Smaller but more flexible community banks have joined forces to launch USDF, a new stablecoin minted by US banks. The consortium will leverage the Provenance blockchain and two FinTech firms with veteran leadership to facilitate a new on-ramp to digital assets.

Stablecoins Instead of CBDC for the Global Reserve Currency?

As time moves forward, it seems that the US monetary system will rely more on well-regulated stablecoins for its digital money needs rather than a Central Bank Digital Currency (CBDC). While China has already rolled out its digital yuan (e-CNY) to over 140 million people, the US hasn’t yet taken even the first practical steps to bring a CBDC to life.

This is not very surprising, given that even the World Economic Forum has noted some CBDC disadvantages. Moreover, such a development is facing growing opposition among members of US Congress. Just today, Rep. Tom Emmer from Minnesota introduced a bill that would prevent the Federal Reserve from issuing a CBDC directly to individuals.

Today, I introduced a bill prohibiting the Fed from issuing a central bank digital currency directly to individuals. Here’s why it matters: pic.twitter.com/S7pQ5rVc6n

— Tom Emmer (@RepTomEmmer) January 12, 2022

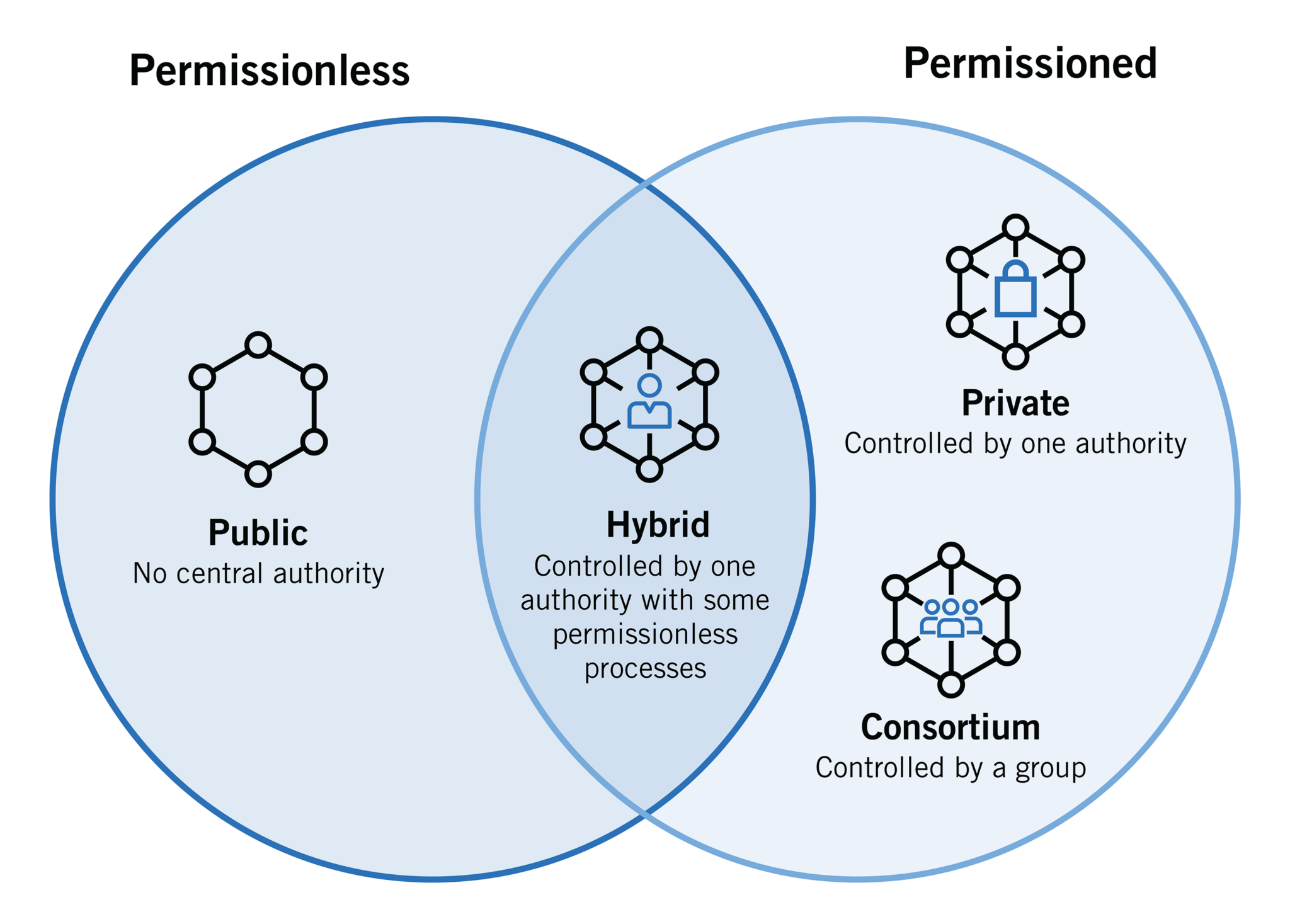

The main thrust of the bill is to keep digital money as close to physical cash as possible. Meaning, it should be open, private, and permissionless. These are the key attributes many blockchain projects boast, including stablecoins. It is then no surprise that commercial banks are taking direct steps to issue their own stablecoin.

Join our Telegram group and never miss a breaking digital asset story.

