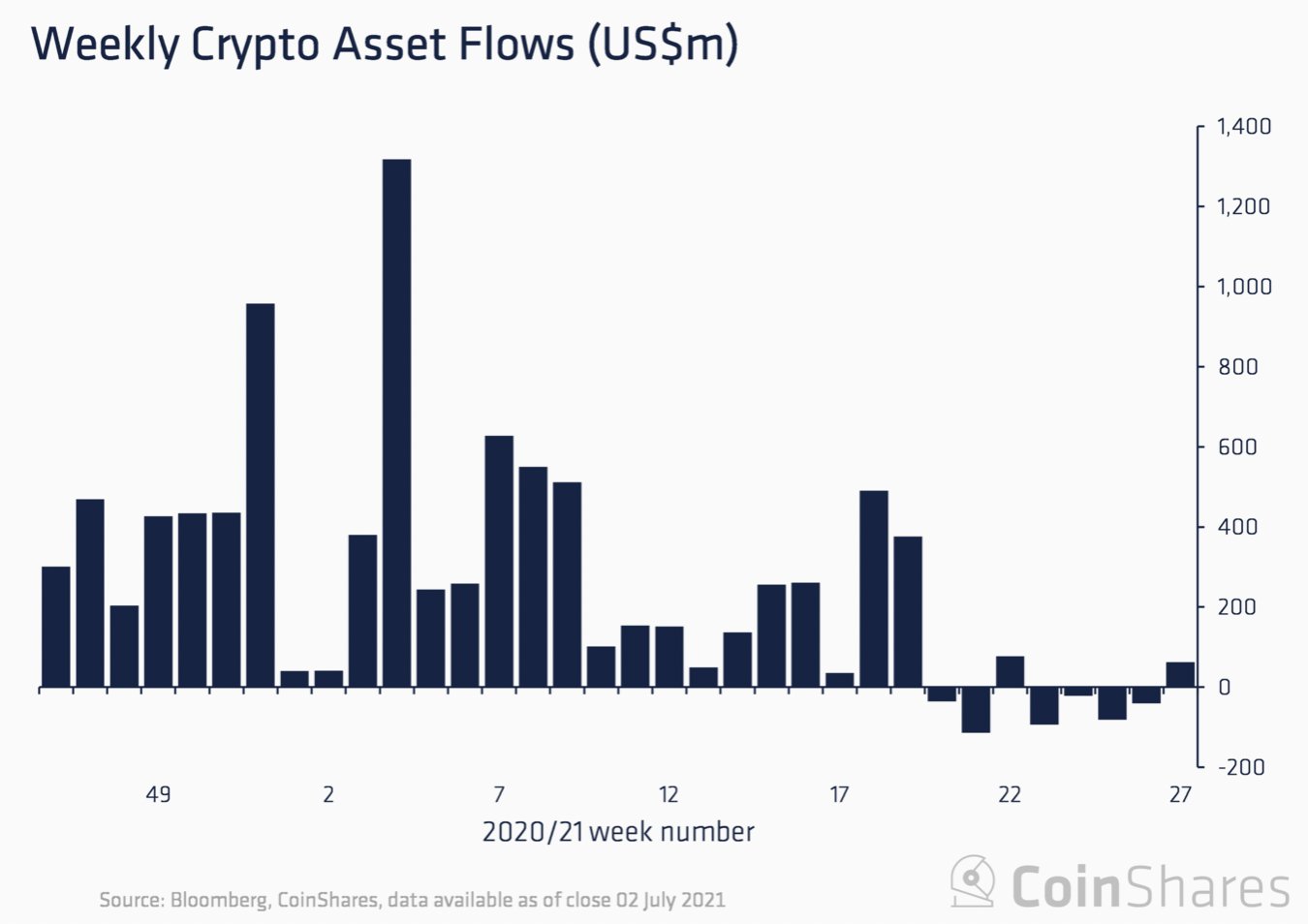

Following a period of successive outflows, new data gathered by digital asset investing firm CoinShares revealed a slight change that could signal a reversal of bearish investor appetite for cryptocurrencies.

According to the data, institutional investors bought $63 million worth of positions in crypto funds. This is notably the first positive inflow for such funds in five weeks, although it is orders of magnitude different from the $1.2 billion recorded during the peak of the bull market.

Source: Coinshares

Apart from the collective growth of the crypto funds, individual digital assets have also recorded substantial inflows for the first time in 9 weeks. Bitcoin, for example, recorded the highest number of inflows among other cryptocurrencies at $39 million. Ethereum on its own, recorded about $18 million inflows while XRP, Polkadot, and Cardano all saw inflows of $1.2 million, $2.1 million, $0.7 million respectively.

There is also data on investors who have chosen to diversify and put funds into multi-digital asset investment products. With a slight increase from the previous weeks, inflows on different crypto assets were at $0.6m showing that investors are less interested in diversifying than investing in a particular asset.

Due to different factors that affected the crypto markets, some crypto investors sold off their assets most probably out of fear of losing their money. However, the recent increase recorded by CoinShares across all individual digital assets indicates that investors are having a change of mind and are returning.

Amongst factors that contributed to the deep plunge in the price of cryptos, especially bitcoin, was the announcement that Tesla CEO Elon Musk made that the electric car company would no longer accept bitcoin from customers as payment for services.

Just as the news of the company’s bitcoin purchase affected bitcoin’s price, the news of the company rejecting bitcoin did the same but in a negative way. Several bitcoin holders liquidated their positions, causing the largest cryptocurrency to plummet by 15% shortly after Musk’s tweet went viral.

There was also further distress following the exile of Bitcoin mining operations from China following a government order against the industry.

These events not only affected Bitcoin but other cryptocurrencies too. Fortunately, the market seems to be regaining its stance as a recent report mentioned that the crypto industry, in general, increased by over 10% hitting $1.5 trillion.

Affiliate: Get a Ledger Nano X for $119 So That Hackers Won't Steal Your Crypto!

Follow us on Twitter, Facebook, and Telegram to receive timely updates. Subscribe to our weekly Newsletter.

coinfomania.com

coinfomania.com