital asset investment products; however, this was much smaller than previous weeks suggesting investors were less interested in diversification.

When it comes to digital asset managers, the largest one in the world, Grayscale still hasn't seen any while its AUM is currently at just above $30 billion. Meanwhile, the second-largest CoinShares had net outflows with its AUM now at almost $3.3 billion, with 3iQ also recording net outflows.

While inflows have finally come in, Bitcoin investment product trading turnover was the lowest since November 2020. According to CoinShares, a similar observation was seen more broadly across the whole of the Bitcoin ecosystem, with volumes down 38% relative to the average for 2021.

Among altcoins, Polkadot (DOT) had the highest inflows of $992.1 million followed by XRP and Cardano (ADA) at $512 million and $90.7 million respectively. [coin_stats_table symbol="DOT"][coin_stats_table symbol="XRP"][coin_stats_table symbol="ADA"]

Inflows of $0.6 million were seen into multi-digital asset investment products; however, this was much smaller than previous weeks suggesting investors were less interested in diversification.

When it comes to digital asset managers, the largest one in the world, Grayscale still hasn't seen any while its AUM is currently at just above $30 billion. Meanwhile, the second-largest CoinShares had net outflows with its AUM now at almost $3.3 billion, with 3iQ also recording net outflows.

Inflows Recorded Across Digital Assets for the First Time in 9 Weeks: CoinShares Report

bitcoinexchangeguide.com

05 July 2021 14:24, UTC

bitcoinexchangeguide.com

05 July 2021 14:24, UTC