USDF Consortium: New Stablecoin Platform

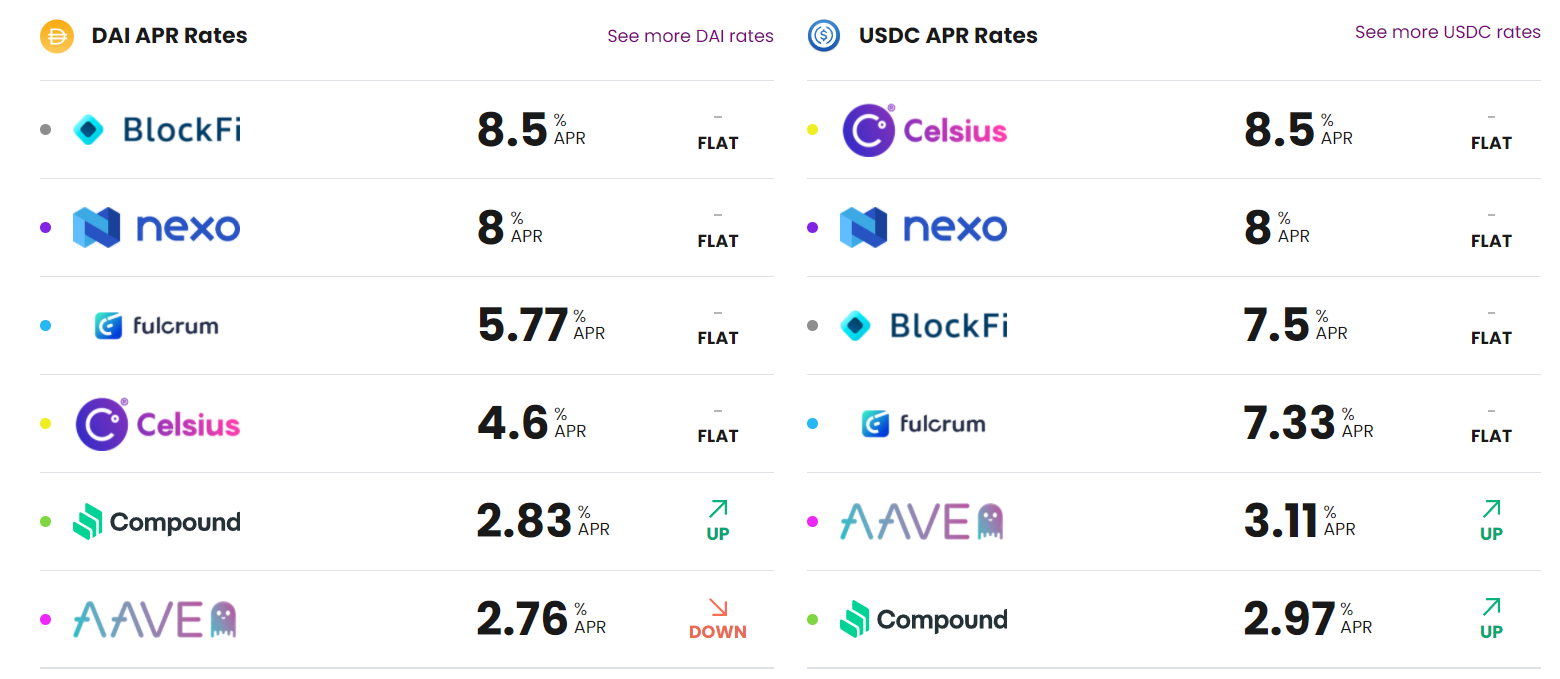

The commercial bank landscape features a significant differences when compared to emerging FinTech or crypto platforms such as BlockFi, Nexo, Celsius Network, or even Binance. With the average interest rate in a US savings account floating around 0.04%, these other emerging platforms offer considerably higher yields.

With hundreds of cryptocurrencies and tokens in play, stablecoins tend to offer the highest yields while offering refuge from crypto volatility at the same time. In turn, stablecoins disincentivize people from using bank accounts as anything other than a transitory point in the crypto-to-fiat conversion.

However, even that necessity is fading with crypto banks partnering with Visa and MasterCard for a seamless shopping experience. To further halt this trend, San Francisco-based USDF Consortium launched on January 12, 2022, as a network of FDIC-insured banks to provide the first US bank-minted stablecoin – USDF (USDForward). The Consortium’s founding banks have the following total assets under their belt:

- New York Community Bank (NYCB) – $56.2 million

- NBH Bank – $6.6 million

- FirstBank – $24.4 million

- Sterling National Bank – $29.7 million

- Synovus Bank – $54.3 million

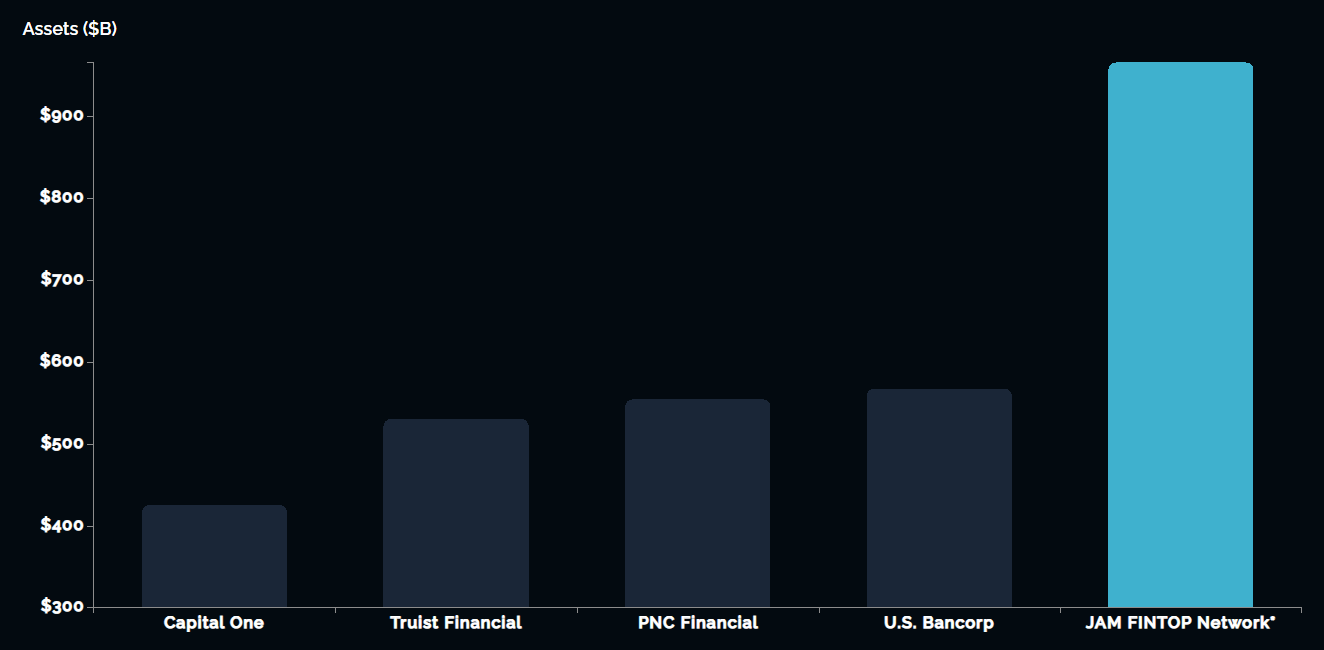

As you can see, the Consortium’s founding banks are small-cap banks, all well below the 40th rank in the US by asset size. In charge of developing the USDF stablecoins are two FinTech firms – Figure Technologies and JAM FINTOP.

Figure Technologies was founded in 2018 with $447.4 million total funding and headquartered in Charlotte, NC. Figure’s CEO and co-founder is Mike Cagney. Interestingly, he is also the founder and former CEO of online lending and investing platform SoFi.

Although a relatively new blockchain startup with 476 employees, Figure is owned by HomeBridge Financial Services, a non-bank lender with nearly 3,000 employees, having generated $749.45 million in revenue last year.

Even more impressive, JAM FINTOP is all about implementing new technologies for financial institutions to remain competitive. Jam Fintop Network consists of 79 community bank partners in the US. As a whole, the combined assets of the network members account for approximately $1 trillion.

Which Blockchain Will USDF Stablecoin Use?

The USDF (USDForward) stablecoin will be based on the Provenance blockchain, an open-source, permissionless, Proof-of-Stake (PoS) platform for launching DeFi dApps. Provenance raised $20 million back in 2019. The blockchain itself is a public one, just like Bitcoin and Ethereum. Unlike private blockchains that are permissioned, public blockchains allow anyone to access the network and execute transactions.

Figure Technologies CEO, Mike Cagney, noted in the press release that USDF stablecoins can be minted on demand and are coming online soon.

“The ease and immediacy of using USDF for on-chain transactions was demonstrated this fall when NYCB minted USDF used to settle securities trades executed on Figure’s alternative trading systems. We are tremendously excited that NYCB expects to be minting USDF on demand and on a regular basis in the coming weeks.”

Based on the veteran FinTech experience employed by the two FinTech firms, and the financial power backing them, it is safe to assume that USDF will be as regulated as Paxos (PAX and BUSD stablecoins). If you recall, Paxos is so well-regulated and overseen by the New York State Department of Financial Services (NYDFS) that Bank of America joined Paxos’ Settlement Service last May.

Powered by Provenance blockchain, USDF Consortium is poised to become Paxos’ close competitor, starting with community banks first. Seeing the writing on the wall, NBH Bank’s Chief Digital Officer, Valerie Kramer, expects USDF stablecoin to become the foundation for customer-retention, which is under constant DeFi assault.

“The USDF Consortium will allow banks of all sizes, and importantly, community banks, to provide the digital banking solutions that more and more of our clients expect,”

Getting banks into the stablecoin game should go hand-in-hand with asset management firm NYDIG onboarding 650 smaller US banks by providing a crypto custody service. Based on these initiatives, it looks like financial experts are not particularly worried about the upcoming stablecoin legislation. Blockchain-based finance benefits—less friction, real-time payments, settlement certainty—are simply too powerful to keep ignoring.

It would certainly become much more convenient if your bank account becomes your crypto and stablecoin off-ramp. Do you think this trend has what it takes to drastically accelerate crypto adoption? Let us know in the comments below.

tokenist.com

tokenist.com